Discover Why Smart Investors Are Buying Into Gold

JUMP TO SECTION

What Are the Main Benefits of Gold?

Why Invest in Gold? As a financial backer there are unlimited open doors accessible with regards to adding to your portfolio. From stocks and offers, to land, digital forms of money to artistic work you can follow your inclinations or follow the group, go for the new and the high danger or avoid any unnecessary risk.

So why purchase gold?

Gold is undoubtedly a laid out market. It’s one of humanity’s longest-standing valuable resources, our adoration for this sparkling metal tracing all the way back to the beginning of civilization.

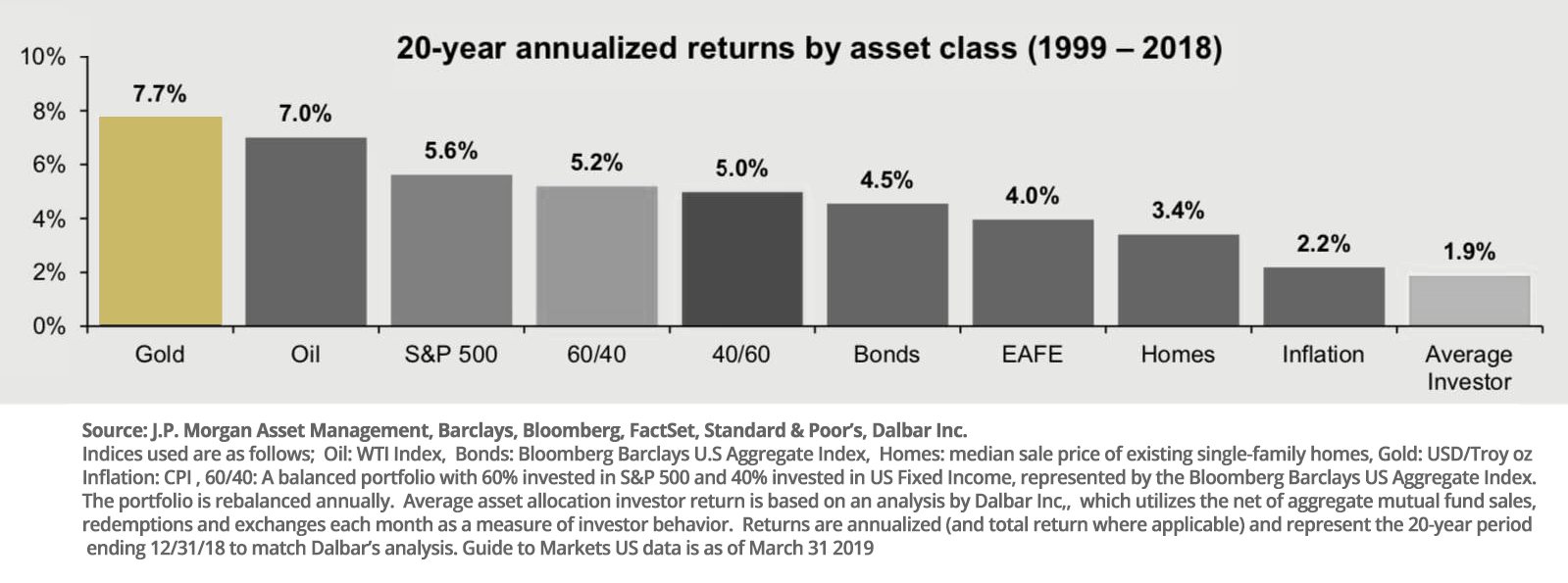

A new report by J.P. Morgan Asset Management has demonstrated gold to be clear victor as far as yearly return contrasted with a wide scope of customary speculations, beating most business sectors by an impressive edge:

It’s a market that has it’s reliable fans ($100bn in day by day gold exchange recommends there are in excess of a couple) however similarly there are various large name skeptics – Warren Buffett broadly considered gold a “pet stone” since it simply stays there delivering no profits or premium.

Furthermore he’s right – gold doesn’t have a yield similarly as stocks and offers do, or cash in a premium bearing record – however at that point neither do other actual resources like your home, uncovered land, show-stoppers, fine wine, or collectibles but we actually get them.

Would could it be that prompts nations, countries and enormous institutional financial backers to load up on the yellow metal in record volumes? For what reason are Swiss treatment facilities working day in and day out and still stay behind interest?

Gold is an Excellent Store of Value – Gold Protects Wealth

There’s an explanation the well off stay rich – they’ve figured out how to KEEP the cash they’ve procured. How can it be that generational abundance can go as the decades progressed and now and again many years – yet stay immaculate by the attacks of expansion, market declines and clashes? Single word: gold.

When nations are hoping to safeguard their sovereign abundance, to have a strong establishment whereupon to get cash on the worldwide business sectors, to change over their exchange or tax assessment excesses into a genuine and actual resource or to assist with settling their nation’s esteem according to the world – where do they go? Gold.

The justification for this is straightforward. Gold safeguards against expansion and shields against monetary market misfortunes.

Dissimilar to paper monetary forms, gold’s inventory is limited; national banks can’t print gold similarly as they print cash. No measure of bookkeeping wizardry that makes cash out of nowhere can be accustomed to create new gold.

As we said on our super gold page $100 set in a case in the mid 1970s and opened now would have a small part of the purchasing power it had when fixed. Cash has been depreciated by expansion – a result of printing yet increasingly more fanciful cash. Food and merchandise don’t go up in esteem, it simply takes more debased money to purchase them consistently. Your yearly raise isn’t actually a raise – it’s just rebalancing your work worth to count with a lessened dollar.

Had that $100 been changed over to a few gold coins and they’d been set in a similar time case until the present time – you’d observe that their purchasing power currently was pretty much precisely the same as today as it was during the 70s.

The paper we consider as cash and work our entire lives to save is ceaselessly decreasing in genuine worth. Gold doesn’t, as it’s little marvel the well off utilize the very systems that have worked since the beginnings of progress. They purchase – and hold – gold.

The alternate way that gold safeguards abundance is by going about as a market support. In spite of the fact that it’s worth when taken a gander at in paper monetary forms should be visible rising consistently across time, on a more modest course of events gold’s cost should be visible to be substantially more unpredictable.

As much because of money vacillations and interchange between one cash and the following, the cost of gold is likewise impacted by different business sectors like stocks and offers, fates, exchanged assets and wares.

A fence is actually important for a wagered on two restricting results. You think shares will really do above and beyond the following not many years, you purchase shares – yet you additionally take one more situation in the event that you’re off-base.

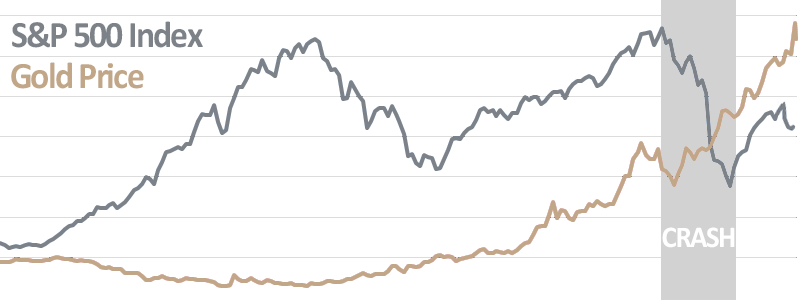

Albeit not permanently set up, gold will normally stay level or decrease somewhat while stocks are rising, however in a monetary accident gold will generally rocket – a connection that is sufficiently able to see the rich and enormous asset directors utilize gold as a type of assurance.

In any case, it’s not simply big-time dealers or the very rich who purchase gold as a fence.

In the last enormous accident of 07-08 when a great many Americans saw their 401ks and IRAs sliced by a half, gold arrived at record unsurpassed highs in USD helping the upsides of retirement accounts weighty in the metal.

Back to now, abundance directors have by and by began encouraging their clients to load up on gold, nations are purchasing in record volume and investigators are making stressed commotions that something important could be not too far off. In any event, checking out the roughly long term win/fail pattern of our monetary business sectors it’s plain to see we’re beginning to look very much past due on the following emergency.

Once again gold is getting ready to do it’s job protecting wealth.

Discover much more about the benefits gold can have for your investment portfolio in Goldco’s free Gold Investor Guide

Is Investing In Gold A Good Idea?

This relies upon your conditions. Considering what we said above, on the off chance that your speculations are vigorously one-sided towards stocks, shares and other paper resources – or then again assuming you own more than one piece of land venture, it wouldn’t damage to investigate avoiding potential risk.

Is investing in gold smart?

Most monetary guides open to a solid broadening of resources propose setting to the side between 3-10% of a portfolio to gold. There are the individuals who say half, yet they are especially in the minority – but given the expectations that the following accident will make 07-08 seem as though a bright cookout, who can say for sure.

It has less rhyme or reason on the off chance that you have very little extra capital, or any speculations. You wouldn’t support against speculation hazard, basically searching for resource appreciation.

While gold goes up in esteem (it’s found the middle value of 9% each year throughout the course of recent years) and is known to rise steeply in monetary emergencies, there are different speculations that can perform better for the time being. They might be dependent upon precisely the same dangers that gold is utilized to safeguard against, however with a low money total to contribute this could be more useful to you than the insurance gold would offer. After all $5k in gold, regardless of whether it pairs in cost during a banking and land crash is probably not going to have the option to help you when your house is worth half and turns into a significant monetary weight.

For those with $25,000 or more to contribute, gold unexpectedly turns into an exceptionally valuable device and it’s at this level that gold makes it’s mark.

Perhaps the most ideal way to purchase actual bullion is through a Gold IRA – when the public authority gives you an assessment advantaged course to making any ventures, it’s savvy to benefit as much as possible from it. The other key benefit to having gold in an IRA is the security it can give you when you want cash the most: retirement.

You didn’t labor for quite a long time to lose it all since a few covetous brokers chose to play on the financial exchange.

Is Investing In Gold Safe?

We’ve effectively settled gold as a place of refuge resource, used to get abundance – be it a nation’s riches, generational abundance, individual resources or a retirement account.

However, what are the security issues in putting resources into gold? Is putting resources into gold high danger?

Gold is clearly liable to hazard of robbery. At the point when individuals picture bullion bars they frequently consider The Italian Job or Goldfinger where criminals grab a fortune in gold bars (yet with no achievement)

Since gold is a concentrated versatile wellspring of abundance, this makes it simple to take. It’s additionally exceptionally simple for hoodlums to eliminate a gold bar’s character, liquefying it down and transforming it as another bar, in addition to being inert to something besides the most grounded acids, gold can be covered however long the criminal needs with no harm. On the off chance that it’s taken – it’s gone.

In this manner it’s vital for store your gold securely – regardless of whether in a satisfactorily safeguarded protected at home all with you fighting the temptation to tell anyone about it – or in a solid and completely guaranteed vault. We cover gold stockpiling and vaulting exhaustively here.

With your gold secured, there’s little to no chance of theft and even if it were to happen you’re insured.

The other sort of robbery regularly brought up in association with putting resources into gold is administrative seizure. Seizure isn’t entirely unachievable – after the entirety of dislike the US government doesn’t have structure in such manner. 1933’s Executive Order 6102 required a handover of any private resident’s gold over 5oz. It was made to assist with making more dollars which at the time were as yet in view of gold. In the occasion, not very many were indicted and there are no exact figures on how much was raised, logical because of exceptionally low recognition of the law.

It’s actual under current bureaucratic regulations, gold bullion is as yet ready to be seized by the public authority in the midst of public emergency – but in an emergency there are far lower draping natural products for the present government to pick from than a singular’s assortment of gold coins.

With banking being completely computerized and bank bail-ins previously endorsed into regulation, it’s undeniably almost certain everybody with any extra capital would see it taken from them in a tick of a button than having the feds going house to house taking 10oz here and 15oz there. Moreover the dollar is presently not attached to a Gold Standard and to print more cash it basically needs to add additional zeros to the furthest limit of a PC monetary record.

Finally the remaining risk in gold investment is the possibility of a drop in value.

Similarly as with any venture, gold does rise and fall ceaselessly all through the space of a day because of exchanging on the worldwide business sectors, international occasions, money developments and other market influences.

Also albeit gold has seen an arrived at the midpoint of 9% yearly development throughout recent years, on a more modest time period it very well may be likely to rises and falls, esteem crashes and record tops – where gold takes care of it’s business going about as a support speculation and afterward revising in cost after the emergency has passed.

Not at all like stocks, cryptographic forms of money and some other paper or advanced resource it’s so far-fetched as to be inconceivable that gold will at any point arrive at a zero worth. It’s excessively uncommon, excessively essential to society, industry and our actual mind, it’s mental worth developed over mankind’s set of experiences to at any point have no worth to us.

Organizations can go back and forth, countries and domains rise and fall – however gold can’t avoid being gold 100% of the time.

Is gold investing wise? If you doubt it, then it’s down to you versus history.

Learn some of the safest wasy to invest in precious metals with Goldco’s free Gold Investor Guide

What are the Advantages of Gold in an IRA

An IRA resembles any interest in that you need it to increment in esteem after some time. What’s different with regards to an IRA is that it’s an expense advantaged approach to purchasing explicit ventures, where these assessment investment funds are skilled to us by our national government as an approach to lessening the expenses of retirement arranging.

Is Gold Better Than Cash?

For purchasing milk at the corner store no. Cash is incredible for little day by day exchanges and for this reason we have it. Circling cash is an exceptionally helpful and generally mysterious vehicle of trade.

However, could we suggest cash as a venture? By no means.

The entire moment, consistently the cash in your wallet and your ledger is losing worth to expansion. Furthermore with feature expansion rates being so vigorously controlled through continually changing the technique by which they are determined you can ensure your dollar is contracting far quicker than everything that the public authority is saying to you.

Think a “exorbitant premium” financial balance will cover you? The banks realize their cash is persistently losing esteem – after the entirety of it’s them who are making new cash out of nowhere, so it’s far-fetched they will need to pay you more than they are losing. Indeed it might slow the misfortune, yet even an exorbitant premium record in these long stretches of ultra low loan costs will see your cash decrease in genuine terms.

Gold then again, it’s utilization as a store of significant worth laid out over centuries, ascends in esteem after some time to counter expansion.

A gold coin that would whenever have purchased a suit of defensive layer would today actually purchase a lovely custom fitted suit – the current reinforcement of work area bound business knights. The cost of a sheep in scriptural times when estimated in gold, is still extensively comparable to the cost of a sheep today.

Envision your incredible extraordinary granddad locking away a $100 note for a group of people yet to come. In 1900 the normal American procured 22 pennies 60 minutes, so this $100 would compare to a gigantic piece of his yearly compensation. This was an important note and one he was certain his kids’ youngsters would appreciate.

How sublime things would you be able to manage that $100 now? Excursion to the film with your family? A dinner out?

Consider the possibility that he’d traded it for gold and silver. In 1900 $100 would have purchased 5oz gold coins and 8oz in silver.

The case he’d fixed for your future advantage would never again hold $100, yet metals worth more than $7600 at the present cost – a close to correct comparable to their repurchasing power ever.

$7600 could have a genuine effect in somebody’s life. $100 considerably less so.

In light of this, by all means hold some money for it’s utilization in making buys, yet with respect to clutching dollars as a venture for any timeframe – it possibly pays in the event that you convert them from paper dollars into genuine cash.

The main genuine cash in these long periods of government issued types of money are valuable metals like gold and silver.

Who is Investing In Gold?

The World Gold Council detailed that 2018 saw the most elevated level of yearly national bank gold buys since the suspension of the highest quality level in 1971, as well as the second most noteworthy yearly complete on record.

Nations kept on purchasing gold in record sums in 2019, with China and Russia among those driving the charge – their authoritatively announced figures showing an expansion of 62 tons and 73 tons individually somewhere in the range of Q1 and Q3. Turkey saw an expansion of 91 tons over a similar period – a 230% increment on it’s general possessions in 2017. Unreported figures could be altogether higher.

Investigators are anticipating a remarkable ascent in national bank purchasing across Western Europe and European banks have likewise begun to crowd the metal all while offering exceptionally sure expressions on their sites about gold. Commerzbank considers gold an “anchor of trust” while the Dutch bank DNB depicts gold as “a definitive save resource.”

The super-rich are additionally moving into actual gold, considerably more so than they have as of late.

Goldman Sachs have affirmed that the worldwide first class are hurrying towards bullion in inclination to paper resources, their new abundance the executives report saying:

Since the finish of 2016 the suggested work in non-straightforward gold venture has been a lot bigger than the form in apparent gold ETFs… This [data] is steady with reports that vault request worldwide is flooding… Political dangers, in our view, assist with clarifying this since, in such a case that an individual is attempting to limit the dangers of approvals or abundance charges, then, at that point, purchasing actual gold bars and putting away them in a vault, where it is more hard for state run administrations to contact them, seems OK.”

To summarize a significantly longer report into plain English, the rich are purchasing actual gold, preparing themselves for a possibly serious accident.

In 2018 America had more than 5 million High Net Worth (HNW) and Ultra High Net Worth (UHNW) people – so it’s presumably not unexpected to learn America is likewise home to the most bullion sellers on the planet – and they’re occupied.

Be that as it may, it isn’t simply the super-rich. The American prepper development is preparing for what it considers to be a huge financial accident and is purchasing up gold and silver for an occasion which could see the dollar downgraded essentially.

Once seen by a lot of people as minimal more than tinfoil cap trick scholars, preppers are presently being joined by significant US organizations making arrangements for an approaching monetary catastrophe and experts are foreseeing a looming collapse portraying our present monetary framework utilizing words, for example, “lunacy” and “unimaginable”.

Obviously they may be generally off-base and all that will go on with no guarantees – except for even a quick glance around outside, at blocked shopping centers and without a moment’s delay incredible American organizations shutting their entryways for great tells a very clear truth. Something isn’t right.

Yet, setting to the side conversation about crashes and the expectations of very generously compensated investigators, gold is only a shrewd speculation. It’s recorded use as a store of significant worth proceeds and with it’s normal 9% yearly value ascends throughout the course of recent years, it stays a reliable and consistent entertainer.

To this end a large number of customary Americans are adding a level of gold in their retirement accounts or enhancing their stocks and different speculations for certain actual valuable metals.

It’s a solid, reliable speculation. It just so happens it could likewise save you in a crunch.

What are the Advantages of Gold in an IRA

An IRA resembles any interest in that you need it to increment in esteem after some time. What’s different with regards to an IRA is that it’s a duty advantaged approach to purchasing explicit speculations, where these expense investment funds are skilled to us by our central government as an approach to lessening the expenses of retirement arranging.

The entire reason for an IRA is that it’s there to help accommodate you in your retirement.

To wind up poverty stricken at 70, working long into your senior years or relying upon your kids and grandkids, then, at that point, making a successful retirement plan isn’t something to be messed with.

Therefore the accident of 07-08 hit IRAs and 401k plans so seriously – particularly for individuals near retirement age at that point. Whenever the monetary emergency struck, it cleaned half from the worth of millions of retirement accounts practically for the time being.

Painstakingly thought out plans for a lighthearted retirement were destroyed and ways of life must be downsized radically. It doesn’t make any difference that 6 or after 7 years the business sectors were in the groove again – for those now in retirement who’d been so seriously impacted the harm was done and their life had taken on a totally different quality to the one they’d expected.

Simultaneously as the emergency was annihilating expectations and dreams for some, gold was taking off to record highs. Financial backers frantic to sell their quickly falling stocks and offers were scrambling for place of refuge ventures and gold the most popular of all saw a tremendous ascent, both during the emergency and in the years following as limited scale retail purchasers got into the market expecting to recover a portion of their misfortunes from the accident.

For those retired folks who’d been informed concerning gold’s advantages as a fence before the accident and who’d added actual bullion to their IRAs – it was an alternate story.

Gold’s trip had repaid any stock misfortunes their record had seen. Regardless of whether this hadn’t brought about a general benefit (except if the record was for the most part put resources into gold) the retired people were viewing at extensively similar degrees of cash in retirement as they’d made arrangements for. Gold had played out the specific assignment it had been added to help accomplish.

Similarly as with any venture portfolio it pays to have enhancement and a fence. By not having every one of your eggs in a solitary container you increment your possibilities of development and diminish your dangers. An IRA shouldn’t be any unique and in light of the fact that it’s for your later years it’s even more essential to take care of business.

We have a full segment checking out Gold IRAs which looks at the cycles required and subtleties what can and can’t be added to an IRA. If you keep these straightforward guidelines or work with an IRA proficient, there’s no great explanation for why adding gold inside an IRA ought to be any more challenging to purchasing any speculation and with the right counsel it tends to be a lot simpler.

The whole purpose of an IRA is that it’s there to help provide for you in your retirement.

To wind up poor at 70, working long into your senior years or relying upon your kids and grandkids, then, at that point, making a viable retirement plan isn’t something to be trifled with.

For this reason the accident of 07-08 hit IRAs and 401k plans so gravely – particularly for individuals near retirement age at that point. Whenever the monetary emergency struck, it cleaned half from the worth of millions of retirement accounts practically for the time being.

Painstakingly thought out plans for a lighthearted retirement were demolished and ways of life must be downsized radically. It doesn’t make any difference that 6 or after 7 years the business sectors were in the groove again – for those now in retirement who’d been so gravely impacted the harm was done and their life had taken on an altogether different quality to the one they’d expected.

Simultaneously as the emergency was annihilating expectations and dreams for some, gold was taking off to record highs. Financial backers frantic to sell their quickly falling stocks and offers were scrambling for place of refuge ventures and gold the most well known of all saw a huge ascent, both during the emergency and in the years following as limited scale retail purchasers got into the market wanting to recover a portion of their misfortunes from the accident.

For those retirees who’d been advised of gold’s benefits as a hedge before the crash and who’d added physical bullion to their IRAs – it was a different story.

Gold’s trip had repaid any stock misfortunes their record had seen. Regardless of whether this hadn’t brought about a general benefit (except if the record was for the most part put resources into gold) the retired folks were viewing at extensively similar degrees of cash in retirement as they’d anticipated. Gold had played out the specific errand it had been added to help accomplish.

Likewise with any venture portfolio it pays to have broadening and a support. By not having every one of your eggs in a solitary crate you increment your possibilities of development and diminish your dangers. An IRA shouldn’t be any unique and on the grounds that it’s for your later years it’s even more essential to take care of business.

We have a full segment checking out Gold IRAs which analyzes the cycles required and subtleties what can and can’t be added to an IRA. If you observe these straightforward guidelines or work with an IRA proficient, there’s not a really obvious explanation for why adding gold inside an IRA ought to be any more hard to purchasing any venture and with the right consultant it very well may be a lot simpler.

And besides who wouldn’t want to make tax savings when buying gold?

Want more? Get our free Gold Investment Guide – a unique physical investor kit delivered direct to your door.

Learn more about gold’s unmatched properties for protecting wealth, either as part of your investment portfolio or inside a retirement account.