Vaulting Silver Investments at Home

Dollar for dollar, pound for pound silver weighs more and takes up far more space than gold – so if you’re a serious home investor you’re going to need a…

Dollar for dollar, pound for pound silver weighs more and takes up far more space than gold – so if you’re a serious home investor you’re going to need a…

Silver coins have massive opportunity for growth in 2020 – but with such a wide choice of silver bullion products available, what silver coins are best inside an IRA?…

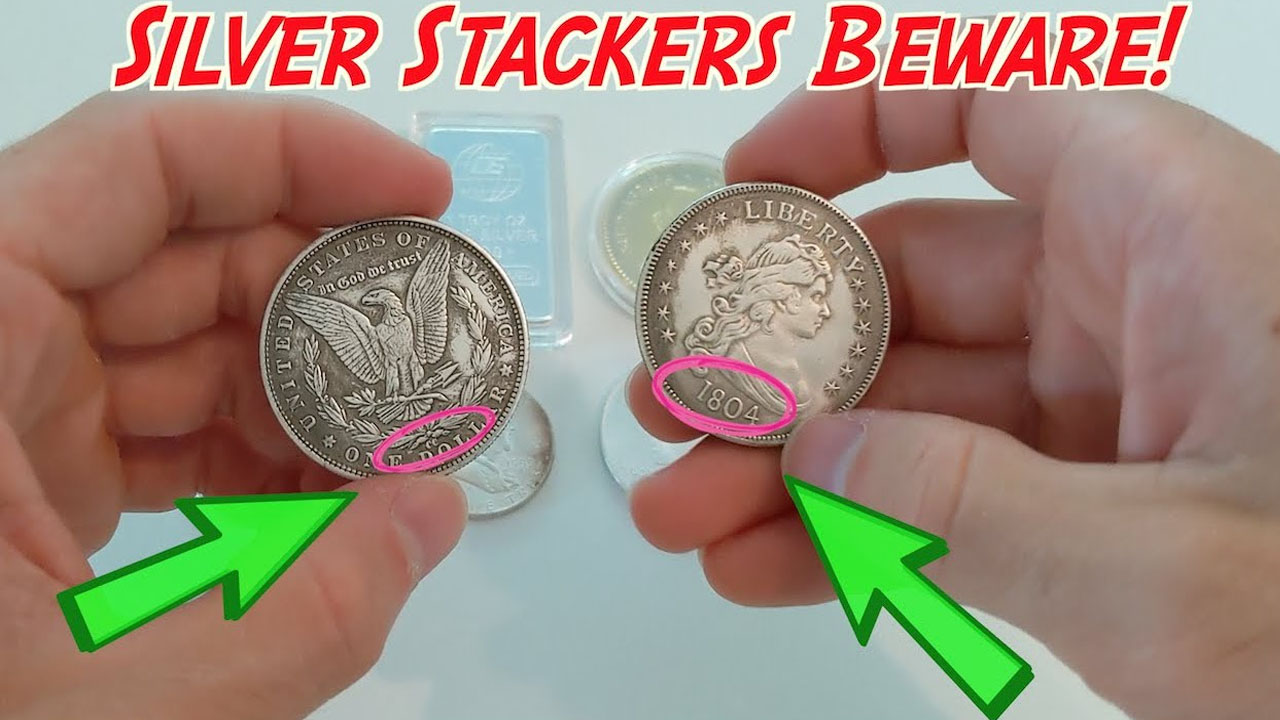

While making the counterfeit coins is the true crime, allowing replicas to be sold and buying those replicas can be a gray area. Forgetting the trademark and design copyright violations,…

This page takes a gander at how to source and purchase the right sort of silver for venture, how this contrasts and alternate approaches to putting resources into silver and how to guarantee you just arrangement with reliable silver sellers.

As well as the how what and where, we take a gander at the upsides and downsides of involving silver for speculation purposes, including the dangers implied.

Of the relative multitude of actual valuable metals, putting resources into silver offers fledglings by a wide margin the least demanding passageway to the market.

This is generally because of silver’s similarly low cost per unit, making silver bullion bars and coins a significantly more appealing suggestion than gold.

At current costs you can put resources into 85 ounces of silver at a similar cost as an ounce of it’s more extravagant kin – meaning you can pick between having a decent measured small bunch of silver or a minuscule 1/10oz gold bar for a similar capital expense.

The “habit forming substance” to metals contributing, a silver bullion purchase simply checks out as the initial step.

Purchasing silver for speculation conveys less capital danger particularly while making your first purchase – even the littlest test venture of say $200 – $500 will set you up with a decent determination of bars and coins.

Likewise, because of their lower complete worth there is substantially less concern while working with another bullion vendor, or in delivery and capacity than you’d have while purchasing even a solitary 1oz gold coin.

Genuinely dealing with the metal and feeling the weight – all while partaking in the unique glimmer of silver – helps give a first-time financial backer a genuine association with your recently gained bullion. It’s a significantly more remunerating metal to claim and deal with dollar for dollar, giving financial backers much more delight than the tiny measure of gold you could purchase at a comparable cost.

This is particularly so with regards to stout poured (cast) silver bullion, satisfyingly strong and because of how they are made there’s little danger of even abundant taking care of having any impact on esteem.

Uncirculated bullion coins then again, can see resale values impacted by scratches and stamps if over-took care of.

A couple of 5oz cast silver bars or little heap of silver coins will be probably not going to show a robber the same way as your PC, tablet or widescreen television.

With silver there’s less need to put resources into a decent quality protected until you begin to develop your silver speculation over a limit you’re awkward with – adding further to silver’s low boundary to section.

What’s more since silver bars and coins are weight for weight multiple times less significant than gold, counterfeit silver bullion is extensively more uncommon than gold. Albeit silver fakes do exist, since they have a comparative assembling cost to counterfeit gold, yet with lower per-unit benefits, selling counterfeit gold is essentially a superior recommendation for the normal fraudster.

Less expensive to purchase, more secure to hold and with less should be phony mindful, no big surprise silver is the top metals venture for novices.

To get everything rolling around the five-figure mark or higher you’ll have to think distinctively to somebody a few bars and a few coins. This is on the grounds that a portion of the benefits limited scope home financial backers appreciate, don’t continue so well at scale.

Like gold, silver is a significant burden metal but since you require multiple times more silver than gold to match a gold venture, silver will be a far heavier speculation to store.

Silver is likewise less thick than gold which at 19.32 g/cm3, is practically twofold silver’s 10.49 g/cm3 meaning an ounce of gold occupies a large portion of the room of an ounce of silver.

$25,000 in gold may just gauge a pound and occupy less room than a little cappuccino, however $25,000 in silver tips the scales at a weighty 85lb. You’d require a great deal of cups to hold 1375 silver coins!

This implies a bigger scope financial backer is more averse to deal with their silver speculations, or store them at home picking rather for proficient bullion vaulting. Secure vaulting gets rid of the danger of robbery and even means the metals can be purchased in an xpense advantaged way.

Similar as putting resources into gold, there are three head approaches to putting resources into silver:

purchasing the actual metal either as bullion bars or coins

purchasing a paper subsidiary of silver, for example, a Trade Exchanged Asset (ETF)

purchasing partakes in silver mining and investigation organizations

The principal strategy – purchasing silver as actual bullion bars or coins is both the most clear and the main genuine approach to straightforwardly put resources into silver.

Silver bullion has a far lower unit cost normally between 85-65 more affordable than gold ounce for ounce. This makes silver simpler to purchase, giving financial backers in actual silver a lower boundary to passage.

While the other silver speculation strategies really do follow silver’s cost to a more prominent or lesser degree, they are basically a paper or computerized intermediary, which might possibly be upheld by a vault of actual silver.

exchanging silver etfsThe second and ever famous as a silver speculation intermediary, silver ETFs are typically supported by actual metal, regardless of whether practically speaking this might cover just a small portion of the worth, everything being equal.

There are reserves upheld by more actual silver than others – but there are moreover “silver” assets with in a real sense no silver support them by any stretch of the imagination.

With these paper silver subsidiaries, there is dependably a peril that should more individuals unexpectedly wish to trade out and change their paper over to silver than the asset really possesses, then, at that point, there could be a default.

It’s an improbable situation, yet progressively conceivable given current influence in the framework.

Not many silver subsidiaries markets get a larger number of forecasts of default than COMEX – it appears to be scarcely a month goes by where some distribution isn’t anticipating the fast approaching breakdown and default of this silver prospects and choices market, in any case – up to this point – these expectations have failed miserably.

The accentuation is on up until this point.

The third and other non silver speculation is silver mining shares (called diggers) a regularly high-hazard venture with a chance for phenomenal benefit in case of an enormous new silver find, yet additionally an undeniable opportunity of misfortune where an intensely supported mine investigation strikes out. A couple of large misses for a mining organization and it’s lights out.

Silver diggers are especially in danger when silver costs are powerless and the expense of mining and refining is more prominent than or near the current market cost. Throughout recent years, silver has oftentimes dipped under it’s expense to dig – a take for financial backers hoping to purchase the metal, yet horrible news for mining organizations.

Mines might decrease staff , limit their result or really close their mines for a period to diminish upward – yet assuming silver’s value stays beneath, at or just somewhat over the market cost for any time span as it can and does, then, at that point, the mining organizations can be in danger of liquidation and with that your mining shares becoming useless.

Obviously regardless of whether a digger close, the actual silver keeps on existing inside the ground and the land will hold it’s worth trusting that another excavator will exploit a more grounded market.

Your portions in the first mine will stay as useless bits of paper.

Which takes us back to the genuine metal: actual silver bullion, which either as a component of an expense advantaged retirement account, a resource in your broadened venture portfolio – or a heap of metal sitting in your home safe – will assist with differentiating your resources and keep up with your riches.

Discover more advantages physical silver has over other investments – with Goldco’s free Precious Metals Investor Guide

Why silver bullion and not other forms of silver investment?

As currently referenced there is a danger of default or absolute misfortune in paper subordinates of silver, something undeniably more outlandish in the actual ware – so assuming we will purchase silver we like to purchase the real metal.

Be that as it may, actual silver is typical in different structures as well – from decorations and silverware to gems and surprisingly old coins.

Bullion vendors sell sacks of scrap coin – old worn money that is between 40%-90% unadulterated and this can offer one of the least value courses into silver. A few silver coins are as yet available for use and “coin-roll trackers” will swim through boxes of nickels and dimes searching for this secret fortune, getting a dollar of silver for a couple of pennies.

Many home financial backers gather scrap silver as harmed flatware and broken gems, as a lot of it is 90% unadulterated or “authentic” silver at 92.5% unadulterated – which can be gotten in secondhand shops and yard deals for pennies on the dollar assuming that you have your brains about you.

Scrap silver financial backers are entirely keen on weight and will separate and smash their silver at times trading out their take at a seller – and leaving with one or the other money – or as is all the more frequently the case bullion.

Why bullion? Since bullion is generally exchanged, effortlessly esteemed, traded and can be stacked productively in vaults – none of which old broken cups and flatware can guarantee!

As we’ve effectively seen, silver is as of now multiple times more affordable than gold. This implies the gold/silver proportion is at present 85:1.

In weight per dollar silver is similarly much better worth than gold – however this isn’t what we mean by offering brilliant worth. Silver offers astonishing worth in another manner…

The gold:silver proportion has not forever been 85:1 – indeed it’s just seldom been this high. Across the twentieth century the proportion found the middle value of a much lower 47:1. The last time the gold/silver proportion was at these levels was preceding the extraordinary monetary accident of 2007/08. The time before that, it was the significant downturn in 1991.

The proportion commonly spikes like this either during a financial emergency or quickly preceding one. While our currency markets are as of now giving the presence of being hearty, examiners are cautioning of overvaluations and overheating – so rationale directs the last option.

What this all means is silver is right now enormously underestimated according to gold – and odds are high we’re on the cusp on another monetary emergency – an occasion which commonly helps safe-have valuable metals costs.

Crash or no accident, something that is for sure is the proportion is right now 60% higher than it’s 20-year normal and constrained to standardize to it’s mean worth.

Furthermore this would give a critical lift to the cost of silver.

Likewise with gold, when paper markets jump, silver will in general ascension. This isn’t generally the situation, especially in light of the fact that silver has various modern uses, however there is enough of an acknowledged relationship to mean financial backers utilize silver to fence their wagers on market development.

In the event that they figure stocks will rise, they get some silver in the event stocks fall. Assuming that it appears we’re very nearly an accident, they’ll purchase silver (and gold) as a place of refuge speculation.

Given silver’s undervaluation corresponding to gold, it’s even a valuable support inside a valuable metals portfolio. In the event that market influences see the gold/silver proportion return really near it’s middle worth silver should ascend in cost extensively, in any event, considering a little drop in the cost of gold.

Resource broadening is the main genuine method for defending against market hazard.

While gold is ordinarily the most popular fence for paper market misfortunes, it turns out silver is the support’s fence!

As we laid out in our gold segment while the financial area, real estate market and paper stocks slumped in 2007/08 gold entered a significant buyer market. Gold’s general increase from a 2008 low to it’s 2011 high was an amazing 166% – more than making up much of the time for misfortunes in all around supported records.

In any case, silver? On account of silver’s more noteworthy instability, during a similar time-frame silver bullion saw an enormous 448% climb, beating gold by practically 300% .

Whenever you’re keen on putting resources into silver, you’ll before long see that this was definitely not an oddball event: from it’s 1970 low to a 1980 high silver rose an astounding 3,105% – almost 1000% higher than gold’s ascent.

Indeed, even across more limited time spans, in smaller than normal bulls, it’s silver’s more noteworthy unpredictability that sees dealers benefitting such a great amount from the metal’s market swings, contrasted with gold’s more steady advancement.

Silver’s modern take-up just making everything easier…

Much as platinum and palladium are utilized in vehicle impetuses and are being promoted as likely substitutes for lithium and cobalt in the up and coming age of battery-powered batteries – silver has a tremendous and always developing scope of employments across the tech world.

On account of it’s brilliant electrical and warm conductivity, pretty much every piece of present day electrical tech from PDAs and tablets to workstations and TVs contains silver. Chinese telephone producer Huawei alone cases to have sold 200 million telephones in 2019 – a comparative add up to apple – and information for 2018 shows a sum of 1.56 billion advanced mobile phones were sold worldwide in that year alone. 2019’s figures as of now propose a record year for innovative telephones.

Considering each PDA contains roughly 0.33g of silver, this implies 2018’s new cellphones ate up right around 11 million official ounces of silver – and we say gobbled up on the grounds that it’s uncommon that PDAs are reused for their silver substance.

One more gigantic development region for silver is in sun powered chargers. The photograph voltaic cells used to transform light into power contain a meager layer of silver metal. As we progressively go to elective wellsprings of force in a bid to decrease fossil fuel byproducts, sunlight based chargers are on the ascent and generally speaking being incorporated into all new homes by regulation.

Expanded use in photovoltaics and other tech from purchaser electrical merchandise to clinical gadgets alongside new plastics tech requiring silver as an impetus, all mean silver’s interest is simply going to continue to rise.

Also with expanded interest, comes higher market costs.

Similarly as gold, silver is an amazing store of abundance and worth. Alongside gold, silver was utilized as cash, first as exacting gold and silver coins and later with gold and silver-supported paper monetary forms.

silver quarterSilver is as yet flowing as cash in America today. Old nickels, dimes, quarters and half-dollars contain between 90%-35% unadulterated silver – little marvel these coins are being gobbled up by silver stackers on account of their metal worth being far more noteworthy than face esteem.

For what reason are these coin’s metals now worth more than their presumptive worth? Expansion.

After the US government decoupled the dollar from valuable metals they were allowed to make as much paper cash as they needed, first printing and afterward adding zeroes onto PC accounting pages. This has done is downgrade the dollar and the resultant expansion has seen the dollar’s spending power decline consistently.

There is 0.0723 official ounces of unadulterated silver in a 1964 dime. Back in 1964 silver was $1.29/oz meaning a dime contained 9.3 pennies worth of silver, giving the dime it’s dime esteem.

Assuming you’d taken a 1964 dime and a base-metal coin from the next year – and put them in a crate, what might the two of them be worth today?

The 1965 dime would in any case merit a dime. The 1964 dime with it’s 90% silver substance is currently worth $1.32 as scrap silver (or then again on the off chance that you don’t have any idea what you were holding – a dime!)

Your silver dime has seen a 1220% increment in esteem, because of expansion – or all the more reasonably your 1965 dime has lost 1220% of it’s spending power.

Little marvel silver and gold are the main genuine types of cash staying in our universe of paper monetary standards.

One more key advantage of putting resources into silver is request. A significant variable in any venture is having the option to sell your resource rapidly. Silver is generally acknowledged as an important resource, both in money related terms and socially regardless of where you are on the planet.

silver is worldwide investmentAlthough a few nations in the Center East lean toward gold to silver, for us in the west silver is our generally ordinarily traded actual valuable metal.

For more modest ventures this interest and rivalry to purchase, implies you can be sure you’ll have the option to sell your silver bullion rapidly and at a fair cost whether you’re in a cosmopolitan city or unassuming community – and for bigger speculations, regardless happens to the worldwide economy, there will constantly be a business opportunity for silver.

Whenever everyone needs it, you won’t ever experience difficulty selling.

A vital part to popularity, silver ventures are profoundly fluid. You can trade silver on worldwide business sectors in minutes or move starting with one vault in one country then onto the next somewhere else through a trade with a couple of mouse clicks.

With well more than USD $15bn streaming in day by day exchange, silver speculations are probably the most straightforward resource for regular financial backers to trade.

Regardless of whether over the counter, from vault to the vendor, or on a computerized trade – silver moves quick with insignificant spreads.

Synthetically named a “respectable” metal, silver is among the most un-responsive of metals.

Not normally a central issue for most financial backers, unadulterated silver, similar to gold is synthetically steady – meaning it just responds to a couple of solid acids. Albeit silver’s surface layer will discolor softly in the climate and imperfection whenever took care of because of oils in our grasp, a fast buff will quickly return try to please metal.

It’s the meaning of a purchase and fail to remember resource, sitting with no danger of debasement for many years, even hundreds of years.

We realize that paper cash when put away in mass without being accurately wrapped and in the right climate can disintegrate to clean very quickly. That is not the situation with silver and this is one of the fundamental advantages of putting resources into silver for “preppers” – a store of unadulterated silver bullion covered underground can endure endlessly.

Or possibly until a prepper’s final plan, when the so-called SHTF.

Albeit this impediment is generally usually laid at gold’s entryway – it tends to be remained constant of silver as well: Silver doesn’t deliver any profits or interest.

While this is unquestionably an admirable sentiment, it’s definitely not a legitimate contention – on the grounds that silver bullion basically isn’t this kind of resource. Venture grade silver is a genuine resource, as in land and other actual speculations. Saying silver doesn’t pay a yield isn’t such a lot of contrasting apples with oranges as apples with a mountain.

Houses don’t deliver profits. Show-stoppers and collectibles don’t pay interest. Neither terrains, or speculation wine. Come to specify it, there is certifiably not a solitary actual exchanged product or other actual venture where the actual item Pays a yield.

How you Manage the ware can produce a yield – and that is the reason subordinates of wares can and do make yields. Leasing a house or land produces a yield. Making a specialized instrument, for example, a silver future or silver asset makes yield.

Not at all like profit bearing stocks or premium bearing money, silver has partaken in a 2667% cost increment somewhere in the range of 1920 and 2020 – an arrived at the midpoint of 26% yearly return – and as a drawn out resource it accompanies various duty benefits not delighted in by these different resources.

These benefits more than offset silver’s absence of delivered profits, particularly close by your decreasing dollar.

Again this is valid – as a genuine resource and an important item, silver bullion ought to be put away some place safe and be safeguarded against burglary.

silver vaulting costs moneyBut because of the intensity of expert vaulting administrations, vaulting and protection expenses are comprehensively comparable to the yearly charges on any overseen specialist record or exchanging stage.

As far as worth, you’re getting a great deal of safety value for your money. Outfitted watchmen, impact resistant vaults, huge substantial dividers and 5-foot thick steel entryways don’t come modest.

With advanced resources, what are you really paying for?

Again this is valid – as a genuine resource and an important item, silver bullion ought to be put away some place safe and be safeguarded against burglary.

silver vaulting costs moneyBut because of the intensity of expert vaulting administrations, vaulting and protection expenses are comprehensively comparable to the yearly charges on any overseen specialist record or exchanging stage.

As far as worth, you’re getting a great deal of safety value for your money. Outfitted watchmen, impact resistant vaults, huge substantial dividers and 5-foot thick steel entryways don’t come modest.

With advanced resources, what are you really paying for?

Silver is commonly brought to showcase as an auxiliary result of mining different metals – copper, zinc and gold. Under 33% of silver creation comes from explicit silver mines.

Modern scale mining of any kind can’t at any point be called harmless to the ecosystem, however for silver’s situation the metal is normally found as a feature of another activity. The mine is there as of now and silver is a cheerful extra.

Current silver-explicit mines then again are striving to tidy up the excavator’s demonstration utilizing new advances and mining strategies to diminish hurt – and rewarding the networks wherein they work. It’s taken some time, however the business has at long last acknowledged it needs to diminish the mischief it causes.

One more in addition to for silver is a major development in reusing. With silver’s worth expanding and reusing advancements further developing we’re seeing modern and scrap silvers being reused where whenever they were disposed of.

Despite the fact that there are as yet modern uses for silver which see the metal artificially obliterated – new enterprises are being made getting each ounce of scrap silver and gold out of disposed of hardware and modern waste. Silver’s quality in piece even structures a fundamental fixing in gold’s substance re-refining process.

Silver like gold, is a definitive in recyclable metal.

Silver’s benefits far offset the metal’s weaknesses making it as we would like to think, one of the top purchases at present accessible in elective resource speculations.

For more advantages investing in silver can bring to your portfolio – read Goldco’s free Precious Metals Investor Guide

In spite of the fact that there are some vigorous “silver stackers” who will just at any point put resources into silver bullion and coins, it’s seldom an instance of putting resources into silver OR gold – but instead every metal has various utilizations in an all around expanded portfolio.

Gold is a valuable expansion venture much as silver and assists with making a decent valuable metals portfolio that will perform preferable in certain conditions over a portfolio just holding silver. Gold is a definitely less unstable venture than silver and can assist with smoothing the impacts of silver’s wild jumps.

As we referenced before, gold occupies undeniably less room for a dollar comparable sum and while you’re talking $50k or $100k in silver that is an immense stockpiling saving while trading to gold.

This implies there’s no requirement for such a huge home-safe – and assuming you store your metals with an outsider, there will regularly be lower vaulting expenses related with gold.

Gold can without much of a stretch be truly exchanged by limited scope financial backers, regularly being offered to purchase silver when gold pinnacles, or the other way around – and it’s during this actual exchanging where gold can be a preferable wagered over silver. On account of assessment.

Silver and gold can be burdened distinctively in certain wards. Albeit not generally the situation, silver being a modern metal can at times draw in deals duty or Tank at the full rate, where gold bullion is zero-appraised. Paying an additional a 20% in charge for $10,000 of silver contrasted with paying zero expense on $10,000 in gold will swing many gold’s way for even the most faithful silver fan.

So, gold routinely frames part of a more extensive valuable metals portfolio which can likewise incorporate silver, platinum and palladium, all metals that perform diversely in different circumstances, and when joined produce an all around expanded and possibly intense blend for capital development.

As usual, it pays to converse with a valuable metals expert to examine what is going on and realize how silver and gold can both help you.

While first searching for silver bullion to purchase, the majority of us start with a web-based pursuit. The web has been a gift from heaven to silver financial backers, making it more straightforward to find both the right data while settling on speculation choices and to find dependable and solid silver bullion sellers.

As well as searching for a vendor, we’d suggest you search with the expectation of complimentary Silver Venture Guides which will help you study contributing as well as give you some underlying understanding into what different bullion sellers resemble to manage.

There are as of now north of 1400 bullion vendors recorded in the business index and hundreds more modest organizations who are not – so dislike you will at any point be stuck for decision. Sellers know this and are truly carrying their A-game to contend with the best in the business.

Numerous sellers have superb sites and proposition free transportation so making your first little test buy is never a troublesome cycle. A couple of silver bars and coins are a decent spot to begin assuming that you’re apprehensive and might want to try things out with another seller.

Online sell-offs have become famously terrible for selling fakes, as have various merchant locales. Albeit this is more normal with gold bars, it actually pays to stay with a known public brand or a believed nearby seller for your first test purchase.

Valuable metals are strong long haul ventures, yet being a significant expense obtaining, it’s significant you ensure your speculation venture gets going on the right foot.

Regardless of whether you’re purchasing retail, through a silver speculation organization or IRA expert ensuring you are both viable is foremost for smooth and blissful ventures.

Learn more about gold’s unmatched properties for protecting wealth, either as part of your investment portfolio or inside a retirement account.

With actual silver bullion contributing your principle decisions are to purchase through nearby coin shops, online internet business stores with straightforward self-serve checkouts – or through proficient valuable metals venture organizations like Goldco.

Silver speculation organizations can offer a full scope of warning administrations, including venture and portfolio counsel. For those having some expertise in regions, for example, Valuable Metals IRAs or seaward vaulting, this particular exhortation can be worth the effort’s weight in gold.

Proficient venture organizations will commonly have a base speculation sum, as a rule $25-$30k. This is because of there just being little charges in silver bullion, with organizations making just 1% benefit on any arrangement, in spite of holding your hand and doing all components of the venture cycle for you.

These organizations can offer brilliant incentive for both new and prepared financial backers, regularly having marked down vaulting expenses and extraordinary discount costs because of the huge economy of scale on which they run.

Where currency stores might zero in exhortation on extraordinary gatherer coins, and not low-premium silver bullion – and online business help work areas are just there to assist with checkout issues and breakdowns, the vital contrast with silver venture organizations boils down to the nature of both their administration and counsel.

The experts employed by these organizations know basically everything about the silver venture market and are equipped for prompting on anything from current and future economic situations, to forthcoming changes in regulation and will be similarly as eager to assist with choosing things to best match your hunger for hazard as they are to help move your 401k to a silver IRA.

In spite of the fact that there are great many limited scope metals vendors, proficient Silver Venture Organizations are many less on the ground and will normally be revolved around valuable metals exchanging or vaulting focuses like New York, Southern California, Texas and Miami.

For any venture more than $25,000 we’d constantly suggest the master assist they with giving over some other strategy for purchasing – particularly for a rookie to valuable metals.

Need more? Get our free Metals Speculation Guide – a remarkable actual financial backer pack conveyed direct to your entryway.