Adding Silver to an IRA

Silver IRAs Offer Tax Advantage and Security with Huge Potential

JUMP TO SECTION

Silver: Your IRA’s New Best Friend

A Silver IRA can shape a great expansion inside an all around differentiated venture portfolio, assisting with supporting a retirement plan from many dangers of market slumps or monetary emergency.

Not exclusively will silver in IRA accounts loan the IRA silver’s abundance safeguarding capacities, adding silver to an IRA is indeed one of our most expense proficient ways of putting resources into silver bullion.

Acting much as a Gold IRA will during seasons of market pressure, a silver-upheld IRA likewise brings silver’s underlying potential for enormous cost increments, on the off chance that you’re a financial backer for whom market-beating capital increase is similarly just about as significant as assurance from expansion and emergencies.

This page hopes to give you clear data checking out the requirement for a Silver IRA, the guidelines behind opening and putting resources into one and how to best exploit adding silver to an IRA.

Investing in Silver for Retirement. Why?

We’re informed it’s fundamental we make arrangements for our retirement. What’s more it’s valid, we’re aging each day and retirement costs are getting more costly – so for what reason would we confirm or deny that we are doing really near enough with regards to our retirement investment funds?

Central bank research has as of late shown 13% of Americans matured 60+ have positively no cash saved for retirement. For individuals in the 45-59 age section this figure increments to 17% and moves to more than 26% assuming that you’re matured between 30-44.

Concerning those of us under 30, close to half have made no retirement arrangements or reserve funds by any means.

Indeed, even where we have assembled some retirement investment funds or a retirement plan, the review showed that portion of the over 60s holding 401k and IRAs see themselves as significantly underfunded – a startling idea in our current reality where expansion is eating into our investment funds dollars when state administrations are being cut.

Little marvel the IRS has made various motivators to assist manage this retirement crisis, one of which is permitting financial backers to get to the save-safe house and demonstrated abundance protection that are valuable metals – all at an exceptionally charge advantaged rate.

On account of these progressions in the IRS rules, financial backers can now purchase silver for IRA purposes and treat the venture sum as an expense derivation on our personal government form. In addition to the fact that you get every one of the upsides of adding silver inside your portfolio, yet there’s a decrease in your assessment payable, giving you those dollars back to additionally develop your retirement reserve.

We’ll cover the essential silver IRA rules, silver IRA rollovers and moves in a second.

Turned out your revenue is inside IRA commitment restricts it’s exceptionally simple to exploit this extraordinary duty reward.

Investing in a Silver IRA Account

How might silver assist with safeguarding your IRA? Silver isn’t just a drawn out strong entertainer averaging a 26% yearly development from 1920 to 2020 – yet it’s a demonstrated abundance safeguarding apparatus, used to safeguard generational riches and the accounts of whole countries.

When the mystery of a limited handful at the highest point of the cash pyramid, gold and silver contributing has at long last become simple choices open to any of us, because of changes in IRS rules.

And all we really want to purchase silver in the most duty advantaged way that is available – is an IRA.

Key Benefits of Silver in Your IRA

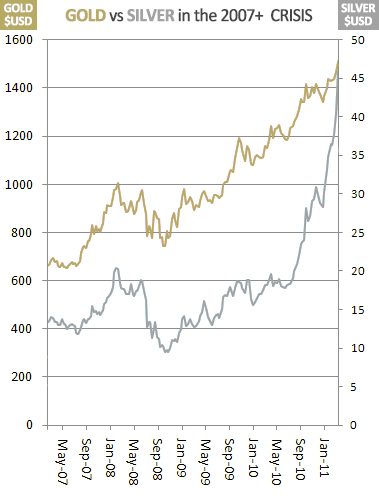

Silver’s defensive power in IRA accounts was most plainly exhibited in our latest financial emergency when a worldwide accident and profound downturn cut the upsides of millions of retirement plans by half, denying retired folks of their well deserved prospects.

silver outflanked gold during 2007 emergency and in after mathDue to silver and gold’s propensity to rise when stocks are falling – those with the premonition to add a level of valuable metals inside their IRA plans had the option to appreciate significant ascents while all the other things including the typically strong land fell through the floor.

Between it’s 2008 low to 2011 high, gold acquired 116% aiding help IRA accounts – however silver’s more unstable nature saw financial backers procure a fantastic 448% benefit as the paper markets consumed.

The contrast between those with and without silver was felt most unequivocally by those nearest to their retirement.

For prospective retired people put principally in paper stocks and bonds, their arrangements for a quality way of life in retirement were sliced down the middle.

IRA plans with an expansion into metals fared better.

Because of these valuable metals they were left practically sound and may even have seen a general benefit on account of gold and silver just doing what they specialize in the midst of emergency.

As we cover here abundance experts and market experts would recommend the response is a major no. Market analysts are composing progressively stressing reports recommending we could be near the precarious edge of something fundamentally more profound and longer enduring than the accident of 07/08.

US government obligation is at a record-breaking high, combined with developing international distress in the Middle East, however Europe and Asia as well. Individual obligation has arrived at impractical numbers with generally American’s scarcely ready to make interest charges, without any reserve funds band-aid on the off chance that things head south.

Whether or not master expectations are precise, we are an undoubtedly in unfamiliar area.

In spite of a visible presentation of solidarity, markets are so delicate thus internationally interconnected that it would take only one little occasion to set off another overall accident – and this time it’s dependent upon us, as people, to guarantee we accommodate our endurance when the following emergency comes.

Charge advantaged gold and silver can assume a vital part in that protection.

Learn more about what silver can do for your retirement planning – inside Goldco’s free Precious Metals Investor Guide

Adding Silver in a Retirement Account

Actual silver bullion must be added into a Self Directed IRA. The most common way of adding the silver is almost equivalent to purchasing any speculation bullion – with three exemptions:

- The buying monies should come from a Self Directed IRA account.

- You are restricted to just purchasing IRS supported metals.

- You really want to utilize a supported IRA overseer/legal administrator/storehouse vault.

So rather than paying your bullion vendor in real money, check, Visa or bank wire you essentially set up an exchange from your IRA record to the specialist.

In each and every other regard it’s you who settles on which bullion bar or coin sizes to purchase, and the brands or mints who produce them. Since valuable metal IRAs are turning out to be a particularly normal course to putting resources into silver, practically all bullion vendor’s greatest dealers are reasonable for valuable metals retirement accounts.

The one drawback is you don’t get to genuinely deal with the metals since they are sent straightforwardly to your safe vault – but the assessment investment funds and the high security of the vault more than compensates for this.

Investing in a Silver 401k Plan?

Not all retirement accounts can put resources into actual silver. Adding silver to a 401k – or so far as that is concerned adding some other actual resource – is definitely unrealistic. Assuming you truly do have one of these business designs and are hoping to add silver or gold to your record, then, at that point, your record will require moved or turned over to a Self Directed IRA.

On the off chance that this turns out to be what is happening, there’s an extremely simple interaction included. Given you’re in a position where you’re ready to leave that 401k arrangement, then, at that point, it’s an instance of filling a couple of structures – something made a lot more straightforward assuming you work with a silver IRA subject matter expert – and playing out a Silver IRA Rollover or Transfer.

In the event that you’re left with a 401k because of your present work, it’s an instance of opening an extra arrangement – a personally managed IRA – and having silver speculations made straightforwardly to your new record. There are expert valuable metals vendors who manage this sort of move and can accomplish the work for your sake rapidly and easily at negligible expense.

In any case, doing a silver 401k exchange, silver 401k rollover or opening another privately managed IRA will be your door to having the option to transform investment funds into sparkling resources – resources demonstrated to be capable assistance develop and safeguard the remainder of your retirement account.

The Silver IRA Rollover

What is a Silver IRA Rollover? A Silver IRA Rollover is the cycle where assets are turned over from a current retirement account into another independently managed IRA or Precious Metals IRA. Albeit these assets are ordinarily circulated to you, the reinvestment cycle whenever done accurately doesn’t set off any available occasions.

As an illustration you might need to move assets from an old manager supported retirement plan into another privately managed IRA. An IRA rollover will protect the expense conceded status of the resources in your old retirement account, without covering current assessments or any early withdrawal punishment at the hour of move.

When would you carry out a Silver IRA Transfer?

You complete a silver IRA move assuming that your current retirement plan is contrary with actual valuable metals.

Moves are most normally done on organization benefits on the grounds that 401k plans are simply ready to hold customary paper resources – not actual like gold and silver.

Rollovers may likewise be dependent upon a saved portion charge while turning over to an IRA – though an exchange isn’t.

At long last regardless of it currently being quite a while since the IRS loosened up it’s guidelines on holding venture grade bullion inside IRAs, there keep on being various legal administrators who will not acknowledge actual resources.

Step #1: Select a Custodian/Trustee to Ac

Step #1: Select a Custodian / Trustee to Accept the Transfer.

In the event that you don’t as of now have an appropriate IRA, you should set one up. To get off to the best beginning and guarantee your picked legal administrator functions admirably with valuable metals we encourage you to work with a Silver IRA trained professional.

They’ll have extremely cozy associations with probably the best legal administrators in the valuable metals market, alongside any structures required – and can assist you with filling them depending on the situation.

An extra reward will frequently be that IRA set-up expenses are decreased because of the volume of business the silver IRA expert sends the legal administrator’s way.

Desk work is either all-advanced or more conventional printed paper frames, and are seldom complicated with the entire record opening interaction taking as little as a couple of days.

Step #2: The Trustee-to-Trustee Transfer

Your new silver IRA legal administrator and your old legal administrator will currently organize to complete a legal administrator to-legal administrator move.

This implies the monetary organization holding your present arrangement makes an installment move straightforwardly into your new retirement plan, the assets moving from one record to the next without entering your own records or setting off a conveyance or available occasion.

Critically there are no assessments kept in any type of move – an aid for moving from a 401k to an IRA. Moves are additionally excluded from the one rollover each year rule.

Transfer Step #3: Buying Silver

Similarly as with the Silver IRA Rollover above, presently it’s an ideal opportunity to add the actual valuable metals to your new IRA.

Contingent upon your requirements, be it for development, for security or a blend of the two, your IRA expert will actually want to prompt you on working out your metals portfolio – silver, gold or a mix of valuable metals.

Given your metals consent IRS rules as being viable with an IRA account (and assuming that you’re working with a subject matter expert, they will be) you can purchase a decent choice of silver bars and coins, gold, venture grade platinum and even palladium.

Secure safeguarded conveyance moves your metals from your bullion merchant direct into your legal administrators vault inside an IRA storehouse and that is the interaction finished.

In addition to the fact that you are ready to exploit both silver’s ability to secure and develop, however you’ve done as such in the most duty productive manner conceivable.

Learn more about what silver can do for your retirement planning – inside Goldco’s freePrecious Metals Investor Guide

Silver Bullion IRA Investing Tips

A silver bullion IRA isn’t about collectibles. It’s completely about the worth of the silver in your bars or coins. This implies you shouldn’t stress over purchasing explicit mintage coins or banishes from one treatment facility over the course of the following.

Given the processing plant or mint is NYMEX or COMEX endorsed or an administration mint and meets the expected immaculateness level then you ought to just be worried about your relationship with a confided in specialist, and purchasing as a lot silver as possible for your dollar.

This might incorporate auxiliary market (used) bullion where you can discover the absolute most reduced charges in the market as well as exceptional offers vendors will make now and again. Since you’re never going to actually deal with this gold – it must be sold before circulation happens – it ought to be of minimal matter what you purchase as long as the silver is IRS consistent.

In any case, regardless of whether you track down deals – and numerous administration printed coins go for a marginally higher premium than conventional silver at any rate – it’s not of an immense concern where your venture is for the more extended term.

With silver averaging 26% yearly expands p/a from 1920 to 2020 – shaving 1% or 2% from a seller’s premium has just negligible impact on your general venture.

Something we accept to be of far more prominent significance both for the presentation of your retirement account and for your own prosperity is working with the right silver speculation experts.

Having a genuine master on your side can assist with having the effect between a silver IRA that just tracks the metal cost, versus one which takes off in esteem.

The trust and security you can create with a decent valuable metals vendor can be of the same amount of significant worth to you as the metals you purchase – realizing a silver intermediary has your wellbeing on a fundamental level and is truly paying special attention to you can’t be underplayed particularly when the valuable metals market is known for having too much reprobates.

Observing without a doubt the least premium and expenses will seldom convert into something besides the most fundamental of administrations. In the event that extraordinary exhortation, nature of administration and genuine inner harmony winds up costing 1-2% more, it’s cash very much spent as we’ll see straightaway.

Discover the best ways to buy silver for your retirement account – inside Goldco’s freePrecious Metals Investor Guide

Choosing a Silver IRA Custodian

While you’re putting resources into an IRA, the IRS expects there to be an outsider going about as a legitimate overseer for any ventures you hold inside the record.

A silver IRA caretaker should be an IRS approved specialist organization for valuable metals IRAs and it is their obligation to really focus for you, to follow values, individual exchanges and obviously tax collection.

In short the overseer’s responsibility is to defend your ventures and guarantee adherence to IRS and administrative regulation.

IRA overseers don’t give speculation guidance, or any dynamic venture the board administrations, yet will help you when you settle on choices to trade resources or move assets, via completing the expected work for your sake, by liaising with different outsiders, middle people and facilitators like bullion vendors, transporting administrations and vaulting organizations.

Despite the fact that there are numerous IRA overseers in the US, not all caretakers work with privately managed IRAs and not all privately managed IRA caretakers manage valuable metals – so decision is more restricted than if you somehow happened to put resources into stocks. Saying that, overseers who manage valuable metals are regularly especially great at what they do because of the expert idea of the venture.

Decision can be additionally affected whether you need a customary expense conceded IRA or a Roth IRA.

In the wake of settling on these choices you can additionally limit your decision in light of:

Custodian’s Investment Selection

Except if you are just needing silver in your IRA, it’s fundamental for work with an overseer who can deal with whatever number of the resources you’re probably going to need inside your record as could reasonably be expected.

The more prominent decision the better as this will future confirmation your record and lessen the need to involve separate organizations for independent speculations.

Custodian / Vaulting Fees

Overseer charges can incorporate support expenses, exchange charges and commission charges where the caretaker enters exchanges for your sake.

A few overseers charge in view of venture esteem, others a decent yearly total. Contingent upon the size of your record this can affect your charges.

Custodian Knowledge

The best overseers are educated – having valuable metals experience, combined with lawful, financial and market information explicit to metals will guarantee all exchanges and possessions are held for your greatest benefit and in accordance with all regulation.

Likewise for those financial backers hoping to join different records, caretakers ought to have master information on solidification works on, monitoring viable and non-viable records.

Custodian Service

The huge one. Your caretaker doesn’t just care for your resources, they are frequently the vital point of interaction among you and the different go-betweens and facilitators fundamental in the smooth activity of your record.

Having your venture processes run as expected, realizing your solicitations are being dealt with effectively and on schedule and realizing you will constantly have somebody ready to address your inquiries to your full fulfillment is vital for both your prosperity and inward feeling of harmony that your advantages are by and large very actually enjoyed.

Great assistance can represent the deciding moment your experience and missed correspondence, or false impressions would cost you be able to time as well as cash.

One caretaker we return to over and over is Equity Trust. 45 years an industry chief, Equity convey a really master administration, satisfying all custodial and authoritative obligations with at least fight and marking every one of our containers for value, administration and decision.

Different forerunners in the field incorporate Broad Financial, New Direction and Provident Trust.

Get more familiar with picking an independently managed IRA caretaker in our principle SDIRA area

Need more? Get our free Metals Investment Guide – an extraordinary actual financial backer pack conveyed direct to your entryway.

Secure your precious metal investments with unbeatable vaulting offers – inside Goldco’s free Precious Metals Investor Guide