Why Should You Be Investing in Silver?

Discover Why Silver is the Must Have Investment for 2020

KEY QUESTIONS

What Are the Main Benefits of Silver?

As a financial backer you as of now have a gigantic selection of ventures when it’s an ideal opportunity to add to your portfolio. The vast majority of us are as of now put resources into the standard blue-chip stocks and securities, or subordinates, ETFs and shared assets. A number have raked in huge profits or anguishing misfortunes in the in the unstable digital money market.

And afterward we have the absolute most established most noteworthy worth resources known to man: valuable metals. So why put resources into silver?

Silver contributing certainly you’d call a laid out market, the metal having been exchanged, utilized as cash and accumulated as a store of abundance for well north of 4000 years.

As an abundance safeguarding resource silver has a demonstrated history, normally assisting with safeguarding resources against expansion and shielding against monetary market misfortunes by going about as a market fence.

Indeed, the cost of silver bullion is unstable over the more limited term and this can make a few financial backers anxious – but it’s this very instability which assists make with silvering market merchants rich with each bull and bear move.

For longer-term property, even the most apprehensive financial backers can relax because of silver having seen a long hidden trip, averaging almost 27% in normal yearly development somewhere in the range of 1920 and 2020, taking it’s cost from 65 pennies, to more than $18.00/oz.

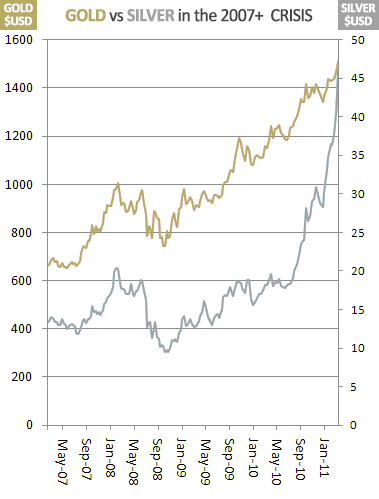

Silver has additionally beated gold during financial exchange crashes, most as of late adding a 448% benefit to silver financial backer’s pockets between 2008-2011 though gold – which is popular for having shot up in esteem during the emergency – “as it were” dealt with a 166% increase from it’s 2008 low to 2011 high.

The once strong dollar – as we showed in our examination of two dimes – has in the interim fallen in esteem.

This is on the grounds that not at all like paper monetary standards, silver’s inventory is limited; national banks can’t print silver similarly as they print cash. No measure of bookkeeping wizardry fit for making new cash out of nowhere can be utilized to enchantment new silver into being.

Albeit silver has generally been utilized for resource security, it’s constantly assumed a supporting role to gold. Indeed the affluent have consistently purchased silver bullion and national banks have possessed it for a really long time, however consistently in more modest amounts than gold.

So what has changed where nations, countries and large institutional financial backers have fired loading up on silver in record volumes?

Why are silver processing plants working day in and day out creating enormous silver bars for the super-rich? Why Now?

Silver Might Be an Excellent Store of Value – But It’s Also Full of Potential

It’s silver’s limited stockpile and it’s cozy relationship with gold which is seeing silver interpretation of another job as star entertainer in enhanced speculation portfolios, with an enormous potential for potential gain.

Silver’s utilization as a modern metal is seeing great many ounces for all time consumed by synthetic cycles consistently – or incorporated into items utilizing strategies which are as of now hard to reuse. Not exclusively are our provisions of silver limited, however they’re diminishing quick – with mining incapable to match utilization.

Furthermore silver’s incorporation into our shopper machines is seeing no indication of easing back: 11 million ounces of silver were utilized in advanced cells in 2018, with 2019 numbers currently higher as Chinese organizations compete for worldwide predominance.

The more fundamental silver becomes to our cutting edge tech – the more noteworthy it’s cost will ascend through basic market elements. From shopper gadgets, to sunlight based chargers, to cutting edge battery-powered batteries we are enduring our diminishing supplies of silver at a steadily speeding up – as we go to silver to assist with making more productive and all the more harmless to the ecosystem tech.

So not exclusively is silver encountering solid upwards cost strain through it’s expanded use in tech – there’s another key pointer proposing silver could go a LOT further.

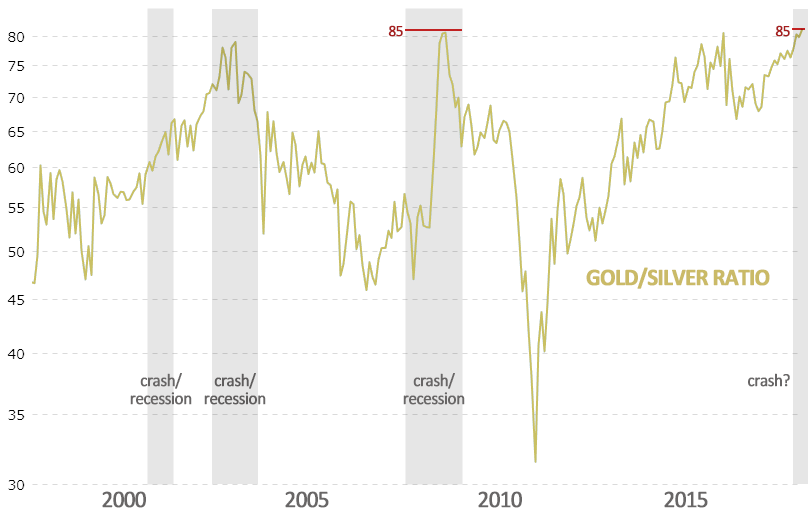

The silver/gold proportion tracks the cost of gold as far as silver. At present the proportion remains at around 85:1 importance you’d require 85 ounces of silver bullion to purchase a solitary ounce of gold.

In any case, this is a bizarrely high figure. The proportion has found the middle value of 47:1 across the twentieth century and before this it was even lower.

Truth be told the last time the gold/silver proportion was at these levels was preceding the extraordinary monetary accident of 2007/08 and the time before that, it was during the major worldwide downturn in 1991.

For this proportion to get back towards it’s twentieth century normal silver would have to become undeniably more important comparable to gold. It’s now on it’s way because of silver’s plenty of new innovative uses, however with the proportion being SO high right now, in spite of these developing modern uses, silver is plainly exceptionally underestimated.

Where a cyclical market sees undervalue or overvalue, it will invariably move to correct this.

For the proportion to reach 65:1 (a figure still far higher than the middle) we’d see a silver cost of $23/oz against gold – and if it somehow managed to follow to 55:1 silver could reach $27/oz. These figures are conceivable as well as possible given current economic situations.

What’s more when there’s another financial emergency or securities exchange crash, silver’s other use can become an integral factor.

The alternate way silver safeguards abundance is by going about as a market fence.

A fence is successfully essential for a bet on two restricting results. You think stocks will in all actuality do above and beyond the following not many years, you purchase stocks – yet you additionally take one more situation in the event that you’re off-base.

In some ways silver itself is a two-way bet

Silver being a modern metal will ascend as it’s modern clients progress admirably – with silver’s utilization in costly hardware and high worth elective influence frameworks when there’s cash streaming in a decent economy, then, at that point, there’s cash being spend on items utilizing silver.

Yet, silver can likewise act like gold, where in a monetary accident silver will commonly take off in esteem – a relationship that is sufficiently able to see the well off and huge asset directors utilize silver as a type of assurance. An assurance that can even beat gold.

In the last large accident of 07-08 when a huge number of Americans saw their 401ks and IRAs sliced by an over half, gold arrived at a record unequaled USD high. Retirement accounts weighty in gold saw a sound increase, to counteract misfortunes in the securities exchanges – however silver went a lot further.

Where gold saw an all out base to-top move of 166%, silver rose 448%!

Had an insightful financial backer paid attention to consultants and got tied up with silver in front of the accident, they would have counteracted misfortunes as well as probably turned a clean benefit.

Which takes us back to now. Abundance supervisors are again encouraging their clients to load up on valuable metals, making stressed clamors that something important could be not too far off.

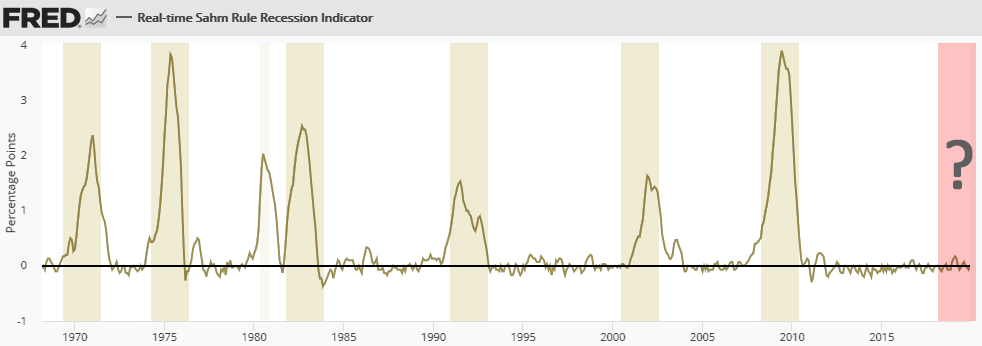

The Boom Bust Cycle

Looking at the approximately 10 year boom/bust cycle of our financial markets it’s plain to see we’re starting to look long overdue on the next crisis:

Data courtesy of the St Louis Federal Reserve

As we previously referenced silver is right now valued where 1oz of gold purchases 85 ounces of silver. This gives a gold/silver proportion of 85:1 – a significant worth which has generally been a decent mark of there being a continuous downturn, or an approaching accident.

Our securities exchanges are at present light – regardless of whether they are making some alert sounds as far as overvaluation – so our bet – and obviously the bet of every one of those climbing into silver and gold, is we are confronting an approaching accident.

Yet again silver is preparing to secure – and develop – abundance.

Learn more about the profits silver could bring to your portfolio – with Goldco’s free Precious Metals Investor Guide

Is Investing In Silver A Good Idea?

Considering what we said above, regardless of whether you’re not keeping watch for a venture giving every one of the indications of being underestimated, silver is as yet a helpful diversifier – particularly assuming that your portfolio or retirement account is inclining vigorously towards stocks, shares and other paper resources – or then again assuming you’re put resources into land.

Is investing in silver smart?

Most monetary consultants who are available to a solid enhancement of resources propose setting to the side between 3-10% of a portfolio to valuable metals.

putting resources into metals to enhance portfolioTraditionally this is gold, however for financial backers hoping to add an additional an aiding of capital development, the metals might be parted 60:40 gold to silver or can go considerably heavier on silver on the off chance that the client is content with the additional unpredictability silver can bring to the party.

For more limited size financial backers with $5-10k to contribute and for whom a metals speculation could be an enormous cut of their accessible capital, silver appears to be legit particularly assuming the financial backer chooses home stockpiling in a reasonably protection appraised safe.

Having various lower-estimated units in a speculation implies any little monetary crises can be managed without selling half of your resources. After the entirety of it’s a lot simpler to exchange a couple of silver bullion bars to meet an unforeseen cost than getting change from a $10,000 gold ingot.

For those with $25,000 or more to contribute, silver unexpectedly turns into a significantly more valuable instrument and this is the place where valuable metals make their mark.

One of the best ways to buy physical bullion is through a Gold and Silver IRA.

After all when the public authority offers you an exceptionally charge advantaged course to purchasing valuable metals, it’s insightful to capitalize on it.

Furthermore obviously one of the vital benefits to having gold and silver in an IRA is the security the metals can give you when you want cash the most: retirement.

Given their set of experiences in utilizing our cash to play on the securities exchanges, wouldn’t you feel more secure having a few resources big shot brokers mightn’t?

We’ve effectively settled silver is an excellent place of refuge resource, used to get abundance – be it a nation’s riches, generational riches, individual resources or a retirement account.

However, are there security issues in putting resources into silver? Is putting resources into silver high danger?

Silver is plainly a more unpredictable metal than gold and in the present moment can take misfortunes – similarly as much as goliath gains – and this is less secure in the event that your retirement is in the short term. In the event that your retirement is further away, you’re bound to exploit silver rising altogether as it’s being figure to do as such.

Silver might have found the middle value of an increment of 26% each year throughout the course of recent years, however there have been years where it’s dropped half and others where it’s ascended more than 700%. Assuming that this degree of instability and potential revenue driven is of a lot of hazard for you, then, at that point, it’s ideal to choose gold.

This being said, not normal for stocks, cryptographic forms of money or some other paper or computerized resource it’s close to unimaginable that silver will at any point arrive at zero worth. It’s excessively intriguing, excessively essential to industry to society and our actual mind, for silver ever to have no worth to us. After the entirety of silver’s 4000 years exchanging as an important resource is a hard history for us to rework.

Silver’s other danger is likewise silver’s most noteworthy advantage: esteem.

Because of this worth, your interest in silver is additionally dependent upon a danger of burglary.

It exceptionally simple for lawbreakers to adjust silver bullion’s character, liquefying it down and changing it as another bar. With respect to silver bullion coins, they convey none of the recognizing imprints or chronic numbers bars do, making one silver coin totally undefined from another. On the off chance that it’s taken – your silver is just about as great as gone.

It’s in this manner vital for store your silver speculations securely – regardless of whether in an enough safeguarded protected at home – or in a safe and completely guaranteed vault. We cover gold stockpiling and vaulting exhaustively here.

With your silver got, particularly in proficient vaulting, there’s practically no opportunity of robbery and regardless of whether it were to some way or another be lost or taken you’re protected.

Is silver contributing savvy? In the event that you question silver’s true capacity, history isn’t your ally.

Find the best ways to hold your silver secure at the best price – inside Goldco’s free Precious Metals Investor Guide

Can I Invest in Silver to Make Money?

We’ve effectively referenced silver’s normal yearly increment throughout the course of recent years, and silver’s propensity to jump heavenward during seasons of emergency – however can putting resources into silver make you rich?

Recollect the proportion of gold to silver we referenced before?

We were in effect extremely moderate when we discussed it getting back from it’s present high of 85:1 to it’s mean worth of 47:1. Indeed we didn’t draw near to mean when we said a worth of just 55:1 would see silver evaluated at $27/oz. At silver’s mean/normal worth of 47:1 we could really see silver selling at $32/oz.

Yet, as we as a whole know for there to be a normal worth – and we realize the high is 85:1 – then, at that point, there must likewise be a comparing low. This is basically the way that midpoints work.

2011 saw a gold/silver proportion at 35:1 – if this somehow happened to return today we’d have a potential for silver to reach $51/oz – matching it’s 1980 high.

Anyway bouncing into out time machine and returning to the last part of the 1970’s or even the last part of the 1960’s the proportion remained at a low of 15:1. If this somehow managed to be the case now and gold stayed at it’s present value, an ounce of silver would out of nowhere be estimated at an incredible $120!

Presently this is as a matter of fact an exceptionally shortsighted perspective on – and a strategy regularly utilized by bullion vendors to recommend we could see an inevitable 800% ascent in the cost of silver.

In actuality, except if there is a seismic change in our reality, a significant disaster, or dollar’s evacuation as our worldwide cash, then, at that point, when we see 15:1 once more, gold will have dropped a bit and silver will have ascended higher to meet it.

Somehow the current proportion plainly shows silver to be all around underestimated comparable to gold and when we truly do get back to a mean worth we can reasonably anticipate a close to multiplying of silver’s cost.

Need more prominent benefits? Looking out at some cost rise isn’t the best way to bring in cash with silver…

Active Trading

To exploit silver’s instability you want to foster a more dynamic technique than basically purchasing and holding.

Albeit more hazardous – particularly to tenderfoots – you can time trades to exploit the every day, week after week and month to month rise and fall of the silver market.

Purchasing at the value lows and selling at the highs is the actual reinforcement of exchanging and is similarly relevant to actual metals for what it’s worth to paper or advanced resources. Amazing luck and diminishing purchase/offer charges to a base is fundamental, yet for somebody with a decent eye or a comprehension of market elements there are huge aggregates to be made.

Indeed, even without steady exchanging, it’s a good idea to purchase low and sell high and this is what numerous valuable metals financial backers and home stackers do, moving among gold and silver contingent upon what is relatively over estimated or under-evaluated. This makes a faster method for developing your valuable metals than basically purchasing and pausing.

At last you can continuously play an exchange game, observing a source selling a silver bullion item lower than you can sell it elsewhere.

In short you become a limited scale bullion vendor. Assuming you scale this enough you can draw in superb discount bargains, purchasing at exchange and selling retail.

This is the manner by which each effective public and worldwide bullion vendor began – from humble beginnings to multi-billion dollar organizations

Is Silver Better Than Cash?

As we previously covered silver used to BE cash – and the extremely observant financial backer can in any case track down silver coins available for use today.

Roosevelt and Mercury Dimes, Washington Quarters, Walking Liberty Franklin and Kennedy Half-Dollars generally contained between 35-90% unadulterated silver – and it was this silver which gave them their worth.

With a silver dime, there was a dime of silver insider the coin. A half dollar was esteemed at that cost since it contained a large portion of a dollar of fine silver.

This framework functioned admirably and was the premise of flowing coins across a few thousand years. A coin’s genuine worth depended on the valuable metal inside.

The issue with this technique – for legislatures – was to give more coins you expected to purchase all the more valuable metals. Or then again on account of many bombing domains, government would essentially add less and less gold or silver inside the coins they printed. The assumed worth of the coins became more noteworthy than their inborn metal substance.

Also the business sectors weren’t inept. For each coin made somewhat from nothing, the worth of any remaining coins was decreased – thus the costs of labor and products rose. Dealers realized this new cash contained less silver thus they needed more coins to keep things squared. Costs didn’t rise – coin values fell – and this was the introduction of expansion.

Obviously the American government had plans to take this thought and truly go enormous.

Fire Up the Money Machine!

At the point when America accomplishes something it does it in style. As a matter of first importance valuable metals were eliminated from new coins, what began being stamped simply from base metals. Similar as their paper dollar cousins, these were given as an intermediary on the worth of valuable metals held by the state.

The dime’s silver substance was supplanted by silver held in a far off Federal Reserve vault.

Sadly this implied the US government actually expected to possess a ton of valuable metals to back the dollar and this was truly restricting their capacity to make new cash to subsidize the capacity of a quickly developing state. They had a go at seizing gold and afterward they attempted downgrading of gold.

Then, at that point, they just got rid of it through and through!

In 1971 Nixon completely decoupled the dollar from the worth of gold and silver, meaning America could start up the print machines and make new cash from nothing. Assuming they required a billion dollars, they printed it. A trillion dollars? Don’t worry about it – after everything what’s the worst that could happen?

All things considered, as of January 2020 the US Federal government is $23 trillion in an opening.

Consequences of Printing Your Way to Wealth

Because of this foolish printing, the entire day sees the cash in your wallet and your financial balance lose worth to expansion. What’s more with feature expansion rates being so intensely controlled through continually changing estimation strategies, you can ensure your dollar is contracting far quicker than everything that the public authority is saying to you.

Valuable metals then again don’t lie, can’t lie and cant be printed from nothing.

dimes and dollars losing valueA 1965 dime in your pocket will have lost 1220% of it’s spending power since it was stamped and all alone is exceptionally close useless – yet a silver dime from the earlier year resembles some sort of monetary person who goes back and forth through time – ready to purchase practically precisely the same measure of labor and products today as it did then, at that point.

A $100 note changed over into silver billion of every 1971 – when the dollar was decoupled from valuable metals – would have purchased 77oz and change of silver – and at current costs you’d be presently be holding $1400 worth of silver. Had you stowed away the $100 under your sleeping pad it would in any case be “valued at” $100. Enough to get you a couple of mid-market tennis shoes.

Regardless of whether you were to have held your $100 note in an exorbitant premium ledger, you’d have required a normal accruing funds of 5.7% each year to match expansion – and any bank expenses or assessments throughout this time would have cleared portion of those gains out.

So could we suggest cash as a speculation? By no means – except if it’s a sack of silver dimes.

In earnestness, by all means hold some money for everyday spending, except concerning clutching cash as a venture for any time allotment – it possibly pays in the event that you can change over your money from paper dollars into genuine cash.

The main genuine cash in the times of government issued money is valuable metal like gold and silver.

Furthermore great guides likewise advise financial backers to expand their resources – to help de-hazard and to fence against different resources performing inadequately.

At the point when securities exchanges crash – and this will in general occur on normal one time each decade – your supports are there to safeguard you against catastrophe and with regards to fences there are not many speculations with similar demonstrated history as valuable metals.

At the hour of composing our financial exchanges are seeing unsurpassed highs and alerts are ringing that costs don’t reflect organization income.

As discusses record markets make it from the monetary press into traditional press and limited scope retail financial backers heap in expecting similar enormous additions as they’re seeing announced, the business sectors start to over blow up and the institutional financial backers and very rich look to their fences detecting an approaching accident.

In the event that you’re not currently large in shares thus haven’t partaken in the excursion upwards this is definitely not a happy chance to enter the market. In the event that you are as of now in, it’s an ideal opportunity to begin making some type of protection strategy against what is no doubt around the bend.

So with regards to the subject of is silver better compared to shares, the response shouldn’t be a yes or a no – an either or circumstance.

An all around arranged portfolio ought to contain a crate of blue chip shares and for the bold a couple of more hazardous ones as well – yet it ought to likewise contain an arrangement B for when the market turns – and it’s a flat out certainty the market will turn sooner or later.

Plan B for some is gold and silver. Regardless of whether you’re at 5% gold or 20% silver and 10% gold is down to your own conditions and the danger in the offers or different resources like land that you own.

We can’t suggest some course yet we in all actuality do prescribe you address an expert valuable metals venture organization who will actually want to appropriately exhort you unbiasedly and under no commitment.

Learn how to get best advice from gold and silver professionals – with Goldco’s free Precious Metals Investor Guide

Who is Investing In Silver?

The actual silver market – and the market for silver subsidiaries – are both far more modest than those for gold. While gold see $100bn in every day exchange, silver can be pretty much as little as a 10th of this, yet this shouldn’t imply that there are no huge silver financial backers.

As per figures from the Silver Institute from a normal of 1,020 million ounces mined and reused each year, modern venture eats up over portion of all actual silver at 578 million oz, with 248 million oz of silver tracking down it’s direction into purchaser hardware. Silver gems speculation – one of the market’s enormous purchasers – utilizes 212 million oz.

Truth be told of all yearly silver creation, just 18% advances into speculation bullion bars and coins – with the most recent figures from 2018 appearance 181.2 million oz being changed into new venture grade silver that year.

Notwithstanding this nearly low figure for bullion, presently 29 million a bigger number of ounces are being purchased by financial backers than the market can supply – so who’s placing silver’s yearly considers along with shortfall?

Well in the two years before the 2008 monetary emergency, interest for silver bullion was just 6% of yearly inventory. Quickly that the emergency started, financial backers raced to purchase silver and gold because of their place of refuge properties against dollar hazard. By 2010 actual silver bullion request was up 166% and by 2011 interest was up 238%.

Silver speculation assets and trade safes right now hold a little more than 920,000 million ounces of silver.

Where when national banks were offering their silver possessions and adding them to yearly inventory figures – this totally halted in 2014. China’s interest for silver has expanded 475% in 15 years and India’s 650% in 10.

Silver is being accepted for similar reasons as gold: we are currently in what must be depicted as a high-hazard period with over-esteemed securities exchanges past due their next crash, international strife and a quickly moving loyalty away from the dollar as our worldwide exchange money

Where the super-rich are moving into actual gold, normal Americans are becoming “silver stackers”, saving any extra money every month to grow a stock of silver for when the inescapable emergency breaks.

Since the accident of 2008, private financial backers have stacked over 1,500,000,000oz of silver bullion, holding it away as a danger mitigator.

For some, the arrangement is to exploit silver’s benefits in the accident, while for other people – the “prepper” local area – these silver property are to be used as genuine cash in case of a dollar degrading, state-wide friendly distress – or much more awful.

Be that as it may, setting to the side discussion about securities exchange and dollar crashes, silver is only a savvy venture. It’s chronicled use as a store of significant worth proceeds and with it’s normal 26% yearly value ascends throughout the course of recent years and it’s present undervaluation against gold – it’s a speculation with a great deal of potential.

For this reason a great many Americans are adding a level of silver and gold in their retirement accounts or broadening their stocks and different ventures with actual valuable metals.

Silver is a solid, trustworthy speculation. It just so happens it could likewise save you in a crunch.

Where To Start Investing In Gold

The web has been a boon to gold financial backers, making it simpler to find both the right data while settling on speculation choices and to find dependable and solid gold sellers.

Except if you have an excellent nearby vendor, or even notwithstanding of this – we would suggest beginning with a web search. Most importantly you’d be searching with the expectation of complimentary Gold Venture Guides which will help you study contributing as well as give you some underlying knowledge into what different bullion vendors resemble to manage.

There are as of now north of 1400 bullion sellers recorded in the business registry and hundreds more modest organizations who are not – so dislike you are at any point stuck for decision.

Numerous sellers have fantastic sites and free transportation so it’s anything but a troublesome cycle making a little test buy. A couple of silver bars and coins or a little gold bar in the event that you’re apprehensive and might want to try things out.

Online sell-offs have become famously terrible for selling fakes, as have various merchant destinations. It’s ideal to stay with a known public brand or a believed nearby seller for your first test purchase – however on the off chance that not recollect whether an item appears to be excessively modest, there’s a justification behind that.

Valuable metals are wonderful long haul speculations and being a significant expense obtaining, it’s significant you ensure your venture gets going on the right foot.

Regardless of whether you’re purchasing retail, through a gold venture organization or IRA expert ensuring you are both viable is foremost for smooth and blissful speculations.

Learn more about how silver can protect your assets in a recession – inside Goldco’s free Precious Metals Investor Guide

What are the Advantages of Silver in an IRA

An IRA resembles any interest in that you need it to increment in esteem over the long run. What’s different with regards to an IRA is that it’s an expense advantaged approach to purchasing explicit speculations, where these duty investment funds are talented to us by our national government as an approach to decreasing the expenses of retirement arranging.

The entire reason for an IRA is that it’s there to help accommodate you in your retirement.

To wind up poor at 70, working long into your senior years or relying upon your kids and grandkids, then, at that point, making a successful retirement plan isn’t something to be messed with.

To this end the accident of 07-08 hit IRAs and 401k plans so seriously – particularly for individuals near retirement age at that point. Whenever the monetary emergency struck, it cleaned half from the worth of millions of retirement accounts practically for the time being.

Painstakingly thought out plans for a lighthearted retirement were wrecked and ways of life must be downsized definitely. It doesn’t make any difference that 6 or after 7 years the business sectors were in the groove again – for those now in retirement who’d been so gravely impacted the harm was done and their life had taken on an altogether different quality to the one they’d expected.

Simultaneously as the emergency was obliterating expectations and dreams for some, silver and gold were taking off to record highs. Financial backers frantic to sell their quickly falling stocks and offers were scrambling for place of refuge speculations – gold and silver both saw a monstrous ascent, during the emergency and in the years following.

Albeit gold is the metal generally refered to similar to the large entertainer in the midst of emergency, silver was the superstar. From a 2008 low to 2011 high gold saw a 166% increase – while silver gave a staggering 448% benefit.

For those retired people who’d been instructed concerning gold and silver’s advantages as a fence before the accident and who’d added actual bullion to their IRAs – these value rises made up for any stock misfortunes their record had seen meaning those retired people were viewing at extensively similar degrees of cash in retirement as they’d made arrangements for. Gold and silver had played out the exact errand they had been added to help accomplish.

Likewise with any speculation portfolio it pays to have broadening and some type of a support. By not having every one of your eggs in a solitary container you increment your possibilities of development and decrease your dangers. An IRA shouldn’t be any unique and in light of the fact that it’s for your senior years it’s even more essential to get it right while you can.

We have a full area taking a gander at Silver IRAs looking at the cycles required and itemizing what can and can’t be added to an IRA. If you observe these basic guidelines or work with an IRA proficient, there’s not a really obvious explanation for why adding silver inside an IRA ought to be any more troublesome than purchasing other standard ventures and with the right counsel it very well may be such a ton more straightforward.

Furthermore who wouldn’t have any desire to make burden investment funds while purchasing silver?

Need more? Get a free Metals Investment Guide – a novel actual financial backer pack conveyed direct to your entryway: