Gold Bars: Investment Basics – What, How and Where

JUMP TO SECTION

Why Invest in Gold Bullion Bars?

On the off chance that you’ve settled on the choice to put resources into gold, how could you pick gold bullion bars over coins or adjusts? In spite of the fact that there are numerous special cases, gold bullion bars will commonly have a somewhat lower premium than bullion coins, particularly cast (poured) bars as these have the easiest assembling process out of all bullion items.

Bars are truly universal and can be bought and sold at close to premium anywhere in the world.

Enormous 400oz bars separated, they are reduced, simple to convey and store, simple to stow away whenever required and toward the day’s end there’s something practically supernatural with regards to grasping a gold bar.

Bullion bars are accessible in the most stretched out scope of sizes, from parts of a gram as far as possible up to monster great conveyance bars tipping the scales at 400oz – the bigger bars offering the absolute best worth gold accessible to financial backers.

While there are huge mint pieces accessible these are regularly gatherers things and will quite often accompany a lot higher premium.

Bars are not difficult to stack and proficient to store without the “squandered” space related with roundabout coins and adjusts – and let’s be honest when we consider bullion, the majority of us quickly picture bars.

Cast or Minted?

While purchasing bullion bars there’s a decision among cast and printed – and various purchasers have an inclination for one over the other. While cast bars are essentially liquid metal filled a shape and afterward hit with a creators mark and other lawful subtleties, stamped bars are made in a multi-step process.

First painstakingly estimated spaces are produced using a huge sheet of gold, or cut from a long slender expelled or cast bar. These spaces are then taken care of into a stepping or squeezing machine, driving the clear between two adversely engraved formers which engrave the clear with an example, edging, and a presentation of fineness and creators mark. Examples can be basic or elaborate and level regions ordinarily have a cleaned smooth appearance. Bar chronic numbers are either engraved or stepped in the wake of stamping.

A few printed bars can be genuinely excellent highlighting lavish plans with UK Britannia bars and Swiss PAMP Fortunas conveying two of the most intricate inscriptions – skirting on authority quality.

Lavish bars, particularly from such esteemed mints will regularly convey a higher premium in contrast with plain cast conventional bars from workaday purifiers.

Albeit the motivation behind contributing is normally purchasing as low as could really be expected, premium producers bars will commonly be more straightforward to exchange in any market than nonexclusive and order a more exorbitant cost because of their attractiveness, frequently higher than spot. Sellers will rarely offer anything at spot or higher for conventional bars.

Home stackers who step by step purchase anything that bar is accessible at the least cost will rapidly foster a wide assortment of fluctuated plans and sizes, something which can make the venture interaction more tomfoolery and practically habit-forming – as many YouTube recordings will verify.

Auxiliary market bars (used) are as can be anticipated regularly nearer to detect than new bars offering financial backers a few critical reserve funds while purchasing at amount.

A Word on Damage

Scratches and scrapes are unavoidable and on cast bars these can be huge without decreasing qualities – and indeed there are purchasers who love gathering “vintage” bars for the patina they might convey.

On stamped bars harm can degrade the worth, since they ruin the appearance in a seriously clear manner, so that even banishes from premium makers will just at any point exchange beneath spot.

Obviously as a financial backer all you’re truly keen on is gold substance – and in the event that you purchase direct from vendors and vault with them – bars will be new and can be exchanged to the seller anytime promptly. Since the vendor knows the bars and their full solid chain of authority they will regularly pay more at buyback than some other seller and this is one of the principle advantages of seller vaulting.

Purchasing gold bullion bars is gold contributing at it’s generally fundamental – a basic and somewhat reasonable interaction where you can possess a protected and strong speculation at the most minimal conceivable expense.

Learn more about the place bullion bars have in any diversified portfolio – inside Goldco’s free Gold Investor Guide

Is Investing in Gold Bullion a Good Idea?

As we’ve laid out, gold bullion bars are not difficult to purchase, simple to sell and will ordinarily offer the most reduced premium out of all weight-for-weight bullion items. Their simplicity of stacking and effective impression can make vaulting costs lower for bars than for coins, particularly at higher dollar values.

Given gold’s utilization as a store of significant worth and a defender of riches, it’s a good idea to take the most proficient and practical course to that speculation – gold bars.

In our book that makes putting resources into gold bullion a generally excellent thought.

Are there any negatives to gold bars?

In certain locales gold coins and all the more explicitly legitimate delicate gold coins can be excluded from Capital Gains Tax. This implies when gold ascents essentially in worth and you come to exchange you will keep away from an expense bill. Not so with gold bars (there are a couple of exemptions – lawful delicate bullion bars however these are phenomenal)

Albeit capital increases charge excluded coins can save you huge totals when you make a huge addition on resale, their underlying price tag can be 5-10% higher than a comparable nonexclusive bar, so you want to weigh up investment funds at buy versus expected investment funds at deal.

Are Gold Bars a Safe Investment?

Gold is viewed as a protected venture and gold bars are one of the most exchanged and generally acknowledged type of gold speculation – thusly gold bars are to be sure a protected venture.

However, (there’s consistently a yet) saying this doesn’t imply that all gold bars are as they appear.

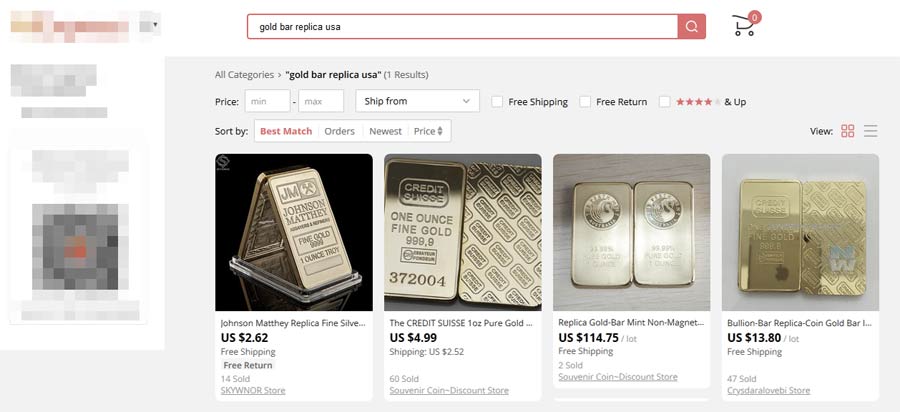

There are a developing number of phony gold bars going onto the market – some are ludicrously clear Chinese duplicates of well known bars like PAMP Suisse, Scotiabank and Royal Canadian Mint, bars that are purportedly implied as curiosity gifts however can in any case be not difficult to trick newbies searching for a deal

Then again there are modern duplicates intended to dupe even experienced financial backers where a strong gold covering covers a tungsten center – this is on the grounds that tungsten has a very much like thickness to gold so loads will appear to be right.

Now and again veritable gold bars have pits bored out of them which are then loaded up with tungsten poles prior to being resealed with unadulterated gold – a lot harder to recognize and a stunt that is even gotten out bullion banks.

At long last unadulterated gold bars from mostly secret producers typically in China or the Middle East are being stepped with the signs of significant purifiers to get a superior cost – a stunt which is likewise being accustomed to bring struggle gold and wrongfully dealt gold into the market.

Indeed you’re purchasing genuine gold – however the actual bar is an illicit duplicate or produced using unlawful gold and accordingly getting it turns into an offense in many nations.

What to look out for

Be particularly careful about great arrangements. Gold bars only from time to time sell at spot let alone beneath spot – so except if a notable seller is having a misfortune driving proposal to acquire new clients, be careful.

Since gold is in such interest, even a dealer in a rush will actually want to draw near to detect at quite a few coin or pawn shops.

Assuming a gold bar is accessible discounted to the general population at over 5% underneath gold’s market value then, at that point, it’s a phony or a cheat – no exemptions

To be certain beyond a shadow of a doubt that your gold bars are a wise speculation it pays to just purchase from a respectable source – either a significant gold vendor, direct from the purifier or through an expert gold venture organization.

It’s definitely not worth taking the risk to do in any case.

Read more shocking tricks, cheats and scams common in the gold bullion market, with Goldco’s free Gold Investor Guide

How Much do Gold Bars Cost?

Gold bars are a unique venture item and to be treated in a duty advantaged way in numerous purviews they should be valued near the spot cost of gold.

In actuality genuine gold bars will continuously sell (with a couple of special cases) for more than spot because of the expense of mining, refining, stamping, measure, accreditation, bundling, stockpiling, protection and transportation in addition to a little benefit for the distributer.

Once at the retailer or bullion specialist there should be a recompense made for business and advertising costs and another little benefit.

These inherent expenses and costs per bar are pretty much no different for huge bars as they are for little thus while putting resources into gold bullion bars you will normally find the charges on little bars are higher comparable to their unit cost than on huge bars. It’s essential math.

Further value contrasts can be found between the gold bars from various mints with the absolute most regarded mints conveying a higher premium on a like for like premise than those from more modest, less notable mints or on conventional unbranded bars.

A 1kg bar from the UK’s Royal Mint will cost more than one from say the Scottsdale Mint in the US or a treatment facility like Kaloti in Dubai.

How does this translate into the real world?

The by and large charges on gold bullion bars can go from just 0.5% over spot for goliath 400oz great conveyance bars up to 50-60% on little 1g bars.

Vendor expenses can frequently be decreased further by requesting products of a thing permitting the seller to impart a portion of their discount markdown to you because of economies of scale.

Regarding the matter of premium brand and conventional bars – premium marked bullion is ordinarily simpler to exchange and can order a greater cost than nonexclusive or obscure brand bars in the optional market because of trust and the more popularity of known bars.

In the event that you are following oneself purchase and home stockpiling course, this is certainly something to remember when it comes time to for you to exchange.

The accompanying diagram shows cost charges per bar size – and across various brands from nonexclusive to premium. These costs are taken from a normal cost determined across 5 driving bullion internet business locales for examination.

Average Premium By Bar Size for Branded, Generic and Bulk

| Bar Size | Premium Branded | Generic Bar | Bulk Buy |

|---|---|---|---|

| 1g | 59.0% | 30.7% | 15.2% |

| 2.5g | 37.3% | 24.8%: | 14.4% |

| 5g | 23.6% | 12.8% | 8.6% |

| 10g | 15.2% | 9.5% | 7.2% |

| 1/2oz | 10.7% | 8.4% | 5.7% |

| 20g | 10.6% | 7.3% | 5.1% |

| 1oz | 6.6% | 4.3% | 2.9% |

| 50g | 7.6% | 4.6% | 4.0% |

| 100g | 6.6% | 3.9% | 2.5% |

| 250g | 3.8% | 3.4% | 2.6% |

| 10oz | 6.4% | 3.5% | 2.9% |

| 500g | 3.3% | 3.0% | 2.4% |

| 1kg (1000g) | 2.8% | 2.5% | 2.0% |

| 400oz | – | 2.2% | 0.8% |

Key Takeaways:

- Most noteworthy premium is 59% for a superior marked 1g bar, least premium is 0.8% for mass purchased 400oz bars.

- The best purchases for more modest to mid-scale financial backers are 1oz conventional bars and 100g nonexclusive bars.

- Anything more modest than 10g should be named an oddity or collectable as expenses are too high to even think about making these bars a strong venture.

As should be visible purchasing gold even at spending plan web based business locales can accompany a decent reach in charges.

Learn how to find the best value bars and get the best prices for your investments with Goldco’s free Gold Investor Guide

What are Popular Gold Bar Sizes?

The most well-known estimated bar for huge scope bullion speculation is the 400oz great conveyance bar. This is the bullion bar you find in motion pictures, the bars held by states, public banks, institutional financial backers and the richest.

In spite of the fact that offering the least charges and the most thought type of abundance gold can offer, these are not really reasonable for generally little to mid-scale financial backers and at well over a large portion of 1,000,000 dollars for every bar don’t satisfactorily take into consideration selling parts of your venture while requiring more modest dollar values.

For most financial backers there’s an inclination for a scope of more pragmatic more modest bars – the decision of which differs generally from one country to another.

In the US the most well known sizes traded by financial backers are the 1oz and 10oz bullion bars, albeit the 1000g or Kilobar (32.15 official ounces) is filling in prominence on account of it’s low premium and global allure particularly by financial backers with at minimum some seaward presence.

European Investors all the more regularly purchase bars utilizing the decimal measuring standard (with an exemption being the consistently well known 1oz bar) and the most ordinarily exchanged bars are kilobars, 500g, 250g, 100g and 50g bars close by the 1oz.

China’s most famous gold bar is the kilobar and surprisingly Chinese national banks lean toward the exceptionally standard kilobar to the more conventional 400oz great conveyance bar.

The Middle East and India lean toward the kilobar and their own bar sizes estimated in Tolas (1 Tola = 2.666 Troy Ounces) with the most widely recognized Tola bars being 1, 3, 5 and 10 Tolas.

As should be visible the most general bar, well known with gold financial backers across the world is the 1000g/1kg kilo bar pressing an astounding 32.15 oz of fine gold into a little, exceptionally versatile and effortlessly put away unit.

For us be that as it may, the 1oz and 10oz bars remain lords in the USA as far as worth and liquidity.

What are Popular Gold Bar Brands?

Similar as bar sizes, gold bar brand prevalence changes by country albeit most financial backers in the West will know about the significant brands across the US, Canada and Europe. Some European brands will quite often convey a higher premium in America because of delivery costs and their relative extraordinariness.

APMEX

APMEX, Inc., are situated in Oklahoma City, Oklahoma, and are the world’s biggest web-based retailer of valuable metals, having sold more than $10 billion in valuable metals since being established in 1999. As well similar to a bullion seller selling a wide scope of marked bars, APMEX produce their own famous scope of gold bars in both measurement (0.5g, 1g, 5g, 10g, 1000g) and royal loads (1/2oz, 1oz, 5oz, 10oz) at 0.9999 fineness (99.99% unadulterated gold).

Is There Tax on Gold Bars?

The duty financial backers pay on gold bars rely upon which express the bar is purchased and put away in as every one of the 50 states can set it’s own degree of deals charge.

While certain states are zero-appraised on venture grade bullion, different states can energize to 10%. This essential far reaching charge is notwithstanding any nearby area or city deals charge.

For instance, in Alabama, the fundamental deals charge on bullion is 4% though inhabitants in Mobile or Montgomery need to pay an extra 10% nearby rate giving a complete state and district deals expense of 14%

Staying with Alabama any venture bullion purchased outside of state is likely to a “utilization charge” at similar rate as the business charge.

This gives a few US gold vendors and metals financial backers a major benefit over others in view of their area.

Capital Gains Tax on Gold Bullion

In America the IRS believes bullion to be both a Capital Asset and a Collectible, so Capital Gains Tax (CGT) will be payable on any increases made when bullion is sold, and this is set at a limit of 28% (collectibles).

As a general rule the real rate paid will shift contingent upon various variables including the vender’s pay and the period of time the resources have been held.

To examine explicit CGT liabilities you ought to talk with an authorized bookkeeper or duty subject matter expert.

Can Gold Bars be held in an IRA?

The IRS currently permits explicit grades of speculation bullion to be held in an IRA taking into account gold to be purchased in a profoundly charge advantaged way.

As can be anticipated from the IRS there are severe principles overseeing what metals can be purchased and where they ought to be put away which we cover exhaustively in our Gold IRA segment.

Gold bars for IRA utilize should meet least fineness necessities and be fabricated by a NYMEX or COMEX-supported purifier/assayer and ought to be ISO9001 Certified. The base immaculateness ought to be .995 fine (99.5% unadulterated gold) or more noteworthy.

Instances of a few passing gold bars appropriate for holding in an IRA incorporate any size of:

Credit Suisse .9999 fine bars

PAMP Suisse .9999 fine bars

Ohio Precious Metals .9999 fine bars

For more details on Gold IRAs including specific advantages, rules and regulations click here.

Want more? Get our free Gold Investment Guide – a unique physical investor kit delivered direct to your door.

Learn more about gold’s unmatched properties for protecting wealth, either as part of your investment portfolio or inside a retirement account.