Investment in Gold Bullion Coins

Gold Coins: Investment Basics – What, How and Where

KEY QUESTIONS

Why Invest in Gold Bullion Coins or Rounds?

Assuming you’ve settled on the choice to put resources into gold, how could you pick gold bullion coins or adjusts over bullion bars? All things considered, bars will commonly have a marginally lower premium than coins on a load for weight premise.

Their prevalence is probably down to the way that we’re acclimated with coins – we use non-bullion coins in each day life so it’s an idea all of us are basically used to. In addition there’s the authority in us. Who hasn’t or doesn’t know something like one individual who’s gathered coins, regardless of whether surprising, old or unfamiliar – it’s a generally expected leisure activity here in America.

Furthermore abnormally America actually has coins containing valuable metals in every day dissemination – quarters, dimes, half dollars, and dollars made in and before 1964 are 90% unadulterated silver and half dollars dated from 1965-69 are 40% silver. While they’re turning out to be progressively interesting because of the leisure activity of “coin roll hunting” we’ve every taken care of them.

What’s a Bullion Coin – What’s a Round?

Gold bullion coins and rounds are a precious metals coin made specifically for investment – and because they are often tax-advantaged or tax exempt, they are legally required to be sold near to gold’s market (or spot) price.

To count as bullion their value should be based on the weight of gold they contain and not on any other factor such as age, beauty or rarity. These types of coins are collectables – or numismatics – and don’t carry any tax advantages.

Bullion coins are truly universal and can be bought and sold at close to spot anywhere in the world. They are compact, easy to carry and store, easy to hide if required and in many cases are even legal tender with additional tax benefits in some jurisdictions.

Bullion coins and adjusts are accessible in a wide scope of sizes, from parts of a gram or ounce (fractionals) as far as possible as much as one kilogram coins (32.15 official ounces) – albeit the most well-known gold bullion coins contain one ounce of fine gold.

Huge mint pieces will quite often be gatherers things and can convey a lot higher premium while kilo coins are frequently minimal more than plate formed bullion bars.

Simple to stack inside coin tubes and uniquely planned boxes – coins can likewise be held in individual containers to help safeguard from harm.

Gold Bullion coins are made in a two stage process where painstakingly estimated spaces are first cut from a huge sheet of gold. These spaces are then taken care of into a press machine, where a “strike” powers the clear between two contrarily engraved formers (coin pass on) which engrave the clear with an example, edging, and a presentation of fineness and other data. Coins don’t commonly convey chronic numbers as bars do.

Coins Offer a Wide Selection of Choice

There is a stunning decision accessible in bullion currencies and rounds, with some being genuinely excellent models including elaborate plans with UK Britannias and Austrian Philharmonics being two prominent models – skirting on authority quality.

Other bullion coins like US Gold Eagles or American Buffaloes from the United States Mint are obviously incredibly well known in the US ticking the energetic purchase America confine a way that little else in the market can

Coins from lofty mints and lawful delicate government mint coins will typically convey a higher premium in contrast with nonexclusive rounds from workaday purifiers.

Circulated Coins

While most speculation grade gold bullion coins are somewhere in the range of 99.5% and 99.99% unadulterated gold there are some, particularly those generally utilized however lawful delicate or regularly utilized as a mechanism of trade that may be not produced using unadulterated fine gold, yet a combination to make them harder wearing.

Alloyed circled coins can be less exorbitant on a for each unit front – a major benefit for new financial backers – yet it will likewise forbid them from use in a Gold IRA which has severe principles in regards to fineness or virtue, and will comparatively mean they don’t have a similar expense benefits as unadulterated gold bullion coins in states or nations where that benefit exists.

Striking alloyed bullion coins incorporate the Krugerrand, US Gold Eagle and the UK sovereign (all 91.67% unadulterated gold) with the Mexican Gold Peso alloyed to 90% gold.

The US Gold Eagle is an exemption for the no-IRA rule – it meets all requirements for an IRA

Other Considerations

Albeit the motivation behind contributing is typically purchasing as low as could be expected, premium mints and legitimate delicate coins are normally more costly than conventional rounds.

One benefit of this, is it is typically more straightforward to exchange a notable mint’s coin in any market contrasted with conventional rounds – or if nothing else they will order a greater cost because of their allure, frequently higher than spot.

Sellers will seldom offer anything at spot or higher for conventional rounds.

Secondary Market Coins

Optional market coins (used coins) are as you would anticipate that regularly closer should recognize than new.

This can offer financial backers a few huge investment funds particularly while purchasing at amount. In spite of the fact that scratches and scrapes are unavoidable these can run from practically none to significant wear – with a harmed coin just truly selling at it’s fundamental piece cost.

In any event, when a harmed coin is from a top notch mint, it will no doubt just at any point exchange underneath spot.

Gold “Stackers”

Home-stockpiling stackers will quite often purchase anything mint pieces or adjusts are accessible at the most reduced cost on the day and can rapidly foster a wide assortment of fluctuated plans, identities and sizes.

This can make the speculation cycle more tomfoolery and practically habit-forming, skirting into an authority’s region.

For a home stacker it tends to be extremely simple to flip from being a financial backer into a specialist then into a numismatist gatherer – which is a risk. Numismatics is a profoundly expert field where it’s feasible to lose huge load of cash assuming that you need information, due to the tremendous expenses included.

To this end we generally prescribe adhering rigid to bullion.

Learn more about the place bullion coins have in any diversified portfolio – inside Goldco’s free Precious Metals Investor Guide

Is Investing in Gold Coins a Good Idea?

As we’ve laid out, gold bullion coins are not difficult to purchase, simple to sell, all around famous and they’re a fantastic mix of size and premium – as well as being more quickly appealing to most than bullion bars.

In our book that makes putting resources into gold coins an awesome thought. What’s more who doesn’t cherish the possibility of a chest brimming with gold coins!

In certain purviews explicit lawful delicate gold coins are absolved from Capital Gains Tax. This implies when gold ascents essentially in worth and you come to exchange you will keep away from a duty bill. In a state or country with zero deals duty or VAT on venture gold, your gold bullion coins could and up being completely tax exempt at both the trading part of any bargain.

Albeit capital additions charge excluded coins can save you critical totals when you make an enormous increase at liquidation, their underlying price tag can be just about as much as 10-15% higher than a comparable conventional round.

You want to weigh up investment funds at buy versus expected investment funds at deal, yet given gold has acquired a normal of 9% each year throughout recent years, it shouldn’t take long for the tax reduction to be felt.

Are Gold Coins a Safe Investment?

Gold is viewed as a protected venture and gold coins are one of the most copious and all around acknowledged type of gold speculation – in this manner gold coins are certainly a protected speculation.

However, not all gold coins are as they appear.

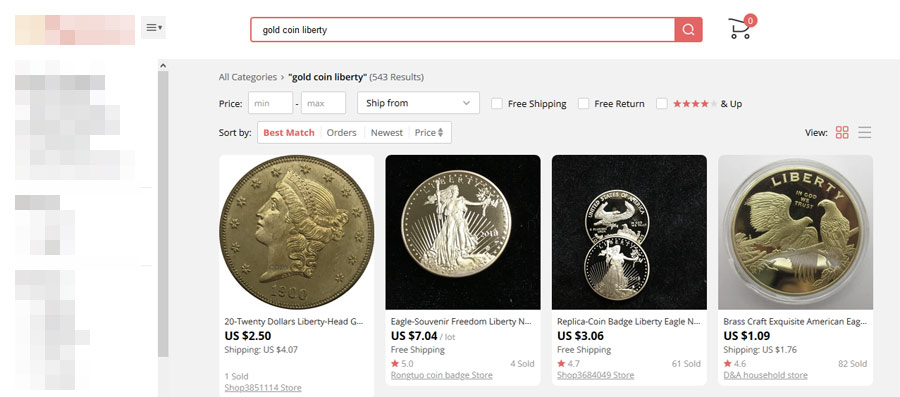

We’re seeing a tsunami of phony gold coins going onto the market, the greater part of which are impossible to miss Chinese duplicates of famous coins like Canadian Maples, Gold Eagles and American Buffaloes.

Other normal fakes are abnormal unfamiliar coins, ancient pieces and the pervasive Nazi gold. These coins are normally sold on the huge Chinese exporter locales as curiosity gifts however when they get into America a few corrupt venders can track down ways of tricking newbies searching for a deal.

What to look out for

Be careful about any arrangement that appear to be unrealistic. Gold coins rarely sell retail at spot and never beneath spot – so except if a major name seller is having a misfortune driving proposal to acquire new clients, be careful.

Since gold is dependably in such interest, even a dealer in a rush will actually want to draw near to recognize at quite a few coin or pawn shops, so there will be no compelling reason to sell at a major markdown.

Assuming a gold coin is accessible at a bargain to the general population at over 5% underneath gold’s market value then, at that point, it’s a phony, without any exemptions.

To be certain beyond a shadow of a doubt that your gold coins are a wise venture, you ought to just at any point purchase from a legitimate source – either a significant gold vendor, direct from the mint or through an expert gold speculation organization.

Deals in valuable metals are never what they appear.

Discover the secrets unscrupulous coin and bullion dealers use to scam, rob and con you – inside Goldco’s freePrecious Metals Investor Guide

How Much do Gold Coins Cost?

Gold coins are an exceptional speculation product and to be treated in an assessment advantaged way in numerous purviews they should be valued near the spot cost of gold.

Truly authentic gold coins will constantly offer for more than spot because of the expense of mining, refining, printing, bundling, stockpiling, protection and transportation in addition to a little benefit for the distributer.

Once at the retailer or bullion specialist there should be a remittance made for business and advertising costs but then another little benefit.

The greatest value differential will be founded on the coin’s size.

The implicit expenses and costs per coin are pretty much no different for standard 1oz coins as they are for fractionals (½ ounce, ¼ ounce, 1/tenth ounce and so forth) thus while putting resources into gold bullion coins you will normally find the charges on fractionals are a lot higher according to their unit cost than on standard coins.

Further value contrasts can be found between gold coins and adjusts from various mints, regardless of whether administrative mints of private mints with probably the most regarded mints conveying a higher premium on a like for like premise than those from more modest, less notable mints or on conventional rounds.

A 1oz Britannia from the UK’s Royal Mint will cost more than a 1oz round from APMEX, or a carbon copy gold sovereign from Kaloti in Dubai.

Certain gold coins are likewise classed as lawful delicate and as such they will be liberated from Capital Gains Tax in specific locales. These will generally convey a higher premium at buy yet this should be more than compensated for at deal.

How does this translate into the real world?

The generally speaking expenses on gold bullion coins and adjusts can go from just 2% over spot for conventional rounds to 40% on huge name mint fractionals.

gold coin pricesOn the subject of premium brand and nonexclusive rounds – very much regarded and premium mint coins are normally more straightforward to exchange and can order a more exorbitant cost than conventional or obscure brand adjusts in the auxiliary market because of trust and the more appeal of known coins.

Vendor charges can frequently be diminished by requesting products of a thing permitting the seller to impart a portion of their discount markdown to you because of economies of scale. The more you purchase, the more prominent your’ markdown on the seller’s premium.

The accompanying diagram shows cost expenses per coin size and across various mints from conventional rounds to the best coins – all charges in light of normal cost at 5 significant internet business bullion vendors.

I am rawAverage Premium By Coin Size for Branded, Generic and Bulk

Size / Brand

Premium Branded

Generic Bar

Bulk Buy

1/10oz

40.0%

15.1%

11.6%

1/4oz

19.2%

13.1%:

10.4%

1/2oz

15.1%

9.1%

7.0%

1oz

8.1%

4.4%

2.9%

1oz Eagle

7.5%

–

6.1%

1oz Maple

6.4%

–

5.3%

1oz Buffalo

7.1%

–

6.2%

1oz Britannia

7.5%

–

6.8%

1oz Krugerrand

6.5%

–

4.0%

Key Takeaways:

Highest premium is 40% for a premium-branded 1/10oz coin, lowest premium is 2.9% for bulk-bought generic 1oz round.

The best buys for any coin investors are 1oz generic rounds or 1oz Krugerrands – bought in bulk.

Anything smaller than 1/4oz – epsecially those from big-name mints – should be classified as a novelty or collectable as premiums are too high to make these coins a solid investment.

Buying gold coins and round in different sizes and from different mints can carry a significant range of premiums.

html block.

Click edit button to change this html

Get the best gold coins for the lowest premiums with little-known buyer secrets – inside Goldco’s freePrecious Metals Investor Guide

Where Can I Start Investing in Gold Coins?

Because of the fame of currency gathering in the US, combined with the prevailing force of the United States Mint, it’s feasible to get your first gold bullion coin at practically any pawn shop, neighborhood coin shop and surprisingly a few gem dealers – meaning pretty much every unassuming community will have something like one nearby hotspot for gold coins.

However, in this web associated world there are likewise in a real sense 1000’s of coin stores and bullion sellers with an internet based presence and web based business office.

What’s more on the off chance that that doesn’t work for you there’s dependably Amazon!

To get the best costs most Americans will by the same token:

Take a DIY course and go with a web based business store, where costs are most reduced however exhortation is slender on the ground as these are ordinarily a self-administration activity, or

Work with an expert gold speculation organization, where costs might be partially higher however master administration and guidance customized to your requirements are incorporated with each exchange. This is our favored choice, particularly for new financial backers.

Prior to making a huge speculation with a web based business organization it helps in the event that you make a couple of more modest exchanges first to perceive how administration quality and conveyance contrast and assumptions.

This is on the grounds that there have been a few spending plan end bullion vendors who have failed or been shut down because of misrepresentation in the beyond couple of years, so keep an eye out for pointless requesting issues, transporting delays or other warnings that propose income is tight. Assuming that everything is great and when you’re sure the organization is ideal for you – then, at that point, you can make bigger buys.

It’s somewhat unique with the huge gold venture organizations as these will regularly have least request upsides of $10-25,000 on account of the exceptionally close edges they work with.

When you make a buy you’ll be on awesome conditions with no less than 2 of their expert counsels, contingent upon your requirements and will presumably have an excellent inclination concerning whether they’re an organization you need to work with.

The somewhat higher expenses they charge for such assistance concentrated is regularly more than compensated for by the discount limits they can get by their nearby immediate associations with every significant mint and processing plants.

Eventually the decision is down to you – no frills administration on an online business stage where you can purchase individual coins each in turn, or a full warning and custom portfolio building administration at close to discount evaluating.

Get the best gold coins for the lowest premiums with little-known buyer secrets – inside Goldco’s freePrecious Metals Investor Guide

Where Can I Start Investing in Gold Coins?

Because of the prevalence of currency gathering in the US, combined with the prevailing force of the United States Mint, it’s feasible to get your first gold bullion coin at practically any pawn shop, nearby coin shop and surprisingly a few gem dealers – meaning pretty much every unassuming community will have something like one neighborhood hotspot for gold coins.

However, in this web associated world there are additionally in a real sense 1000’s of coin stores and bullion sellers with a web-based presence and internet business office.

Also in the event that that doesn’t work for you there’s consistently Amazon!

To get the best costs most Americans will all things considered:

Take a DIY course and go with an online business store, where costs are least yet exhortation is flimsy on the ground as these are ordinarily a self-administration activity, or

Work with an expert gold venture organization, where costs might be partially higher yet master administration and guidance customized to your necessities are incorporated with each exchange. This is our favored choice, particularly for new financial backers.

Prior to making a huge speculation with an internet business organization it helps on the off chance that you make a couple of more modest exchanges first to perceive how administration quality and conveyance contrast and assumptions.

This is on the grounds that there have been a few spending plan end bullion vendors who have failed or been shut down because of extortion in the beyond couple of years, so keep an eye out for superfluous requesting issues, delivering delays or other warnings that recommend income is tight. In the event that everything is great and when you’re sure the organization is ideal for you – then, at that point, you can make bigger buys.

It’s somewhat unique with the enormous gold speculation organizations as these will commonly have least request upsides of $10-25,000 on account of the extremely close edges they work with.

When you make a buy you’ll be on awesome conditions with something like 2 of their expert guides, contingent upon your requirements and will presumably have a generally excellent inclination regarding whether they’re an organization you need to work with.

The somewhat higher expenses they charge for such help serious is regularly more than compensated for by the discount limits they can acquire by their nearby immediate associations with every single significant mint and treatment facilities.

Eventually the decision is down to you – no frills administration on a web based business stage where you can purchase individual coins each in turn, or a full warning and custom portfolio building administration at close to discount evaluating.

Learn how to find the bullion dealer who’s perfect for your needs and will never let you down – in Goldco’s freePrecious Metals Investor Guide

What are Popular Gold Coins for Investment?

This fluctuates extensively relying upon the nearby market. In the US, Gold Eagles and Buffaloes are continuously going to offer well because of trust, simplicity of procurement and a specific level of enthusiasm. Gold Maples from Canada are additionally very well known.

American based private mints in all actuality do well on account of their great worth gold rounds with names like Lady Liberty, Prospectors as well as nonexclusive mint marked rounds from any semblance of APMEX and Sunshine Minting.

American Investors additionally prefer to purchase UK coins like Britannias and Sovereigns, Australian Kangaroos, and Austrian Philharmonics albeit none of these approach the ubiquity of Eagles, Buffaloes, Maples and US printed adjusts.

What are Popular Gold Coin and Round Mints?

Specific gold coin popularity varies by country although most investors in the West will be aware of the major mints operating across the US, Canada and Europe. Some European mints tend to carry a higher premium in America due to shipping costs and their comparative rarity.

APMEX

APMEX, Inc., are situated in Oklahoma City, Oklahoma, and are the world’s biggest web-based retailer of valuable metals, having sold more than $10 billion in valuable metals since being established in 1999. As well just like a bullion vendor selling a wide scope of coins from around the world, APMEX produce their own rounds in 1/2oz and 1oz loads at 0.9999 fineness (99.99% unadulterated gold).

Austrian Mint

Established in 1194 the Austrian Mint is situated in Vienna and is answerable for printing Austria’s coins. Starting around 1989 it has been a public restricted organization and an auxiliary of Austria’s national bank Oesterreichische Nationalbank. Despite the fact that it produces bars, the mint is most popular for it’s coins, the most well known being Vienna Philharmonics in 1oz, 1/2oz, 1/4oz, 1/10oz and 1/25oz sizes, all stamped in 0.9999 fine gold. Other gold coins incorporate Ducats, Crowns and Gulden (.986 fineness) albeit these are extraordinary in US.

Engelhard – presently shut

Albeit New Jersey based Engelhard were obtained by BASF in 2006, their gold bullion adjusts were profoundly well known with financial backers across America with 1oz American Gold Prospectors being the most regularly exchanged. Many are presently conveying a higher gatherer’s premium because of their expanding extraordinariness.

Heraeus

The Heraeus valuable metals treatment facility has been situated in Germany for more than 160 years and Nanjing, China starting around 2018. Heraeus for the most part delivers venture bullion bars, however 1oz and 50g rounds are accessible in 0.9999 fine gold, some of which come including a rainbow shaded security visualization, named a Kinegram®

Perth Mint

Laid out in 1899, The Perth Mint is Australia’s true bullion mint and entirely possessed by the Government of Western Australia. Perth Mint marked bullion coins and adjusts are accessible in a wide scope of sizes and plans with Lunars, Kangaroos and Koalas being famous speculations with generally accessible in 1/20oz, 1/10oz, 1/4oz, 1/2oz, 1oz, 2oz, 10oz and 1kg sizes – stamped in .9999 fine gold.

Rand Refinery

South Africa’s Rand Refinery is the biggest single-site valuable metals refining complex on the planet. Laid out in 1920 it has refined very nearly 50,000 tons of gold. Most popular for its Kruggerrand coins, Rand additionally delivers huge cast bars for national banks, bullion banks, institutional and bigger scope financial backers. Kruggerrands are most normal in 1oz sizes but on the other hand are accessible in fractionals 1/2oz, 1/4oz and 1/10oz – at .917 fineness.

Illustrious Canadian Mint

Laid out 1908, the Royal Canadian Mint is a Crown partnership, working under the Royal Canadian Mint Act, creating all of Canada’s flow coins, and a wide scope of financial backer bullion. RCM’s chief gold bullion coin The Gold Maple is stamped in .9999 fine gold and comes in 1oz in addition to 1/2oz, 1/4oz, 1/10oz and 1g weight fractionals.

Imperial Mint

Laid out in 886 The Royal Mint is the most established treatment facility still in presence and is an administration claimed mint creating coins for the United Kingdom. The Royal Mint’s essential gold bullion currencies are Britannias (.9999 fine gold, 1oz, 1/2oz, 1/4oz and 1/10oz sizes) and Sovereigns (.9167 gold – full sovereign, half sovereign, quarter sovereign in addition to £2 and £5 sections) despite the fact that they in all actuality do make a wide scope of other higher premium collectables.

Scottsdale Mint

Arizona based Scottsdale Mint is an exceptionally famous private mint, most popular for their silver however progressively creating a wide of gold coins and adjusts generally in 1oz sizes with exactly 1/5oz fractionals – all from .9999 fine gold

US Mint

Established in 1792, The United States Mint is a unit of the Department of the Treasury liable for creating money for the United States, as well as controlling the development of bullion. US Mint gold bullion coins are the most well known gold coin interests in the USA today and comprise of American Gold Eagles (1oz, 1/2oz, 1/4oz and 1/10oz – in .9167 fine gold) and American Buffaloes accessible in the one-ounce size and .9999 fineness.

Valcambi

Laid out in 1961 Valcambi is a main Swiss metals processing plant, 95% possessed by REL Singapore. furthermore 5% by Rajesh Exports Limited India. Valcambi produces a wide scope of gold bullion adjusts stamped in 100g, 1oz, 10g 5g 2.5g and 1g sizes. All Valcambi adjusts are .9999 fine.

Scotiabank

Scotiabank portrays itself as Canada’s Precious Metals Bank and it is one of the world’s biggest valuable metals sellers, with a long term history as a market creator in valuable metals. ScotiaMocatta the valuable metals banking division of the bank was shut in January 2019 because of thump on impacts of the 2016 messy gold outrage which took out a few worldwide processing plants, yet Scotiabank marked bullion adjusts stay well known speculations accessible in 100g, 1oz, 10g and 5g sizes. All Scotiabank adjusts are fabricated by Valcambi from .9999 fine gold.

Become an instant expert on the world’s most popular bullion coins – with Goldco’s free Precious Metals Investor Guide

Is There Tax on Gold coins or rounds?

The duty financial backers pay on gold rounds relies upon which express the round is purchased and put away in as every one of the 50 states can set it’s own degree of deals charge.

While certain states are zero-appraised on speculation grade bullion adjusts, different states can energize to 10%. This essential widespread assessment is notwithstanding any nearby area or city deals charge.

Speculation bullion adjusts purchased outside of state can be likely to a “utilization charge” at similar rate as the business charge.

This doesn’t concern US Legal Tender bullion mint pieces – which generally speaking are absolved from deals charge (except if sold as collectibles).

This implies a 1oz American Gold Eagle will be deals charge absolved even in states with a business charge on gold – while a 1oz gold bar will be available.

Unfamiliar Legal Tender bullion coins are possibly absolved from deals charge whenever sold at face esteem – something that would not be probable with as an illustration a UK £2 sovereign!

Gold Bullion Coin Tax Rates (Unless Exempt Coins)

Alabama

4% deals charge with County and City charges which can add another 4-10%.Alaska

No state deals charge, however neighborhood legislatures can add County and City charges.

Arizona

No business charge on Coins, or Precious Metals.

Arkansas

6% Sales charge on Coins and Precious Metals with County and City charges amounting to 5%

California

Deals charge exception on Coins and Bullion more than $1500.

Colorado

Zero state charge, but nearby deals charge on Coins and Bullion fluctuates by City.

Connecticut

No business charge on Coins in addition to exclusion on Bullion more than $1000.

Delaware

No business charge on Coins or Precious Metals.

Region of Colombia

5.75% deals charge on Coins and Precious Metals.

Florida

Zero deals charge on U.S. Coins or Currency. Exclusion on Bullion more than $500.

Georgia

No business charge on Coins or Precious Metals.

Hawaii

General Excise Tax on Coins and Bullion – paid by the merchant yet might be given to the purchaser.

Idaho

No business charge on Coins or Bullion.

Illinois

No business charge on Coins or Precious Metals.

Indiana

Indiana quit charging charges on coins, lawful delicate, and bullion July 1, 2016.

Iowa

No business charge on Coins or Precious Metals.

Kansas

6.15% Sales charge on Coins and Precious Metals.

Kentucky

6% Sales charge on Coins and Precious Metals.

Louisiana

Exclusion on Coins and Bullion more than $1000.

Maine

5% Sales charge on Coins and Precious Metals with neighborhood County and City charges on top.

Maryland

Numismatic Coins and Bullion absolved more than $1000.

Massachusetts

Coins and Bullion absolved more than $1000.

Michigan

No business charge on Coins or Precious Metals.

Minnesota

6.875% Sales charge on Coins and Precious Metals with neighborhood County and City charges on top.

Mississippi

7% Sales charge on Coins and Precious Metals, with unfamiliar lawful delicate coins excluded.

Missouri

No business charge on Coins or Bullion.Montana

No State deals charge except for a 3% temporary duty in certain areas.

Nebraska

No business charge on Coins or Precious Metals.

Nevada

6.85% Sales charge on coins/numismatics (anything selling more than half of its Face Value), however private mint Bars and Rounds absolved.

New Hampshire

No business charge gathered on Coins or Precious Metals.

New Jersey

7% Sales charge on Coins and Precious Metals.

New Mexico

No business charge, yet comparable “Gross Receipts Tax” paid by vender is regularly given to purchaser

New York

Bullion and Coins available at 4% in addition to nearby City and County charges, Bullion excluded more than $1000.

North Carolina

4.75% Sales charge on Coins and Precious Metals in addition to nearby City and County charges.

North Dakota

No business charge on Coins and Precious Metals.

Ohio

Deals charge exclusion on bullion and ‘Venture’ coins.

Oklahoma

No business charge on Coins and Precious Metals.

Oregon

No business charge on Coins and Precious Metals.

Pennsylvania

No business charge on Coins and Precious Metals.

Rhode Island

No business charge on Coins and Precious Metals.

South Carolina

No business charge on Coins and Precious Metals.

South Dakota

No business charge on Coins and Precious Metals.

Tennessee

7% deals charge on Coins and Precious Metals in addition to neighborhood County and City charges.

Texas

No business charge on Coins and Precious Metals.

Utah

No business charge on Coins and Precious Metals.

Vermont

6% deals charge on Coins and Precious Metals with bullion explicitly referenced in Vermont charge code.

Virginia

5.3% – 6% deals charge on Coins and Precious Metals.

Washington State

No business charge on Coins and Precious Metals.

West Virginia

6% deals charge on Coins and Precious Metals in addition to a 1% nearby assessment in certain Counties and Cities.

Wisconsin

5% deals charge on Coins and Precious Metals in addition to up to a 0.5% nearby assessment in certain Counties and Cities.

Wyoming

4% deals charge on Coins and Precious Metals in addition to 0.1% – 2.0% neighborhood charge in certain Counties and Cities.

Can Gold Coins be held in an IRA?

The IRS currently permits explicit grades of venture bullion coins to be held in an IRA taking into consideration gold to be purchased in an exceptionally charge advantaged way.

As can be anticipated from the IRS there are severe standards administering what coins can be purchased and where they ought to be put away which we cover exhaustively in our Gold IRA segment.

Gold coins for IRA utilize should meet least fineness necessities and be made by a NYMEX or COMEX-supported purifier/assayer and ought to be ISO9001 Certified. The base virtue ought to be .995 fine (99.5% unadulterated gold) or more noteworthy with a special case being given to American Gold Eagles.