How a Gold Mutual Fund Works

Gold as an investment is available in several forms. Some of these are gold bullions, gold futures, gold mining stocks, and gold mutual funds. The latter has emerged as ..

Gold as an investment is available in several forms. Some of these are gold bullions, gold futures, gold mining stocks, and gold mutual funds. The latter has emerged as ..

Som https://www.investingoldandsilverira.com//a-warning-gold-ira-home-storage/e less market-savvy brokers thought they’d found the perfect solution to getting more clients – Home Storage Gold IRAs – but as their customers could be finding out soon, they’re…

Gold is Alien? Gold Can Treat Cancer? We All Contain Gold? In a world of alternative facts and fake news, we’ve checked and double-checked all 45 of these facts about…

This page looks at how to source and purchase the right sort of speculation gold bullion, how this contrasts and alternate approaches to purchasing gold and how to guarantee you just arrangement with reliable bullion vendors.

As well as the how what and where, we view at the upsides and downsides of involving gold bullion as a speculation, the dangers implied and the moral side of putting resources into gold.

For anybody needing to know how to put resources into gold – at it’s generally essential level it’s basically the same as making any speculation or productive exchange. You purchase at a value that is lower than you sell.

Albeit many business sectors and ventures are inclined to high instability, sharp ascents and surprisingly more profound dives, gold has forever been a place of refuge speculation and store of abundance, with gold rising consistently across tens, hundreds and even millennia.

It has kept an extensively comparative worth corresponding to products administrations since it was absolute initially removed from the beginning it’s this protected dependability which has considered gold demonstration to be strong monetary establishment for the rich, for countries and for domains across time.

Albeit gold can change on a week after week, month to month or yearly premise, making gold an exceptionally famous product for exchanging, gold’s general pattern as a venture has been and remains upwards.

This truly intends that assuming you purchase gold today, you know on normal it’ll be worth more in 5 years, 10 years or 50 years than it is presently. It’s like it has long haul benefit worked in – thus essentially purchasing the metal and holding it will in general be a sound speculation choice.

Where gold has a critical additional advantage over different ventures is the place where it can foster an unexpected unpredictability during a securities exchange crash with estimating heading steeply upwards.

During a market slump as paper stocks jump, speculation cash takes off from the quickly dropping offers and searches for a protected harbor. Gold being one of the most outstanding known safe house speculations sees an abrupt inundation in purchasers which makes gold’s value rise and rise forcefully. In the accident of 07-08, gold climbed 25.5% to an untouched high while the S&P 500 failed 56.8%.

Those with the prescience to possess gold had the option to sell, take significant benefits and put these back into the now demolished financial exchange prepared for the following unavoidable stocks climb and gold’s similarly inescapable remedy to it’s normal more loosened up rising pattern.

The most effective method to put resources into gold isn’t such a lot of an issue of timing – despite the fact that purchasing during a remedy absolutely helps – it’s more one of just settling on a choice to purchase.

After this it comes down to choosing the approach to putting resources into gold that requests most.

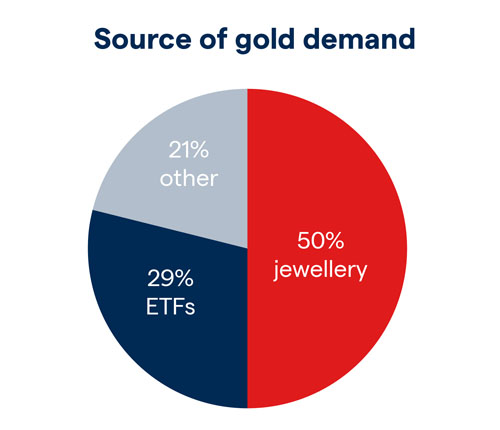

There are three head approaches to putting resources into gold:

purchasing the actual metal – putting resources into bullion bars or coins

purchasing a paper subsidiary of gold, for example, an Exchange Traded Fund (ETF)

purchasing partakes in gold mining and investigation organizations

The primary strategy – purchasing gold as actual bullion bars or coins is both the most clear and the main genuine approach to straightforwardly put resources into gold. While different strategies are unquestionably connected with gold, or they track gold’s value they are a simple paper or advanced intermediary, which might be upheld by a vault of actual gold.

The second and ever well known as a gold venture intermediary, gold ETFs are normally supported by actual metal anyway this commonly covers just a negligible portion of the worth of all delivered endorsements.

A few assets are supported by more gold than others while there exist “gold” assets with in a real sense no gold behind them by any stretch of the imagination. On account of any gold ETF this implies that should more individuals wish to sell their ETFs on the double than the asset claims in gold, then, at that point, there could be inconvenience.

The third and other non gold speculation is gold mining shares (called diggers) a regularly high-hazard venture with a chance for phenomenal benefit in case of an enormous new gold find, yet additionally an undeniable opportunity of misfortune where a vigorously subsidized mine investigation strikes out. A couple of enormous misses for a mining organization and it’s lights out.

Excavators are especially in danger when gold costs are frail and the expense of mining and refining is more noteworthy than or near the current market cost.

Mines might diminish staff , limit their result or really close their mines for a period to decrease upward – yet assuming gold’s value stays underneath, at or just somewhat over the market cost for any timeframe as it can and does, then, at that point, the mining organizations can be in danger of chapter 11 and with that your mining shares becoming useless.

Obviously regardless of whether an excavator shuts, the actual gold proceeds to exist and the land will hold it’s worth trusting that another digger will exploit changes on the lookout.

Your portions anyway will stay useless paper.

Which takes us back to genuine gold: actual gold bullion bar or coins, which whether as a feature of an expense advantaged retirement account, a resource in your expanded venture portfolio – or a delightful metal sitting in your home safe, will assist with defending your abundance regardless business sectors might do.

Expecting you’ve settled on a choice to focus on purchasing actual bullion instead of paper resources, how to begin putting resources into gold is an extremely basic inquiry to address.

As we previously referenced gold is a magnificent mid to long haul speculation, both as a type of protection against market slumps and as a store of significant worth since gold will in general ascent over the long haul, beating many business sectors.

You check out the assets you have accessible for venture, yet additionally work out the probability of requiring a portion of those assets for the time being.

The finances that are protected can go into a drawn out speculation and the cash you might have to access in a rush can go get tied up with some speedy access metals.

In the event that you have $100,000 reserved for your gold contributing purposes yet you’re stressed over support issues on your home or you might have to assist your youngster with their school store – or some other number of potential 4 or 5-figure crises, then, at that point, offer a leeway.

In this model you could permit $20k for crises and take the safe $80k for interest in your more drawn out term metals.

The $80,000 would purchase bigger gold bars where costs are far nearer to the market cost than more modest bars. They can be put away in a vault, or even better vaulted as a feature of an expense advantaged gold IRA and stay there with no pressure or the board stresses for 3, 5 or even 10+ years, filling in worth and prepared to safeguard you in case of any significant financial exchange crash, or international occasion.

This is particularly obvious on the off chance that we’ve not had an accident for a long time as these will more often than not be cyclic with enormous accidents happening roughly at regular intervals plus or minus.

The $20k would in any case be put resources into valuable metals yet would be held in more modest bars, coins or bullion adjusts. Despite the fact that they are somewhat more costly as far as cost per weight, they compensate for it by being effectively distinct or fungible. This means it’s far simpler to offer several 1oz gold bars to cover a $2500 crisis than a 10oz bar or a goliath 400oz great conveyance ingot.

It’s additionally simpler to supplant a 1oz bar or coin after the crisis has passed than purchasing a monster of an ingot. Little bans and coins are accessible from nearby coin and gold vendors in practically any city, though a 400oz decent conveyance bar is to some degree more uncommon on central avenue!

Note: since you might require access our model $20,000 worth of gold it shouldn’t shape part of a Gold IRA because of early withdrawals setting off charge punishments. This shouldn’t imply that it can’t be held in a safe vault by a similar gold seller who orchestrates your Gold IRA – simply not held inside the record.

What’s more discussing vaulting, for a more modest sum, for example, our $20k, nothing can very beat home-stockpiling.

One of the delights of putting resources into gold is the sheer magnificence of the metal and in the event that you’re so disposed and have an appropriately guaranteed safe, your $20k could be held at home and be utilized to purchase a scope of appealing bars and coins from various mints and treatment facilities.

Albeit these are as yet stock bullion things and ought to be purchased as close as conceivable to the market value, there are a few really wonderful coins and bars accessible and the way that they’re both charming to check out and hold can’t be undervalued.

One brief admonition here: Buying mint pieces and bars can quickly become habit-forming and you’ll before long go over collectable, interesting or extraordinary currencies and bars at a cost significantly higher than gold’s spot cost. Try not to purchase these except if you are doing as such as a pleasant side interest, not as a venture. Benefitting from collectable or numismatic ventures is a field best left to specialists with forever and a day of profound market information. Some alleged collectables are not under any condition what they are advertised as and are just bullion sellers hoping to build their benefits.

With your money earmarked for longer term and potential short term investment, now it’s time to make your purchase.

The US is honored with a few thousand valuable metals sellers from little exclusive tasks to multi-billion dollar public and worldwide vendors (we cover choosing a vendor beneath)

When you’ve picked a seller you’re OK with, it’s simply an instance of choosing the bars and coins you wish to buy, concluding whether you’re exploiting government tax reductions, and work out where you might want to store your gold.

Most trustworthy vendors can offer fair guidance on these venture choices, something particularly significant in the event that you’re managing a gold IRA.

With your metals and vaulting decisions made, it’s an instance of opening a record with your bullion seller and moving assets.

This record opening and buy is dependent upon Anti Money Laundering regulations so your character will be both confirmed and checked (you will require ID for any gold buy more than $10k) something a basic custom and has never as far as we can tell prompted any examinations.

When your assets clear, the bullion seller will move responsibility for bullion to you on the off chance that it’s available, or buy bullion for your benefit and boat it to your vault of decision, home or other location as mentioned.

Selling is essentially a switched variant of purchasing and assuming that you’ve vaulted with the vendor and are selling back to the seller it can require minutes to go through and store finances toy your bank whether you’re selling everything, or simply a level of your holding.

Learn more about gold’s unmatched properties for protecting wealth, either as part of your investment portfolio or inside a retirement account.

1. Gold Helps Offset Inflation

As covered before gold is an astounding store of abundance and worth, being maybe it’s most critical advantage, and one exploited by sovereign states, countries, organizations, and the very rich as much as standard limited scope financial backers and gold bugs.

Once utilized as the premise of all cash, first as exacting gold coins and later with gold-supported paper money, gold has since been supplanted by sheets of paper in view of minimal in excess of a guarantee and trust. But then as banks print increasingly more cash from nothing it becomes worth less and less because of expansion.

A one hundred dollar note from the mid 1970’s placed into a crate and opened now would purchase altogether short of what it moved in the times of erupted pants and polyester. Yet, had that equivalent $100 been traded for a 1oz gold coin, it would have kept up with it’s worth comparative with different merchandise at the time it had been boxed. While the $100 would now scarcely get a good dinner and beverages for two, the 1oz gold coin can in any case essentially purchase what it could have some time ago.

It’s worth might have risen when evaluated in dollars, yet truly it’s purchasing power continues as before. Gold hasn’t gone up, it’s basically the dollar that is gone down.

Having cash in the bank isn’t a resource any more – it’s a responsibility – as consistently it’s worth comparative with spending power diminishes.

It has stopped to be cash and is essentially money, a simple to utilize arrangement of installment. Gold is the main genuine cash.

One more key advantage of putting resources into gold is request. A significant component in any speculation is having the option to sell your resource rapidly. Gold is generally acknowledged as an important resource, both in financial terms and socially regardless of where you are on the planet.

For more modest ventures this interest and rivalry to purchase, implies you can be sure you’ll have the option to sell your gold rapidly and at a fair cost whether you’re in a cosmopolitan city or humble community.

For bigger ventures, regardless happens to the worldwide economy, there will constantly be a business opportunity for gold.

A vital part to appeal, gold ventures are exceptionally fluid. You can trade gold on worldwide business sectors in minutes or move starting with one vault in one country then onto the next somewhere else through a trade with a couple of mouse clicks. With well more than USD $100bn streaming in day by day exchange, gold ventures are perhaps the simplest resource for ordinary financial backers to trade.

For limited scope retail purchasers, staying with famous bullion coins, for example, Eagles or Maples guarantees you can sell your gold at it’s actual worth over the counter at your nearby coin shop or straight back to the seller you purchased from.

Gold is likewise straightforwardly fluid. A kilobar in Switzerland can be broken down to tola bars in Dubai, traded to India, be changed into fine gems, be purchased in America, worn for quite a long time then, at that point, broke down as scrap, refined and made into 1oz coins by the US Mint, purchased in the UK, etc.

Since it’s so valuable gold is seldom lost, just remelted and made into something different.

In everyday when paper markets jump, gold trips. Not generally, yet enough to be an acknowledged relationship thus financial backers fence their wagers on value development. Assuming they figure stocks will rise, they purchase gold in the event the stocks fall. Assuming that worldwide business sectors appear to be anxious, they’ll purchase gold as a place of refuge speculation.

The best way to really defend your ventures against most situations is to differentiate – as in the expression don’t tie up your resources in one place. After all Enron was once viewed as a protected speculation – as were innumerable other fallen banks and land reserves, silicon valley unicorns and enormous box retailers.

Gold simply does it’s thing, staying there like a shimmering protection strategy.

Cash is both cumbersome and weighty. $1m in real money gauges anything from 1.1 tons whenever stacked in $1 notes to 22lb in $100s. Regardless of whether stuffed firmly it occupies a ton of room and as anybody watching Narcos or Breaking Bad will know – with enough paper cash you before long run out of spots to put it.

With regards to gold, $1m can be held in only two bars and keeping in mind that truly weighty it’s difficult to accept that such worth exists in two little brilliant blocks.

For anybody living in a geopolitically unsafe country there might be a need to exit rapidly, leaving behind the majority of your assets. A couple of gold bars about your individual and you can have fast admittance to cash anyplace on the planet and truth be told there are bullion bars intended for this very reason – made Mastercard measured and punctured into more modest bars for simple transformation to crisis cash.

A definitive in voyaging cash.

Albeit not a main issue for most financial backers, gold is synthetically steady – it just responds to a couple of the most grounded of acids – meaning it doesn’t rust, disintegrate, break or even lose it’s sparkle. It’s the meaning of a purchase and fail to remember resource, sitting with practically no danger of debasement for many years, even hundreds of years.

Gold has been projected and beaten into elaborate crowns and adornments by old developments, covered and uncovered 1000s of years after the fact – still in a similar immaculate condition as it was when lost.

We realize that paper cash when put away in mass without being accurately wrapped and in the right climate can disintegrate to tidy surprisingly fast. With gold, it’s an instance of issue tackled.

Truth be told this is one of the fundamental advantages of putting resources into gold for “preppers” – a store of gold coins covered underground will endure endlessly.

Silver might discolor and at last break down however gold can be left opened up and straightforwardly in touch with soil until a prepper’s final stage, when the so-called SHTF.

This is the most commonly cited disadvantage laid at gold’s door – it’s lack of any dividends or interest paid. And while this is a valid if only partially true point, it’s just not a valid problem. Gold simply isn’t this type of asset class – it’s a real asset, as in real estate and other physical investments.

Houses don’t pay dividends. Works of art and antiques don’t pay interest. Neither does land, jewelry, intellectual property, investment wine, cases of whisky or any of a plethora of real assets.

Like gold, most can be rented to produce income and much like gold they typically trend upwards on a long term scale. Gold has averaged 9% annual returns over 45 years – and as a long-term asset it comes with numerous capital gains advantages and tax advantages.

These advantages more than offset a lack of paying interest when looked at against the inflationary devaluation of your dividend dollar.

Again this is valid – as a genuine resource and an important, concentrated and compact resource it must be put away some place protected and safeguarded against robbery.

In any case, because of it’s minimal size and the scale and seriousness of expert vaulting administrations, these expenses are extensively practically identical to the yearly charges on an oversaw merchant records or exchanging stages.

Also when you consider that paper resources don’t actually exist anyplace other than on a PC then the thing would you say you are really paying for?

In the momentary the cost of gold can to be sure be unstable, yet this is generally because of cash variances and paper exchanges. Actual bullion is as a general rule a strikingly steady interest in the mid to long haul.

For instance gold estimated in UK Pounds Authentic can be at a record-breaking high, but then when evaluated in USD it has all the earmarks of being dreary and still far beneath it’s USD unequaled best. Similar contrasts can be tracked down while looking at Gold valued in Euros, Australian Dollars or Japanese Yen.

Whenever there are huge contrasts between values in Pound and Dollar, Euro or Yen these neighborhood markets profiting from the potential gain might begin to quickly offer their paper gold subordinates to take benefits or set longer term short wagers against the metal sending the cost down locally as well as setting off calculations on the worldwide market. The equivalent can happen when gold in one money is contrarily impacted contrasted with others, and nearby dealers purchase or put down long wagers, conveying their neighborhood messages worldwide on the open market.

While this instability of the Forex markets joined with enormous paper gold exchanges will quite often drive the actual metal spot value this is only sometimes reflected in long haul interest for actual bullion.

Moreover, it’s this momentary unpredictability which prompts gold being a vigorously exchanged resource on both the paper and worldwide actual business sectors, making merchants rich on both value drops and rises.

Is putting resources into gold moral? While most Western mines work to the most elevated of ecological guidelines, the equivalent can’t be said for more modest distinctive mines working in pieces of Africa and South America.

A portion of these mining techniques really do include poison synthetics and can annihilate entire streams with the harmful muck they produce. The issue doesn’t simply influence the scene, yet additionally the soundness of the diggers and albeit a significant number of these are unlawful and unlicensed mines, there are still enough of them to be an issue.

Added to this, there are various mines in disaster areas. Despite the fact that they are formally boycotted by the gold business, on account of remiss security and a readiness of unfamiliar authorities to choose not to see, it is tragically unavoidable that a few struggle gold and other illicit gold will observe it’s direction into a generally all around managed inventory network – and once here, struggle gold is indistinct from appropriately obtained metal when it’s softened into ingots.

Be that as it may, then again, as recently addressed with gold being so valuable – it’s seldom disposed of.

Entire enterprises have been made getting each ounce of scrap gold out of disposed of gadgets, modern piece and broken adornments. Gold being an unadulterated component is a definitive in recyclable material.

As far as work at distinctive mines, there’s a developing fair exchange development clearing the business, with the “Fair Exchange Gold” seal being applied to an ever increasing number of bits of gold adornments where all parties in it’s creation are both paid appropriately and work in safe conditions. Fair Exchange bullion is not far off.

As we would see it the masters of putting resources into gold far offset the cons, a significant number of which when taken a gander at are scarcely detriments by any means. We are in full arrangement that the entire market should turn out to be better at self-policing and to be sure monstrous progress is being made in guaranteeing ALL gold is equipped for being followed from mine to refined bar – alongside far harder activity on offenders.

See how leading gold dealers are making gold the ultimate in green investment inside Goldco’s free Gold Investor Guide

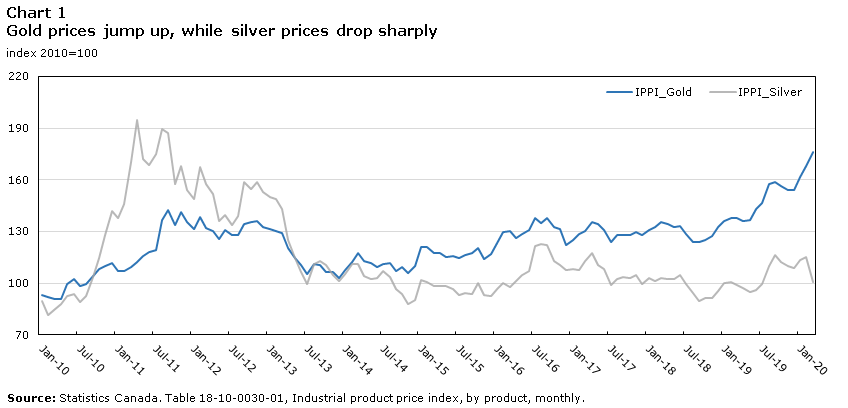

Despite the fact that there are some enthusiastic “stackers” who will just at any point purchase silver bullion and coins, it’s occasional an instance of putting resources into gold versus silver – in picking gold OR silver.

Silver is a valuable broadening venture much as gold and can assist with making a valuable metals portfolio that performs preferred in certain conditions over one that main worries gold. It’s generally supposed to be massively underestimated while taking a gander at noteworthy proportions of silver costs to gold costs and at it’s present costs is as yet quite far from it’s 1980 pinnacle of $50/oz. We cover silver in significantly more detail here.

Famously unstable in cost, particularly according to shake consistent Gold, silver can undoubtedly be exchanged actual structure by limited scope financial backers, ordinarily being offered to purchase gold when silver pinnacles, or being purchased when gold is sad.

Furthermore an extremely enormous in addition to for some: you get much more silver for your cash. At the hour of thinking of you can purchase 85 ounces of silver for one ounce of gold.

On the negative it occupies substantially more room for a dollar comparable sum and while you’re talking $50k or $100k in silver that is a huge load to track down a spot for, transport or in any case transport.

This implies there’s a requirement for a lot bigger home-protected or higher vaulting expenses corresponding to esteem.

Being a modern metal there’s a more noteworthy genuine requirement for silver, and on the grounds that it’s oftentimes consumed, obliterated or disposed of in modern cycles it’s a lessening asset, which in genuine terms could be viewed as more scant than gold.

As a modern metal it’s dealt with significantly more as an item than a speculation across many assessment systems and in these circumstances where venture gold would commonly be zero evaluated for deals charge, silver conveys charge. This is the situation across a significant part of the US and Europe where silver purchasers are distraught because of this duty.

To put it plainly, silver routinely frames part of a more extensive valuable metals portfolio which can likewise incorporate platinum and palladium, all metals that perform diversely in different circumstances, and when consolidated produce an all around differentiated and possibly powerful blend.

As usual, it pays to converse with a valuable metals expert to examine what is going on and realize how silver and gold can both help you.

The web has been a boon to gold financial backers, making it simpler to find both the right data while settling on speculation choices and to find dependable and solid gold sellers.

Except if you have an excellent nearby vendor, or even notwithstanding of this – we would suggest beginning with a web search. Most importantly you’d be searching with the expectation of complimentary Gold Venture Guides which will help you study contributing as well as give you some underlying knowledge into what different bullion vendors resemble to manage.

There are as of now north of 1400 bullion sellers recorded in the business registry and hundreds more modest organizations who are not – so dislike you are at any point stuck for decision.

Numerous sellers have fantastic sites and free transportation so it’s anything but a troublesome cycle making a little test buy. A couple of silver bars and coins or a little gold bar in the event that you’re apprehensive and might want to try things out.

Online sell-offs have become famously terrible for selling fakes, as have various merchant destinations. It’s ideal to stay with a known public brand or a believed nearby seller for your first test purchase – however on the off chance that not recollect whether an item appears to be excessively modest, there’s a justification behind that.

Valuable metals are wonderful long haul speculations and being a significant expense obtaining, it’s significant you ensure your venture gets going on the right foot.

Regardless of whether you’re purchasing retail, through a gold venture organization or IRA expert ensuring you are both viable is foremost for smooth and blissful speculations.

When buying gold as an investment you have a choice to buy through local coin shops, online e-commerce stores which offer a simple self-serve checkout – or through professional gold investment companies.

Gold investment companies like Goldco will offer a full range of services, from investment and portfolio advice, to specializing in areas such as Gold IRAs or offshore vaulting.

They will typically have a minimum investment amount, usually $25-$30k (this is due to the very small premiums in gold, with companies often making as little as 1% profit on any deals) and can carry out all elements of the investment process on your behalf, much as a concierge service.

These can offer excellent value for both new and seasoned investors and will often have reduced vaulting fees and special wholesale prices due to the enormous economy of scale on which they run.

Where coin stores may focus their expertise on special collector coins, not low-premium bullion – and e-commerce giant help desks are only concerned with assisting you with any checkout issues or website malfunctions, the key difference between them and gold investment companies comes down to quality of both service and advice.

The professionals that gold investment companies hire will know the gold investment market inside out and be able to advise on anything from current and future market conditions, to pending changes in legislation and will just as happily help with selecting items to best match your appetite for risk or help rollover your 401k to a gold IRA.

Although there are thousands of small-scale metals dealers, professional Gold Investment Companies are far fewer on the ground and will usually be centered around gold trading or vaulting hotspots like New York, Southern California, Texas and Miami.

For any investment over $25,000 we’d always recommend the expert help they provide over any other method of buying – especially for a newcomer to precious metals.

Want more? Get our free Gold Investment Guide – a unique physical investor kit delivered direct to your door.

Learn more about gold’s unmatched properties for protecting wealth, either as part of your investment portfolio or inside a retirement account.