Investment in Silver Bullion Bars

Silver Bars: Investment Basics – How, What and Where

KEY QUESTIONS

Why Invest in Silver Bullion Bars?

On the off chance that you’ve settled on the choice to put resources into silver, how could you decide to purchase silver bullion bars over bullion coins or adjusts?

A critical component in the dynamic interaction is presumably cost. Bigger silver bullion bars will by and large have a lower premium than bullion coins, particularly with regards to project (poured) bars as these have the most straightforward assembling process out of all bullion items.

Bars are really widespread and can be traded at near premium anyplace on the planet. With the undeniable special case of 1000oz great conveyance bars, silver bars are smaller, simple to convey and store, simple to stow away whenever required and toward the day’s end there’s something profoundly fulfilling about grasping a significant silver bar.

Bullion bars are accessible in the most stretched out scope of sizes, from parts of an ounce as far as possible up to goliath great conveyance bars – with bigger bars offering probably the best worth silver accessible to financial backers.

Bars are not difficult to stack and productive to store without the “squandered” space related with roundabout coins and adjusts – and let’s be honest when we consider the word bullion, the majority of us picture bars.

Cast or Minted?

While purchasing silver bullion bars there’s a decision among cast and stamped – and various purchasers will have an inclination for one over the other.

Where cast bars are essentially liquid metal filled a form which is then hit with a producers mark and other legitimate subtleties, stamped bars are made in a multi-step process:

First painstakingly estimated spaces are produced using an enormous sheet of silver, or cut from a long flimsy expelled or cast bar. These spaces are then taken care of into a stepping or squeezing machine, compelling the clear between two adversely engraved formers which engrave the clear with an example, edging, and a presentation of fineness and producers mark. Examples can be straightforward or resplendent and level regions commonly have a cleaned smooth appearance. Bar chronic numbers are either engraved or stepped subsequent to stamping.

A few stamped bars can be really delightful including lavish plans with UK Britannia bars (imagined) and Swiss PAMP Fortunas conveying two of the most intricate etchings – skirting on authority quality.

Resplendent bars, particularly from such lofty mints will typically convey a higher premium in contrast with plain cast conventional silver bars from workaday purifiers.

Albeit the reason for contributing is generally purchasing as low as could be expected, premium makers bars will normally be more straightforward to exchange in any market than conventional and order a greater cost because of their attractiveness, frequently higher than spot. Sellers will only here and there offer anything at spot or higher for nonexclusive bars.

Home “stackers” who step by step purchase anything bar is accessible at the most minimal cost will rapidly foster a wide assortment of changed plans and sizes, something which can make the speculation interaction more tomfoolery and practically habit-forming – as many YouTube recordings will verify.

Auxiliary market (used) bars are as can be anticipated regularly nearer to recognize than new bars offering financial backers a few huge reserve funds while purchasing at amount.

A Word on Damage

Scratches and scrapes are inescapable and on cast bars these can be huge without decreasing qualities – and truth be told there are purchasers who love gathering “vintage” bars for the patina they might convey.

Truly vintage silver bars can go for altogether higher premium than present day silver, with discolor examples and sprouts all adding to the worth. Never clean a vintage bar!

For stamped bars then again, harm can reduce esteem, since harm ruins the appearance in a seriously clear manner, so even banishes from premium makers will just at any point exchange to vendors underneath spot.

Obviously as a financial backer, rather than a gatherer, all you’re truly intrigued by is silver substance – and assuming that you purchase direct from sellers and vault with them – silver bars will be new and can be exchanged to the vendor anytime immediately. Since the seller knows the bars and their full safe chain of guardianship they will frequently pay more at buyback than some other vendor and this is one of the primary advantages of seller vaulting.

Purchasing silver bullion bars is silver contributing at it’s generally essential – a straightforward and somewhat reasonable cycle where you can possess a protected and strong speculation at the most reduced conceivable expense.

Is Investing in Silver Bullion a Good Idea?

As we’ve laid out, silver bullion bars are not difficult to purchase, simple to sell and will ordinarily offer the least premium out of all weight-for-weight bullion items. Their simplicity of stacking and proficient impression can make vaulting costs lower for bars than for coins, particularly at higher dollar values.

Given silver’s utilization as a store of significant worth and a defender of abundance, it’s a good idea to take the most productive and financially savvy course to that venture – silver bars.

In our book that makes putting resources into silver bullion an excellent thought.

Are there any negatives to silver bars?

In certain wards silver coins and all the more explicitly legitimate delicate silver coins can be absolved from Capital Gains Tax. This implies when silver ascents altogether in worth and you come to exchange you will keep away from an assessment bill. Not so with silver bars (there are special cases – however lawful delicate bullion bars are remarkable)

Albeit capital additions charge excluded coins can save you huge totals when you make an enormous increase on resale, their underlying price tag can be 10-15% higher than an identical conventional bar, so you really want to weigh up reserve funds at buy versus expected investment funds at deal.

Assuming silver contributing conveys capital increases charge benefits where you line, this is something to remember.

Are Silver Bars a Safe Investment?

Silver is viewed as a safe assuming that unstable speculation and silver bars are one of the most broadly exchanged and all around acknowledged types of actual silver – accordingly silver bars are certainly protected.

In any case, saying this doesn’t imply that all silver bars are as they appear.

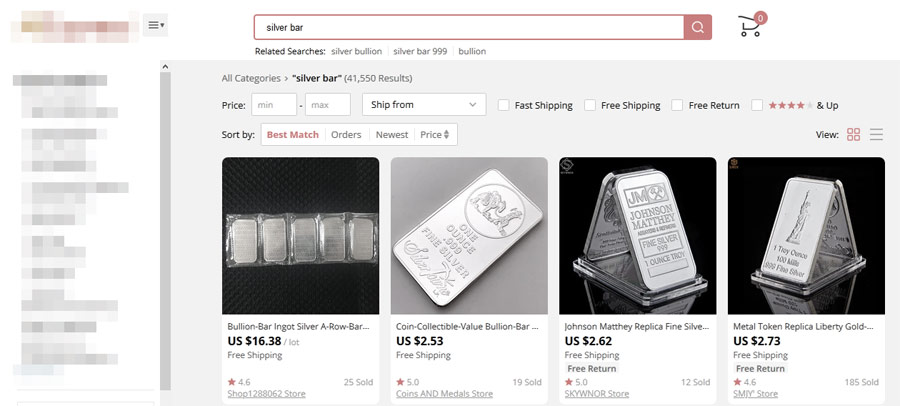

Counterfeit silver bars are on the ascent. Albeit significant lawbreakers are considerably less prone to focus on making ideal reproductions of silver bars than gold, given material expenses are equivalent to for counterfeit gold but resale costs are similarly lower – saying this doesn’t imply that it’s not occurring.

As we previously referenced silver is right now valued where 1oz of gold purchases 85 ounces of silver. This gives a gold/silver proportion of 85:1 – a significant worth which has generally been a decent mark of there being a continuous downturn, or an approaching accident.

Our securities exchanges are at present light – regardless of whether they are making some alert sounds as far as overvaluation – so our bet – and obviously the bet of every one of those climbing into silver and gold, is we are confronting an approaching accident.

Yet again silver is preparing to secure – and develop – abundance.

Learn more about the profits silver could bring to your portfolio – with Goldco’s free Precious Metals Investor Guide

Is Investing In Silver A Good Idea?

Considering what we said above, regardless of whether you’re not keeping watch for a venture giving every one of the indications of being underestimated, silver is as yet a helpful diversifier – particularly assuming that your portfolio or retirement account is inclining vigorously towards stocks, shares and other paper resources – or then again assuming you’re put resources into land.

Is investing in silver smart?

Most monetary consultants who are available to a solid enhancement of resources propose setting to the side between 3-10% of a portfolio to valuable metals.

putting resources into metals to enhance portfolioTraditionally this is gold, however for financial backers hoping to add an additional an aiding of capital development, the metals might be parted 60:40 gold to silver or can go considerably heavier on silver on the off chance that the client is content with the additional unpredictability silver can bring to the party.

For more limited size financial backers with $5-10k to contribute and for whom a metals speculation could be an enormous cut of their accessible capital, silver appears to be legit particularly assuming the financial backer chooses home stockpiling in a reasonably protection appraised safe.

Having various lower-estimated units in a speculation implies any little monetary crises can be managed without selling half of your resources. After the entirety of it’s a lot simpler to exchange a couple of silver bullion bars to meet an unforeseen cost than getting change from a $10,000 gold ingot.

For those with $25,000 or more to contribute, silver unexpectedly turns into a significantly more valuable instrument and this is the place where valuable metals make their mark.

We’ve effectively settled silver is an excellent place of refuge resource, used to get abundance – be it a nation’s riches, generational riches, individual resources or a retirement account.

However, are there security issues in putting resources into silver? Is putting resources into silver high danger?

Silver is plainly a more unpredictable metal than gold and in the present moment can take misfortunes – similarly as much as goliath gains – and this is less secure in the event that your retirement is in the short term. In the event that your retirement is further away, you’re bound to exploit silver rising altogether as it’s being figure to do as such.

Silver might have found the middle value of an increment of 26% each year throughout the course of recent years, however there have been years where it’s dropped half and others where it’s ascended more than 700%. Assuming that this degree of instability and potential revenue driven is of a lot of hazard for you, then, at that point, it’s ideal to choose gold.

This being said, not normal for stocks, cryptographic forms of money or some other paper or computerized resource it’s close to unimaginable that silver will at any point arrive at zero worth. It’s excessively intriguing, excessively essential to industry to society and our actual mind, for silver ever to have no worth to us. After the entirety of silver’s 4000 years exchanging as an important resource is a hard history for us to rework.

Silver’s other danger is likewise silver’s most noteworthy advantage: esteem.

Because of this worth, your interest in silver is additionally dependent upon a danger of burglary.

It exceptionally simple for lawbreakers to adjust silver bullion’s character, liquefying it down and changing it as another bar. With respect to silver bullion coins, they convey none of the recognizing imprints or chronic numbers bars do, making one silver coin totally undefined from another. On the off chance that it’s taken – your silver is just about as great as gone.

It’s in this manner vital for store your silver speculations securely – regardless of whether in an enough safeguarded protected at home – or in a safe and completely guaranteed vault. We cover gold stockpiling and vaulting exhaustively here.

With your silver got, particularly in proficient vaulting, there’s practically no opportunity of robbery and regardless of whether it were to some way or another be lost or taken you’re protected.

Is silver contributing savvy? In the event that you question silver’s true capacity, history isn’t your ally.

Find the best ways to hold your silver secure at the best price – inside Goldco’s free Precious Metals Investor Guide

How Much do Silver Bars Cost?

Silver bars are a unique venture ware and to be treated in a duty advantaged way they should be evaluated near the spot cost of silver.

In actuality genuine silver bars will constantly offer for more than spot because of the expense of mining, refining, stamping, examine, certificate, bundling, stockpiling, protection and transportation in addition to a little benefit for the distributer. Once at the retailer or bullion intermediary there should be a recompense made for business and promoting costs and another little benefit.

These implicit expenses and costs per bar are pretty much no different for huge bars as they are for little thus while putting resources into silver bullion bars you will commonly find the charges on little bars are higher comparable to their unit cost than on enormous bars. It’s essential math.

Further value contrasts can be found between the silver bars from various mints with probably the most regarded mints conveying a higher premium on a like for like premise than those from more modest, less notable mints or on conventional unbranded bars.

A 1kg bar from the UK’s Royal Mint will cost more than one from say Sunshine Minting in the US or Aa treatment facility like the Istanbul Gold Refinery (IGR).

At long last the expenses in mining, delivering and promoting a silver bar are almost equivalent to those for a gold bar. According to the cost of the metal this can be significant, particularly for more modest bars. This implies silver expenses can be essentially higher than gold.

| Bar Size | Premium Branded | Generic Bar | Bulk Buy |

|---|---|---|---|

| 5g | 622.0% | 506.7% | 225.2% |

| 10g | 310.2% | 197.1%: | 167.0% |

| 1/2oz | 165.1% | 98.9% | 83.6% |

| 1oz | 127.2% | 18.2% | 13.1% |

| 100g | 71.7% | 38.2% | 22.6% |

| 5oz | 66.1% | 18.3% | 13.1% |

| 250g | 58.6% | 40.3% | 23.9% |

| 10oz | 30.6% | 14.2% | 12.0% |

| 500g | 29.6% | 20.9% | 13.2% |

| 1kg (1000g) | 25.2% | 13.4% | 8.6% |

| 50oz | – | 10.0% | 4.5% |

| 100oz | 12.4% | 8.2% | 6.6% |

| 1000oz | – | 2.8% | 2.2% |

Key focal points:

- Fragmentary silver bars, particularly from very good quality brands ought to be considered as minimal more than oddities.

- Premium-marked bars regularly come at twofold the markup to nonexclusive.

- Mass purchasing nonexclusive 1oz bars offers the most minimal expenses across every more modest size, yet more than that of a solitary conventional 50oz.

- For gold-like charges, financial backers should look to 50oz, 100oz and 1000oz bars.

Discover insider tricks investors use to get best value buying silver bullion with Goldco’s free Precious Metals Investor Guide

What are Popular Silver Bar Sizes?

The most well-known estimated bar for huge scope bullion speculation is the 1000oz great conveyance bar. This is the silver bullion bar held by legislatures, public banks, institutional financial backers and the richest.

Despite the fact that offering the least charges and the most focused type of abundance silver can offer, these are not really functional for most financial backers and at almost $20,000 per bar this makes selling your interest in more modest dollar increases definitely more troublesome than you’d find with more modest measured bars.

For most financial backers there’s an inclination for a scope of more useful more modest bars – the decision of which fluctuates from one country to another.

In the US the most well known sizes traded by financial backers are the 1oz, 5oz, 10oz and 50oz bullion bars, albeit the 1000g or Kilobar (32.15 official ounces) is filling in prominence because of it’s low premium and global allure particularly by financial backers with at minimum some seaward presence.

European Investors all the more regularly purchase silver bars utilizing the decimal measuring standard (with a special case being the consistently well known 1oz and 10oz bars) and the most usually exchanged bars are 5kg (5000g), 1kg, 500g, 250g and 100g bars close by the 1oz and 10oz.

China’s most well known silver bars are the kilobar and 5kg bar

The Middle East and India likewise lean toward the kilobar and other bigger measurement sizes. Not at all like gold, silver is not generally traded in Tolas – with just vintage silver bars actually being accessible in Tola-weighted sizes.

As should be visible the most general bar, famous with silver financial backers across the world is the 1000g/1kg kilo bar pressing a decent 32.15 oz of fine silver into a little, exceptionally convenient and effectively put away unit.

What are Popular Silver Bar Brands?

Similar as bar sizes, silver bar brand ubiquity changes by country albeit most financial backers in the West will know about the significant brands across the US, Canada and Europe. Some European brands will quite often convey a higher premium in America because of transportation costs and their relative extraordinariness.

APMEX

APMEX, Inc., are situated in Oklahoma City, Oklahoma, and are the world’s biggest internet based retailer of valuable metals, having sold more than $10 billion in valuable metals since being established in 1999. As well similar to a bullion vendor selling a wide scope of marked bars, APMEX produce their own famous scope of stamped/struck silver bars in ½oz, 1oz, 5oz, 10oz, 25oz, 1kg, 50oz and 100oz loads at 0.999 fineness (99.9% unadulterated silver).

Is There Tax on Silver Bars?

The duty financial backers pay on silver bars rely upon which express the bar is purchased and put away in as every one of the 50 states can set it’s own degree of deals charge.

While certain states are zero-appraised on speculation grade bullion, different states can energize to 10%. This essential far reaching charge is notwithstanding any nearby area or city deals charge.

A few states will just duty bullion items under a specific worth, others charge platinum and palladium however not silver and gold

This gives a few US valuable vendors and metals financial backers a major benefit over others in view of their area.

Capital Gains Tax on Gold Bullion

In America the IRS believes bullion to be both a Capital Asset and a Collectible, so Capital Gains Tax (CGT) will be payable on any increases made when bullion is sold, and this is set at a limit of 28% (collectibles).

As a general rule the real rate paid will fluctuate contingent upon various variables including the dealer’s pay and the time span the resources have been held. To talk about explicit CGT liabilities you ought to talk with an authorized bookkeeper or assessment subject matter expert.

Can Silver Bars be held in an IRA?

The IRS presently permits explicit grades of speculation bullion to be held in an IRA taking into account silver bullion to be purchased in an exceptionally charge advantaged way.

As can be anticipated from the IRS there are severe principles overseeing what metals can be purchased and where they ought to be put away which we cover exhaustively in our Silver IRA area.

Silver bars for IRA utilize should meet least fineness prerequisites and be fabricated by a NYMEX or COMEX-supported purifier/assayer and ought to be ISO9001 Certified. The base virtue for silver within an IRA ought to be .999 fine (99.9% unadulterated silver) or more noteworthy.

Instances of qualifying silver bars:

- Illustrious Canadian Mint .9999 fine bars

- Daylight Mint .999+ fine bars

- Ohio Precious Metals .999+ fine bars

- Engelhard Hand Poured .999+ fine bars

- Brilliant State Mint ISO9001 .999+ fine bars

For additional subtleties on Silver IRAs including explicit benefits, rules and guidelines click here

Need more? Get your free Metals Investment Guide – a one of a kind actual financial backer unit conveyed direct to your entryway.

Learn more about how silver can protect your assets in a recession – inside Goldco’s free Precious Metals Investor Guide