The Basics of Investing in Bitcoin

Bitcoin Investing Needn’t be Complicated

KEY QUESTIONS

What Is Bitcoin?

Bitcoin is both the first, the most popular and most broadly involved cryptographic money on the lookout.

At it’s most essential level Bitcoin is both a vehicle of trade and the means for moving and following those trades – all without expecting to depend on outsiders.

In short it’s a cash like resource intended to be both totally private but then completely straightforward – and is held and communicated in a structure which can’t be impeded by enormous banks or government.

Where cash is given by focal state run administrations and constrained by the investors, Bitcoin is made – or “mined” – by a decentralized organization of PCs. It is a really open undertaking – all the source code is accessible to all and anyone with a PC can join this organization and begin mining Bitcoin.

The most common way of mining discharges new Bitcoin from a pool of 21 million coins and includes diggers taking care of mind boggling numerical issues. These numerical statements or calculations confirm, encode and for all time store all Bitcoin exchange records on the “Blockchain.”

Mining? Blockchain?

The Bitcoin idea is both an incredibly straightforward and complex framework, made 11 years prior by an unknown software engineer going by the name “Satoshi Nakamoto”.

Dependent freely upon a gold mine, Nakamoto needed to make a limited advanced resource thus “covered” an aggregate of ₿21,000,000 in a virtual mine. Rather than burrowing with pick and digging tool, Bitcoin excavators would have to take care of progressively complex issues, the demonstration of which would deliver coins simultaneously as checking and putting away Bitcoin exchange subtleties in a cryptographic record – the blockchain.

Like a gold mine, the primary coins would be not difficult to track down for all intents and purposes laying in the virtual soil before the excavator – however as more coins were found diggers would have to burrow increasingly deep where the coins would turn out to be progressively scant.

Once more, similar as gold Bitcoin will not experience the ill effects of the devaluating impacts of expansion. Dissimilar to US dollars which can be made from slight air by the Federal Reserve “printing away issues” through Quantitative Easing, Bitcoin has a proper all out supply.

With any proper stock, expansion sought after will constantly bring about a more exorbitant cost – giving Bitcoin an implicit component to keep up with esteem against a depreciating dollar.

As Bitcoin mining turns out to be progressively troublesome, increasingly registering power is expected to separate each coin, the expense of extricating each coin becomes more noteworthy, adding to the intrinsic worth inside the cash.

As we approach the 21 million figure these issues will turn out to be exceptionally mind boggling and as it does Bitcoin’s natural worth will increment.

At season of composing we have mined a sum of 18,211,425 significance there are just 2.7 million remaining “in the ground” – but to mine these coins will require more processing power than we’ve seen used to this point altogether and take ordinarily longer than the 11 years for the initial 18 million.

How Does Investing in Bitcoin Work?

All Bitcoin exchanges depend on the Blockchain, Wallets, Private and Public Keys

The blockchain is the security, transmission and global positioning framework while Bitcoin are the virtual resources communicated upon it.

To put resources into Bitcoin you’ll require both a wallet and a wellspring of Bitcoin.

All Bitcoin are held in wallets – a special virtual location on the blockchain, and each exchange you make utilizing this wallet will be put away on the blockchain record, showing the Bitcoin amount, the starting wallet address and the getting wallet address.

These subtleties are completely straightforward to any individual who wishes to take a gander at them. Anyone can look on the web and perceive the number of Bitcoin are put away in any wallet.

Simultaneously as being open, all exchanges and wallets are completely private as no recognizable data is put away or communicated – simply the amount of Bitcoin sent and two wallet tends to engaged with any exchange.

Security for Bitcoin speculations is given by a mix of this unhackable blockchain and your Bitcoin wallet having two keys – a public key/address and a private key.

These keys are both long series of numbers, and your public key is then abbreviated to give your wallet’s public location. With this wallet address alone, anyone can add bitcoin to your wallet – but to eliminate bitcoins from your wallet you’ll require the subsequent key – the Private Key.

Your private key is only that – and should stay 100 percent private. This is on the grounds that all it expects to access and eliminate your Bitcoin speculation from a wallet are these two keys – and one of them is now out there.

It’s subsequently crucial for keep your hidden key totally secure.

It’s likewise fundamental that you never lose it – as without your private key, your Bitcoin speculation will remain for all time difficult to reach even to you.

A Word on Wallets

Bitcoin wallets can be held on the web and off – and can be hot or cold.

Hot wallets are live, held on the web and utilized for ordinary exchanges, yet they are additionally very hazardous seeing customary hacking assaults and burglary. You ought to never involve a hot wallet for long haul stockpiling and just keep as much in one as you believe you might have to utilize. Similar to conveying cash in your pocket.

Cold wallets are utilized for longer-term stockpiling and deal more prominent security, in spite of the fact that as we cover here not all wallets are made equivalent. Online wallets are more in danger than disconnected – and wallets on your ordinary PC or cell phone are more in danger than paper wallets and extraordinary equipment wallets.

Paper Wallets

Since all that is expected to utilize a bitcoin wallet is a location, public and private keys, there are numerous who see the benefits and straightforwardness engaged with utilizing a paper wallet.

You basically record your public location, and keep note of the hidden key elsewhere, ideally across numerous protected or secret areas.

An illustration of a full private key is:

E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

This isn’t actually essential and can be inconvenience to type, yet fortunately longer keys can rearranged and abbreviated by programming and different applications into a Mini Key.

The above long key turns into this:

SzavMBLoXU6kDrqtUVmffv

A smaller than usual key like this is continuously going to be simpler to utilize.

For added security, this key can be parted into segments, for example, being composed across a few pages in a book.

Obviously there’s a risk in losing the key or having it found by an outsider – the two results would see you fail to keep a grip on the wallet.

Hardware Wallets

A well known technique utilized for cold stockpiling of Bitcoin is a compact equipment wallet, like those from market pioneers Trezor and Ledger.

These gadgets are successfully exceptionally encoded memory sticks/scaled down PCs containing a solid means to consequently enter the mystery key through an associated gadget while wishing to separate coins.

Every gadget is coupled to confidential “seed state” a bunch of words which can be utilized to reproduce the wallet and it’s substance in case of losing or breaking the gadget. Regardless of whether the gadget producers leave business your seed expression can in any case give access your wallet anytime in the future as your wallet really exists on the blockchain.

A model seed state is:

air terminal hamburger exceptional toy fly fossil dental specialist cabbage fox notice delicate tongue

Seed expressions can comprise of 12 or 24 words from a particular rundown and should be kept totally secure – as anyone with your seed expression will possibly have total admittance to your wallet and it’s substance.

Sourcing Bitcoin: Where Can I Invest in Bitcoin?

Unless you are a Bitcoin miner, you’ll need to find a source of Bitcoin to invest in.

Bitcoin can be bought on Bitcoin Exchanges, through Peer to Peer exchanges, at Bitcoin ATMs and in person – they can also be bought through a tax-advantaged IRA using the services of a professional Bitcoin IRA specialist like CoinIRA.

#1: Bitcoin Exchanges

Bitcoin trades are spots where financial backers can go on the web and trade dollars for Bitcoin or some other upheld cryptographic money.

Subsequent to joining and providing any necessary recognizable proof to fulfill legislative Anti Money Laundering (AML) guidelines you will ether be given a wallet to add your Bitcoin to or be approached to supply your wallet subtleties.

After this you pay via card, bank move or at times even PayPal and Bitcoin are kept in your wallet.

Trades can be costly yet more than that, they add a shaky layer to a generally solid item. Trades can and have been hacked where put away keys are taken giving programmers admittance to all trade wallets and with them all the put away Bitcoin.

Regardless of whether through interior misrepresentation or hacking, utilizing trades on the web or “hot” wallets conveys an extraordinary danger so we generally suggest moving your speculation Bitcoin out of the hot wallet and into a cool stockpiling wallet straightaway.

#2: Peer to Peer Exchanges

Distributed (P2P) trades permit individual financial backers to offer their Bitcoin or request Bitcoin at some random pace of trade.

All clients are appraised for entrust with the two purchasers and dealers rating each other in each exchange, so gave you work believed clients you should be OK (do recall trust appraisals can be faked utilizing an organization of shills.)

The best P2P trades hold a piece of any exchange in trust – similar as escrow – until the two players are blissful, which is an astounding framework in spite of the fact that you should as of now have Bitcoin in your wallet to utilize this, making these sort of trades unsatisfactory for a first purchase.

#3: Bitcoin ATMS

Bitcoin ATMs work very much like any ATM. You can either pay cash in our take cash out, the distinction being balances are put away in Bitcoin wallets.

Whenever you first utilize a Bitcoin ATM it will make a paper wallet and you then, at that point, add either actual dollars through a space or virtual dollars utilizing your bank card. This will change over the dollar sum into Bitcoin, less a charge and add the Bitcoin to your wallet.

Albeit an expensive method for purchasing or sell Bitcoin, these ATMs are extremely simple to utilize and can be tracked down utilizing an internet based finder. [link]

#4: In Person Exchanges

As the name proposes, with an in-person trade you observe somebody hoping to sell bitcoin, you meet them, hand over cash and they will thus move Bitcoin to your wallet.

There are various sites which set up these kind of gatherings, perhaps the most believed site being LocalBitcoins yet likewise with any exchange including enormous amounts of money be savvy: Tell individuals where you’re going, consistently meet in a bustling area and bring no less than one confided in companion.

Assuming you’re content with the individual danger and have concurred a decent conversion scale this can be a superb technique to purchase with the additional benefit that a money exchange into an unknown paper wallet is completely mysterious.

#5: Inside an IRA

The IRS currently permits Bitcoin within a Self-Directed IRA, meaning you can purchase Bitcoin in a profoundly charge advantaged way.

Being able to make charge conceded buys or tax-exempt deals can save a 35% rate citizen over a third at buy or deal. You can either purchase 1/3 additional Bitcoin or save giving the IRS 1/3 of your benefits – the two of which should be phenomenal choices in anybody’s book!

An additional benefit of putting resources into Bitcoin through an IRA is security: All Bitcoin expert IRA suppliers work with the business’ top actual vaulting areas, IRS endorsed stores and top-level IRS checked caretakers. Your Bitcoin are ensured secure as well as guaranteed against misfortune through probably the greatest names in expert protection.

Charge reserve funds and implicit impervious security? Could you ask for anything better!

Bitcoin IRAs

Putting resources into Bitcoin as a component of your IRA is one of the simplest and most secure ways of purchasing.

Proficient Crypto IRA organizations will complete all components of the speculation for your sake, from giving a super protected wallet and full protection of the coins to genuinely vaulting your encoded private key in an IRS endorsed store – all under the watch of an IRS certify caretaker. We have an entire area committed to Bitcoin IRAs here.

How Much Can I Invest in Bitcoin?

There are no maximums for Bitcoin ventures. For guaranteed wallets, for example, with Bitcoin IRAs, some protection arrangements might put down a boundary of $1m per wallet, however this implies in actuality is any sum more than $1m is added to a second or third wallet.

With respect to essentials a “Satoshi” is as of now the littlest unit of Bitcoin recorded on the blockchain. One Satoshi is 100 millionth of a solitary bitcoin or 0.00000001 BTC. At a Bitcoin worth of $10,000 one Satoshi approaches 0.01¢

Again market real factors make purchasing such a limited quantity of Bitcoin close to unimaginable particularly while considering exchange expenses and value spreads on trades. Despite the fact that Bitcoins can be utilized for miniature exchanges, holding Bitcoin for longer-term speculation will in general accompany more noteworthy essentials.

Expert Bitcoin venture organizations will more often than not work with $5,000 or $10,000 essentials as anything beneath this is probably not going to make the financial backer any beneficial increases in a sluggish market, particularly after exchange charges and paying secure vault and overseer expenses.

This is to a lesser degree a concern in a light market as Bitcoin is as of now appreciating.

Other than this, the decision is down to how much you have available for investing.

Remembering Bitcoin is an exceptionally unstable and profoundly speculative market, there’s dependably a genuine risk of misfortune, so except if you have an extremely amazing hunger for hazard it doesn’t seem OK to bet everything on Bitcoin.

For each dollar you spend on Bitcoin it very well might be shrewd to spend a dollar on a more steady resource like gold. Gold has a past filled with ascending during monetary emergencies and has risen 30% in esteem in the time that Bitcoin dropped from $20,000 in December 2017 to the $10,000 it’s at today.

With a portion of your pot settled by gold, you might have the option to more readily manage the cost of the dangers intrinsic in Bitcoin and partake in it’s monstrous potential for groundbreaking increases, all while realizing you’re part-safeguarded from the crypto’s infrequent huge drops.

Until it becomes undeniably more steady Bitcoin as an investmnet is continuously going to be somewhat of a bet – though one where the chances are generally in support of yourself.

With specialists foreseeing Bitcoin costs averaging somewhere in the range of $50,000 and $75,000 before the finish of 2020 to mid 2021 the inquiry is the amount will you hazard on a potential 4000% to 6500% increase?

How Much Should You Invest in Bitcoin?

Whenever we’re inquired “How much would it be a good idea for me I put resources into Bitcoin” our response generally must the marginally bother “just however much you’re ready to lose.

Bitcoin is an unstable, theoretical resource and keeping in mind that there are $billions worth of actual mining rigs investing genuine effort, cash and energy into Bitcoin – it stays a completely virtual resource.

Accordingly, in contrast to gold and silver, Bitcoin – could – drop to nothing.

Presently given the huge measure of actual framework worked around Bitcoin and it’s utilization in great many exchanges across the globe this is profoundly improbable – however it’s certainly feasible.

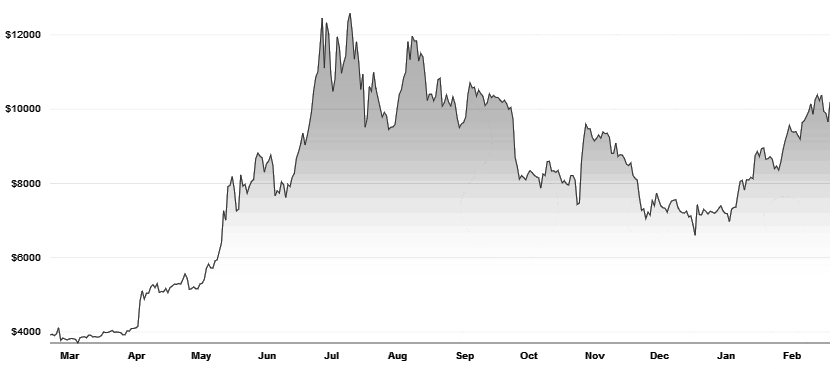

Indeed, even without dropping to nothing, Bitcoin has lost half, 60% and 70% in esteem ordinarily in it’s set of experiences – and surprisingly however it’s hence gone higher and frequently far higher – assuming that you’re one of the financial backers purchasing at a top, not long before a 70% drop it will sting. A ton.

December 2017 and January 2018 purchasers are still on normal 45% down on their speculation. Without a doubt they’re the ONLY long haul financial backers across Bitcoin’s set of experiences to be down, considering that the present cost is higher than any remaining periods, however that is still a considerable amount of financial backers.

However, if they’re actually holding their Bitcoin, even those financial backers will be back operating at a profit assuming Bitcoin follows investigator’s expectations for 2020 and 2021+

In the event that those possibilities of gain and Bitcoins history to date appeal to you, we allude you to our (still) marginally irritating response: Only contribute however much you’re ready to lose.

Is Bitcoin suitable for you? Sort out the real facts from the fiction inside CoinIRA’s free Bitcoin Investor Guide

What to Know Before Investing in Bitcoin?

Anything that you do, don’t misstep the same way as those guileless financial backers who packed into Bitcoin in December 2017 similarly as the air pocket burst.

Before you put resources into Bitcoin you want to have an essential handle of what Bitcoin is, the manner by which it works and a short history of the market. You ought to have the option to perceive an overheated, exaggerated market and know an air pocket when you see one.

All of this and more is accessible in our free Bitcoin Investor Kit.

When you know these key realities you really want to set an objective worth you’ll blissful sell at.

Here is the rub. We appear “cheerful” with 2% we get on an exorbitant premium ledger and the long term yearly normal of 9% on gold is viewed as an astounding return – yet with regards to Bitcoin we’ve seen 1000% gains and know they’re conceivable.

Do you put a drawn out hazard everything amount of cash into Bitcoin and sit tight for a 1000% ascent – or do you set an all the more quickly reachable objective of say half?

half is a remarkable profit from interest in any resource and it’s one which Bitcoin has routinely brought to financial backers in as little as half a month or months.

Indeed you might pass up a greater ascent, yet you’ve actually seen your venture develop by half and left before the consistently developing danger of a revision.

Out of nowhere having the option to purchase half more gold or stocks or some other venture is doubtlessly a major win in anyone’s books – yet maybe you might want to see a 100 percent return prior to leaving?

At $10,000 Bitcoin will just have to return to it’s past high to see you make that addition. Monetary business sectors are continuously returning to past highs – it’s just a system of the commercial center and how new untouched highs are made in any Bull market.

On the off chance that you set a 100 percent expansion as your objective stick with it. Try not to be enticed to remain in the market after your objective has been passed, on the grounds that for consistently that Bitcoin spends over a past ATH, it hazards a revision beneath it.

The possibly time you wouldn’t set an objective is assuming you’re in an extremely long haul “lets see what occurs with Bitcoin” venture. You might make 1,000,000 – yet on the off chance that Bitcoin doesn’t turn out to be the new worldwide cash, being supplanted by something different your whole venture could simply drop to nothing.

Know the resource, know the market, make rules and stick to them!

What Does it Cost to Invest in Bitcoin?

Given the wide selection of courses to venture, purchasing Bitcoin can cost anything from a couple of dollars to 20-35% of your speculation.

Bitcoin ATMs can charge anything from 10-32% in exchange charges and expenses and Bitcoin experts who offer venture guidance and a full white-glove attendant service can be in a similar ballpark.

Meeting an arbitrary person in McDonald’s for an in-person move could be just about as little as a couple of dollars gave you’re both blissful at that rate, while purchasing on a major trade like Coinbase or Coinmama will run you 1.5% – 7% relying upon where you are on the planet and how you’re paying.

Where Bitcoin costs get energizing is the place where you’re purchasing inside a duty advantaged IRA.

For a financial backer in the 35% annual duty section you could successfully save 35% in charge stipends, either on buy or at deal.

Regardless of whether your Bitcoin IRA expert is charging an aggregate of 10-15% in expenses for the demanding IRS-endorsed work they complete for your benefit, you’re currently at a 20-25% saving versus a non-IRA venture regardless of whether you’d paid zero in charges!

What are Alternatives to Bitcoin Investment?

At Investing In Gold we’re continuously going to say valuable metals like Gold, Silver, Platinum and Palladium should be considered in any reasonable and all around broadened portfolio, but Bitcoin is an intriguing new expansion and it can deliver profits to possess basically a little holding in the famous digital currency.

Yet, Bitcoin isn’t the just crypto show around.

Despite the fact that Bitcoin was the first and stays the greatest – it’s in no way, shape or form the main cryptographic money accessible for financial backers.

At any one time there are around 5,000 unique alt-coins (elective cryptographic money coins) accessible. As indicated by CoinMarketCap there are at present 5,112 different cryptos in the market with new ones showing up and more modest ones disappearing without follow consistently.

In among those alt-coins any of them could continue to being the following Bitcoin, however for every one of the a great many alt-coins just 10-20 have any genuine height. The rest are something like what could be compared to awful penny stocks.

The greatest alt-coins incorporate Bitcoin Cash, Ethereum, Ripple, EOS, Tether and Litecoin – however the market is continually evolving. The best 5-10 cryptographic forms of money by market cap 3 years prior look similar to the top cryptos today.

| February 2020 | January 2017 | ||

|---|---|---|---|

| #1 Bitcoin | $169 billion | #1 Bitcoin | $16 billion |

| #2 Ethereum | $26 billion | #2 Ethereum | $715 million |

| #3 XRP | $10 billion | #3 XRP | $231 million |

| #4 Bitcoin Cash | $6 billion | #4 Litecoin | $221 million |

| #5 Tether | $4.6 billion | #5 Monero | $190 million |

| #6 Bitcoin SV | $4.4 billion | #6 Ethereum Classic | $122 million |

| #7 Litecoin | $4.3 billion | #7 Dash | $78 million |

| #8 EOS | $3.6 billion | #8 Augur | $43 million |

| #9 Binance Coin | $3.0 billion | #9 MaidSafe Coin | $43 million |

| #10 Tezos | $1.9 billion | #10 Steem | $36 million |

One thing that’s very apparent looking at all these coins is their total market cap in 2017 versus 2020. Across the board, all coins in both lists have seen gigantic increases in market capitalization, meaning you’d have made money in any of them.

As alt-coins become all the more always stable Bitcoin IRA experts are supporting a developing number of alt-coins inside every IRA account – meaning financial backers can purchase a bushel of crypto’s aiding fence individual coins against the more prominent market.

For full subtleties of the alt-coins as of now permitted within their Bitcoin IRA, Coin IRA’s free aide takes a gander at each coin and what they can offer a financial backer and their site clarifies the cycle in full.

Other Bitcoin IRA suppliers might give a more restricted scope of coins so assuming there’s a particular crypto venture you’re searching for it’s a good idea to work with an organization who can support your requirements.

In any case, all of the main 5 digital forms of money can consolidate to offer an incredible crypto bushel for a financial backer needing adjusted gains less impacted by individual coin’s fierce costs.

Need more? Get your Free Bitcoin Investor Guide – a one of a kind actual financial backer pack conveyed direct to your entryway.

Learn more about Bitcoin and other cryptocurrencies unmatched properties for tax-advantaged profit, when stored inside your retirement account.