Chuddbroker Slams Crypto-Gold

Outspoken analyst Martin Chuddbroker has warned his wealthy clients to stay away from what he calls a new wave of Ponzi schemes. And while Chuddbroker is true to form as…

Outspoken analyst Martin Chuddbroker has warned his wealthy clients to stay away from what he calls a new wave of Ponzi schemes. And while Chuddbroker is true to form as…

Using any new service or product requires a degree of trust. So what’s so special about Bitcoin that means new users or investors can trust the cryptocurrency and not worry…

Often dubbed “The New Gold” Bitcoin is now a serious contender for the crown – could it be that gold has finally met it’s match in the new ultra hi-tech…

On this page we cover the fundamentals of bitcoin contributing, how to source a genuine bitcoin speculation, the most dependable ways of holding bitcoin and the expected benefits (and misfortunes) an interest in bitcoin can produce.

As well as the how what and where, we take a gander at the upsides and downsides of utilizing bitcoin for speculation purposes, and the dangers related with any digital currency.

Putting resources into Bitcoin can be exceptionally beneficial, routinely seeing 500-1000% expansions in cost. However, assuming you get it wrong it can make similarly amazing misfortunes, with half drops being conceivable as well as generally normal in the cryptographic money’s set of experiences.

This is on the grounds that Bitcoin – and to be sure the entire cryptographic money market – is exceptionally unpredictable where steep ascents and precipice like drops can happen practically day by day, and regardless of which course of events you check out for valuing patterns, you’ll see an extremely uneven ocean.

Anyway with instability comes an enormous potential for benefit, especially assuming that you are set up to have the option to move starting with one resource then onto the next easily, riding Bitcoin to highs then, at that point, trading out to another more steady resource like gold when the crypto gives indications of adjusting bearing.

This is the place where joined records, for example, those presented by Goldco become an integral factor, which we’ll cover later.

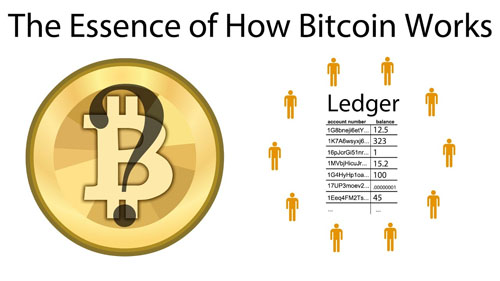

Bitcoin exchanges depend on the Blockchain, Wallets, Private and Public Keys.

The reason for the numerical issues excavators are addressing is to make, keep up with and track a safe “blockchain” – the shared organization where all bitcoin exchanges occur and are put away in a long-lasting record.

This blockchain is the transmission and global positioning framework and your bitcoins are the virtual resources communicated upon it.

All Bitcoin are held in wallets – a virtual location novel to it’s holder, and each exchange you cause will to be put away on the blockchain record, showing the Bitcoin amount, the beginning wallet address and the getting wallet address – and these subtleties are completely straightforward to anyone who wishes to take a gander at them.

Simultaneously the exchange is completely private as none of your recognizable data is put away or communicated – simply the total sent and two wallet addresses.

how does bitcoin workSecurity is given both by the exceptionally intricate and unhackable blockchain and by your wallet having two keys – a public key and a private key.

These keys are both long series of numbers, and your public key is then abbreviated to give your wallet’s public location. With this wallet address alone, anyone can add bitcoin to your wallet – but to eliminate bitcoins from your wallet you’ll require the subsequent key – the Private Key.

Your private key is only that – and should stay 100 percent private. This is on the grounds that all it expects to access and eliminate bitcoin from a wallet are these two keys – and one of them is now out there.

It’s subsequently fundamental for keep your hidden key totally secure.

It’s additionally fundamental that you never lose it – as without your private key, your Bitcoin will remain for all time blocked off even to you.

As referenced, bitcoin is an exceptionally unstable resource when estimated in USD or some other government issued money.

Despite the fact that by plan the worth of Bitcoin should ascend after some time as mining turns out to be more troublesome, actually there is significantly more impacting everything.

Likewise with any fixed-amount resource, instability and value changes are brought about by changes popular – the more individuals who need to possess, purchase and use Bitcoin, the more prominent it’s interest and the higher the cost. As interest drops or enormous deals are made, the value drops.

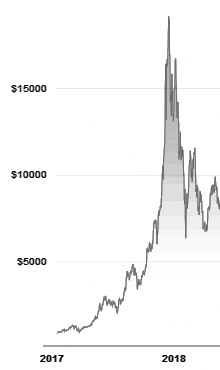

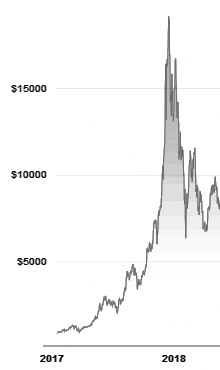

This should have been visible obviously in 2017 when Bitcoin speculation truly entered the public’s creative mind. An ever increasing number of new purchasers entered the market subsequent to hearing or learning about the benefits that had been made by others and as request soar the cost rose from $900 to $20,000 per bitcoin.

During this time, bitcoin’s utilization as a cash hadn’t expanded so much, so this was absolutely a theoretical air pocket – and detecting this a great deal of the previous bigger financial backers took their benefits out.

As more sold, the value started to fall and the more it fell, the more new financial backers terrified and sold, making an input circle.

Obviously the value drop truly hurt those late to the party and a ton of retail financial backers lost undeniably the greater part of their venture – however for those who’d been in for an all the more long haul speculation, the cost after this crash was still considerably higher than it had been toward the beginning of 2017.

Today at just shy of $10,000 per bitcoin we’ve actually seen a 1000% increment on that January 2017 cost, regardless of whether we’re just at half of it’s 2017 high.

One more component to think about while putting resources into Bitcoin is that there are various exceptionally enormous records – early financial backers and originators. It tends to be genuinely simple for these Bitcoin “whales” to influence market estimating on the grounds that in contrast with Forex or Gold, the bitcoin market is tiny.

This implies any enormous exchange by a whale will have an enhanced effect overall market – and this should be visible happening consistently, where fresh insight about the deal – here and there even a tweet – can take the value higher or lower quickly.

Following a Bitcoin whale’s conduct and web-based media remarks can be very enlightening!

Bitcoin is the first cryptographic money, made 11 years prior by unknown developer “Satoshi Nakamoto”.

Wikipedia depicts Bitcoin as “a decentralized computerized cash without a national bank or single chairman that can be sent from one client to another on the shared bitcoin network without the requirement for delegates”

what is bitcoinIn short it’s a cash like resource intended to be both totally private but completely straightforward – and is held and communicated in a structure which can’t be disrupted by large banks or government.

From the very start the quantity of conceivable bitcoins was set at ₿21,000,000 – a deliberately fixed and limited stock expected to guarantee future qualities can’t be “printed” away to nothing as we see with government issued types of money.

In the event that supply is fixed, any increment sought after will bring about a higher market cost.

Bitcoins are “mined” from this limited 21 million coin supply by PCs tackling progressively troublesome numerical issues. The more issues addressed by a Bitcoin digger the more coins they will extricate from this virtual mine.

This is a fundamentally the same as model to a gold mine. At the point when a rich gold crease is first found, mining is simple yet as the limited stock in the mine starts to run out, it becomes far harder to observe increasingly small hubs of gold thus the expense of creation increments.

As the bitcoin mining issues become progressively troublesome, increasingly registering power is expected to remove each coin – and as we approach the 21 million figure these issues become phenomenally intricate.

At season of composing we have mined a sum of 18,211,425 importance there are just 2.7 million remaining “in the ground” – touch to mine these will require more processing power than we’ve found altogether up to this point.

Bitcoin exchanges depend on the Blockchain, Wallets, Private and Public Keys.

The reason for the numerical issues diggers are settling is to make, keep up with and track a solid “blockchain” – the shared organization where all bitcoin exchanges occur and are put away in a long-lasting record.

This blockchain is the transmission and global positioning framework and your bitcoins are the virtual resources communicated upon it.

All Bitcoin are held in wallets – a virtual location remarkable to it’s holder, and each exchange you cause will to be put away on the blockchain record, showing the Bitcoin amount, the starting wallet address and the getting wallet address – and these subtleties are completely straightforward to anyone who wishes to check out them.

Simultaneously the exchange is completely private as none of your recognizable data is put away or communicated – simply the aggregate sent and two wallet addresses.

how does bitcoin workSecurity is given both by the exceptionally mind boggling and unhackable blockchain and by your wallet having two keys – a public key and a private key.

These keys are both long series of numbers, and your public key is then abbreviated to give your wallet’s public location. With this wallet address alone, anyone can add bitcoin to your wallet – but to eliminate bitcoins from your wallet you’ll require the subsequent key – the Private Key.

Your private key is only that – and should stay 100 percent private. This is on the grounds that all it expects to access and eliminate bitcoin from a wallet are these two keys – and one of them is as of now out there.

It’s along these lines crucial for keep your hidden key totally secure.

It’s likewise fundamental that you never lose it – as without your private key, your Bitcoin will remain for all time blocked off even to you.

As referenced, bitcoin is a profoundly unstable resource when evaluated in USD or some other government issued money.

In spite of the fact that by plan the worth of Bitcoin should ascend after some time as mining turns out to be more troublesome, actually there is substantially more having an effect on everything.

Similarly as with any fixed-amount resource, instability and value changes are brought about by changes sought after – the more individuals who need to claim, purchase and use Bitcoin, the more prominent it’s interest and the higher the cost. As interest drops or enormous deals are made, the value drops.

This should have been visible plainly in 2017 when Bitcoin speculation truly entered the public’s creative mind. An ever increasing number of new purchasers entered the market in the wake of hearing or finding out about the benefits that had been made by others and as request soar the cost rose from $900 to $20,000 per bitcoin.

During this time, bitcoin’s utilization as a cash hadn’t expanded so much, so this was absolutely a speculative air pocket – and detecting this a great deal of the prior bigger financial backers took their benefits out.

As more sold, the value started to fall and the more it fell, the more new financial backers terrified and sold, making an input circle.

Obviously the value drop truly hurt those late to the party and a great deal of retail financial backers lost definitely the greater part of their speculation – however for those who’d been in for an all the more long haul venture, the cost after this crash was still significantly higher than it had been toward the beginning of 2017.

Today at just shy of $10,000 per bitcoin we’ve actually seen a 1000% expansion on that January 2017 cost, regardless of whether we’re just at half of it’s 2017 high.

One more element to think about while putting resources into Bitcoin is that there are various exceptionally huge records – early financial backers and originators. It tends to be genuinely simple for these Bitcoin “whales” to influence market valuing in light of the fact that in contrast with Forex or Gold, the bitcoin market is tiny.

This implies any enormous exchange by a whale will have an enhanced effect overall market – and this should be visible happening consistently, where fresh insight about the deal – here and there even a tweet – can take the value higher or lower quickly.

Following a Bitcoin whale’s conduct and web-based media remarks can very eye open!

There are three head ways of putting resources into Bitcoin: Outright buy, Bitcoin mining and the exchanging of Bitcoin subordinates.

Purchasing Bitcoin: You can put resources into Bitcoin itself, purchasing and holding the digital currency in a wallet, either as a component of your speculation portfolio – or even in your IRA.

Mining: You can put resources into a Bitcoin mining organization as you would a Gold mining organization, or you can even purchase a mining “rig” yourself – an expert powerful PC which will make new Bitcoin for you.

Bitcoin Derivatives: As with gold, Bitcoin arrives in a scope of subordinate resources, from Bitcoin ETFs (Exchange Traded Funds), Bitcoin Futures and Bitcoin Options/CFDs (Contracts for Difference)

In spite of the fact that there are many individuals who take in substantial income exchanging EFTs, Futures and Options/CFDs this is adding one more layer of unpredictability onto something which is now famously unstable.

Having the option to make utilized wagers on something however unstable as Bitcoin may be possibly a catastrophe waiting to happen, particularly in the event that you’re not exceptionally knowledgeable about both the specific subsidiaries market and Bitcoin. Indeed you can get definitely more cash-flow than by essentially purchasing bitcoin, yet you can likewise lose more than your underlying speculation – bringing an undeniable risk of negative value.

Mining, particularly home-mining requires both costly gear and uses a ton of power, yet offers a course to procuring what can be under-market esteem coins.

Assuming Bitcoin’s value dips under your complete expenses, you will lose cash on each Bitcoin created, yet on occasion when the cost is higher this is a phenomenal method for adding to your wallet on the off chance that you’re tech-disapproved and can work the frameworks required.

Putting resources into Bitcoin mining organizations is similarly as purchasing any organization stocks – with huge diggers, for example, Marathon Patent Group exchanging on the NASDAQ (Stock: MARA) being famous models.

If market costs stay higher than the expense to mine, Miner stocks can offer a more steady course to contributing bitcoin than claiming the crude coins – despite the fact that your benefits will be correspondingly decreased.

For us the main genuine method for possessing Bitcoin is to really claim it.

Indeed it’s a theoretical resource and yes it’s unpredictable, yet the eventual fate of our reality’s monetary standards will some way or another include the blockchain and with bitcoin being the first and the greatest, it’s considered by most similar to the most secure bet out of all the digital currencies right now available.

Similarly as with any new class of venture, it’s generally smart to begin little.

Never contribute more than you’d be happy with losing, particularly first and foremost – while you find out with regards to how wallets work, how the business sectors act, trades work and the speed at which you can trade your resources.

Bitcoin is thought of as the most secure of all the cryptographic forms of money and it’s certainly the most broadly upheld and seen so it’s a characteristic beginning stage for any new financial backer. Having been in activity now for a long time and seen large number of exchanges across the thing is a continually further developing framework, Bitcoin simply seems OK as a first purchase.

The way that a Bitcoin IRA is currently conceivable, that Bitcoin can be held in your retirement account – says a lot about degrees of confidence in the medium.

Putting resources into Bitcoin as a feature of your IRA is one of the simplest and most secure ways of purchasing.

Proficient Crypto IRA organizations will complete all components of the venture for your benefit, from giving a super protected wallet and full protection of the coins to actually vaulting your encoded private key in an IRS supported store – all under the watch of an IRS certify caretaker. We have an entire segment dedicated to Bitcoin IRAs here.

A cool stockpiling wallet is something contrary to a “hot” wallet – hot being a live wallet held online at a trade, where you can purchase, sell and store your bitcoin.

Hot wallets are incredible in the event that you wish to complete customary Bitcoin exchanges, yet because of their security it’s anything but smart to hold a ton of significant worth in these records after some time – after all we are consistently seeing hot wallets being hacked.

Then again a chilly stockpiling wallet isn’t associated with the web, isn’t held on the web, yet rather in an actual gadget.

A physical “gadget” can be just about as straightforward as a paper wallet, where you have the wallet address, public and private keys recorded.

Since all that is expected to utilize a bitcoin wallet is a location, public and private keys, there are numerous who see the benefits and effortlessness engaged with utilizing a paper wallet.

You just record your public location, and keep note of the hidden key elsewhere, ideally across numerous protected or secret areas.

An illustration of a full private key is:

E9873D79C6D87DC0FB6A5778633389F4453213303DA61F20BD67FC233AA33262

This isn’t by and large significant and can be inconvenience to type, however fortunately longer keys can improved and abbreviated by programming and different applications into a Mini Key.

The above long key turns into this:

SzavMBLoXU6kDrqtUVmffv

A small key like this is continuously going to be more straightforward to utilize.

For added security, this key can be parted into areas, for example, being composed across a few pages in a book.

Obviously there’s a risk in losing the key or having it found by an outsider – the two results would see you fail to keep a grip on the wallet.

A well known strategy utilized for cold stockpiling of Bitcoin is a versatile equipment wallet, like those from market pioneers Trezor and Ledger.

These gadgets are successfully profoundly scrambled memory sticks/small PCs containing a safe means to consequently enter the mystery key through an associated gadget while wishing to separate coins.

Every gadget is coupled to confidential “seed state” a bunch of words which can be utilized to reproduce the wallet and it’s substance in case of losing or breaking the gadget. Regardless of whether the gadget producers leave business your seed expression can in any case give access your wallet anytime in the future as your wallet really exists on the blockchain.

A model seed state is:

air terminal hamburger extraordinary toy fly fossil dental specialist cabbage fox notice delicate tongue

Seed expressions can comprise of 12 or 24 words from a particular rundown and should be kept totally secure – as anyone with your seed expression will conceivably have total admittance to your wallet and it’s substance.

The most dependable type of cold-stockpiling is the place where your wallet data, secret word or recuperation seed express is put away in a completely safeguarded expert vault similarly as gold bullion is vaulted.

This is the technique utilized by numerous suppliers of Bitcoin and digital money IRAs – and relying upon the framework utilized can give you close to quick admittance to your record, offering a considerable lot of the benefits of a hot wallet, yet with the high security of vaulted gold.

With a speculation that can go from being valued at $30,000 to $660,000 over the course of about 11 months, you can never be too secure by they way you hold it.

Discover ow to best secure Bitcoin in your investment portfolio with CoinIRA’s free Bitcoin Investor Guide

Putting resources into Bitcoin can be profoundly beneficial. $30,000 put resources into Bitcoin in January 2017, would have been valued at $660,000 by December that year. Moving to 2019, $30,000 put resources into January would have been valued at $95,311 by Christmas.

Both of these are unimaginable benefits – yet these blur into irrelevance while checking out Bitcoin execution over the more drawn out term.

Had you purchased $30,000 of bitcoin in January 2016, you’d currently possess $1,634,298 worth.

January 2015? Your bitcoin wallet would be esteemed at $2,766,124. What’s more lets not talk about January 2013… Had you figured out how to purchase $30,000 of bitcoin back in 2013 you’d as of now be holding resources worth more than $14.5 Million.

Sadly we don’t enjoy the benefit of a time machine thus for a considerable lot of us these are speculative numbers, however in any event, returning to last year when numerous doubters had concluded Bitcoin was done – your $30,000 would have seen 233% development in a solitary year.

233% additions are exceptionally difficult to beat in even awesome of blue-chip stocks and completely unthinkable in any type of bond or financial balance.

January 2019’s cost was significantly lower than Bitcoin’s 2017’s pinnacle – this is on the grounds that the greater part of Bitcoin’s huge ascensions are followed up by a market remedy.

If you exit Bitcoin while it’s hoping to be going into bubble an area, then, at that point, benefits like 200-500% are conceivable, however investigating all of Bitcoin’s set of experiences they are basically a vital part of the resource’s instability.

On the off chance that you’re open to making a 500% profit from your venture, you just exit by then and move over to another resource class while you trust that Bitcoin will drop once more.

Furthermore in the event that it doesn’t drop, then, at that point, you’ve actually created a 500% gain which could be viewed as great in anybody’s book.

Where are crypto market specialists seeing Bitcoin’s value investigating 2020 and then some?

Anthony Pompliano at Morgan Creek Capital anticipates that BTC should reach $100,000 by 2021’s end.

BitMex CEO Arthur Hayes sees Bitcoin hitting $20,000 before the end of 2020.

Adam Back, CEO of Blockstream trusts anything from $20,000 to $100,000 as being conceivable inside 2020

Marc P. Bernegger at CryptoFinance places a reach on Bitcoin in 2020 – at least $22,000 and a maximim of $55,000.

At last over at PwC, Daniel Diemers the organization’s head of blockchain says he can see Bitcoin coming to $100,000 in 2020.

Taking a normal cost on these expectations of $50,000-75,000, these specialists and experts are profoundly bullish on the resource, proposing a $30,000 speculation made now* could be worth somewhere in the range of $150,000 and $225,000 by mid 2021

Looking significantly further ahead market examiners are seeing Bitcoin as going between $175,000 – $395,000 by 2025.

These expectations depend on nitty gritty specialized investigation and a few of these experts have nailed past highs and anticipated lows with frightening exactness – yet recollect nothing is at any point ensured in any venture!

The main advantage of putting resources into Bitcoin is potential for benefit – there are not many ventures except for other cryptographic forms of money that have come really near the increases delivered by Bitcoin.

In any event, taking into consideration negative episodes in Bitcoin’s value, it’s general pattern has been upwards. More organizations are tolerating Bitcoin as installment and more foundation is being made to let it really florish – similarly as we’re seeing the all out limited measure of mined bitcoins arrive at their 21 million breaking point.

With a limited asset under a high and developing interest – value pressure is continuously going to be moved upwards.

This is the reason such countless examiners are foreseeing costs in overabundance of $150,000 for a solitary bitcoin. For a large number of us not used to the value developments inside the crypto market this would appear to be crazy – however when bitcoin was at $900 a couple of years prior no one would have accepted it could reach $10,000.

Also for a resource that was just worth $20 a couple of years sooner in any event, seeing $900 would have been an exercise of blind faith.

So potential for benefit is guaranteed. Shouldn’t something be said about different advantages?

Bitcoin is viewed as perhaps the most fluid resources in the worldwide monetary market because of a bounty of bitcoin trades, exchanging stages and expert dealers generally ready to do quick exchanges at extremely low expenses.

Outside of these directed business sectors, there are endless shared trades where people can purchase sell and exchange digital currencies secretly, either internet utilizing secure open-source stages total with protection and escrow-like administrations – and surprisingly through stages for organizing eye to eye moves.

Regardless of whether you’re following severe AML conventions presented by the large trades and representatives or you’re going for a more unknown course, changing your Bitcoin into dollars, gold or different resources and back is never troublesome on account of high purchaser interest, permitting financial backers to move into and out of bitcoin quick to exploit market moves.

In any event, for financial backers in a Self Directed IRA, Bitcoin IRA experts, for example, Coin IRA [link] can offer simple to utilize stages to permit account holders to trade their digital currencies close quickly and all inside an assessment advantaged account!

High instability which can bring large benefits can likewise deliver misfortunes – and this applies to Bitcoin however much it does to any unpredictable speculation. Be that as it may, there are different dangers to Bitcoin contributing, some of which are undeniably more genuine.

Except if you are working with a trusted specialist[link] conveying best-in-market protection and offering super secure cold stockpiling vaulting, there are a few critical dangers – of complete misfortune.

It’s feasible to purchase, hold and sell bitcoin totally namelessly – and effectively – but consistently recall that creating gains from a resource without illuminating the IRS is unlawful. It is tax avoidance all things considered.

Indeed the IRS has made it required to report bitcoin exchanges, everything being equal, regardless of how little in esteem – so regardless exchanges you cause you To do have to illuminate the IRS to remain in front of the law.

However, there’s no other person you really want illuminate.

You can possess bitcoin and no one with the exception of the IRS need know. For security disapproved of people and those stressed over the quarrelsome society we’re living in your BTC resources will be forever be protected on the off chance that no one is familiar with them.

Regardless of whether you are putting away your bitcoin at a major trade or in a hot wallet, there’s an opportunity 100% of the time of complete misfortune – that is all your bitcoin being taken by a programmer or because of some inner misrepresentation.

With a few major name multi-million dollar hacks and cheats [link to box] having shaken the crypto local area throughout the long term and incalculable a large number of unreported hacks and burglaries for more modest totals, robbery and misrepresentation is a major gamble.

The equivalent can go for your disconnected wallet whenever put away at home – be it a paper wallet or an actual gadget. Assuming that somebody gains admittance to your wallet and mystery secret key or seed express then they deal with your bitcoin wallet and every last bit of it’s substance.

The best way to be genuinely protected from extortion is utilizing a confided in outsider like CoinIRA.

In spite of the fact that Bitcoin is virtual, disconnected cold stockpiling wallets are most certainly not. Assuming you keep your chilly stockpiling wallet, secret key and seed state at home, regardless of the number of spots you’ve recorded these critical snippets of data, you could undoubtedly lose everything in a fire related accident, cyclone, flood or tropical storm.

Assuming you lose your mystery key and your seed expression you lose all your bitcoin – it’s just straightforward.

To stay away from this gamble, it pays to keep your vital data at a few areas alongside some type of scrambled internet based reinforcement – thusly assuming that the most horrendously terrible occurs, you can constantly recuperate your wallet and admittance to it. For a few inventive ways of concealing your mystery key see our part here [link]

What’s more absolutely never depend on memory. Assuming that you commit your mystery key to memory, what occurs on the off chance that you become debilitated, for example, after a stroke – for sure in the event that you basically fail to remember one little piece of the code. Might you want to hazard losing your whole venture on keeping up with your memory?

Proficient cold stockpiling vaulting administrations, for example, Coin IRA offer completely protected profound frozen cold stockpiling, ensured robbery verification and completely guaranteed to advertise esteem in case of information misfortune or some other calamity.

Except if you’re willing to hazard losing your whole speculation it’s the best way to be sure.

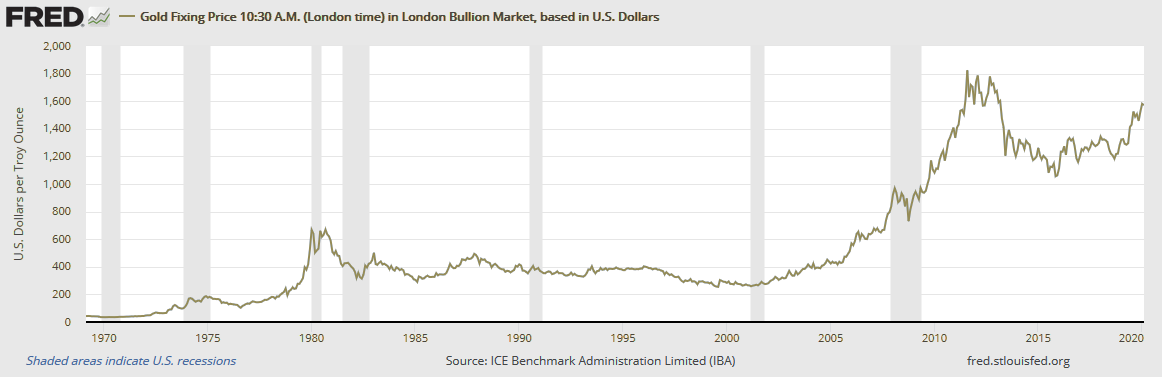

Gold’s actual cost is it’s worth comparable to different resources – it’s purchasing power.

An ounce of gold has consistently purchased pretty much similar measure of wares or administrations across it’s 4000+ year history as it does today and for this reason the metal has such a decent standing as a steady and secure store of abundance.

Whenever estimated in government issued money like USD gold appears to have ascended in esteem after some time – however actually, it’s the dollar that is dropped it’s spending influence comparable to gold.

Bitcoin’s innate worth as well, similar to gold, depends on it’s possible use as a steady method for trade – something that has not come really near completely taking off yet – thus the value we see for Bitcoin right now (instead of it’s worth), is truly down to minimal more than theoretical exchanging.

Also estimating a simply theoretical venture with minimal acknowledged inborn worth utilizing a similarly “useless” government issued money like the US Dollar will intensify immense value developments. Indeed Bitcoin’s unpredictable value developments can make financial backers rich, however they are veiling an absence of any strong fundamental worth – up until this point.

However, what’s to come is computerized. It must be – on the grounds that the manner in which we at present bank and move cash all over the planet is both costly and tedious.

Banking has remained actually unaltered since the 1970s and the justification for this is banks bring in cash at each phase of a monetary exchange – in expenses – and in revenue the cash procures while they defer it’s transmission from their focal record. If banks somehow managed to switch over to having all financial exchanges be prompt, they’d have to track down bunches of better approaches to bring in cash – and banks are slow all the time to change what works for them.

Anyway banks will ultimately change and some are as of now doing as such. Furthermore when they in all actuality do move over to utilizing some form of the blockchain, will they use Bitcoin or will they utilize some at this point obscure digital currency.

In the event that banks DO go with Bitcoin, it’s future will be ensured and with a limited 21 million units ever in presence, each bitcoin will have an enormous inborn worth.

Assuming banks go somewhere else (and given most bank’s insight to have the option to continue to print their own cash with no furthest breaking point it’s far-fetched they will settle on Bitcoin) then, at that point, Bitcoin will become sidelined and with that, it’ll become worthless.

Gold then again will in any case be gold.

Presently what might be said about Gold financial backers searching for a higher benefit potential than Gold’s laid out expansion busting rise? For some, Silver offers higher unpredictability and a more noteworthy potential particularly given a record Gold/Silver proportion – yet even that doesn’t approach Bitcoin’s new history.

For those searching for an interesting and profoundly unpredictable option to a gold portfolio, then, at that point, it’s a good idea to add what’s known as the most secure of the digital forms of money – Bitcoin.

For a novice there can appear to be a practically limitless measure of conceivable outcomes while choosing where to begin putting resources into Bitcoin.

Some portion of your decision will rely upon the sum you need to purchase.

Assuming you’re simply hoping to purchase a little part of a Bitcoin, say $1,000 worth, as a test buy then any of the principle Bitcoin trades will suit you impeccably.

Notable Bitcoin trades are:

You’ll require a computerized wallet where to put your bitcoin – a few trades permit you to open a wallet inside their record pages, others expect you to as of now have a wallet.

Opening a wallet is extremely basic and free. Despite the fact that there are heaps of where you can make a paper wallet, doing as such safely is another matter out and out.

Quite possibly the most confided in site to open a paper wallet is Bitaddress.org where you can open a wallet and accept your public and private keys right away. On showing up at the page you either move your mouse around to make an irregular string or type arbitrary garbage into a text box.

When you arrive at an arbitrariness level of 100 percent, the page invigorates and your key is produced.

It will resemble this:

You can print the page by tapping the print button or record the pubic and private keys some place secure, and you have yourself a disconnected “paper” wallet!

bitcoin exchangesOnline trades are moderately quick, simple to work with and can be cheap yet by putting away your Bitcoin online inside a hot wallet on a trade you are at a far more serious gamble of misfortune, from hacking, extortion and apportionment than you would be with a disconnected wallet – so just at any point store a limited quantity on the web.

A few trades really own the Bitcoin in “your” account and can close or eliminate your entrance honors to a record whenever – we’ve heard some evident shocking tales!

On the off chance that you’re sufficiently fortunate to reside close to a Bitcoin ATM, everything you do is place your dollars in it’s space and the machine will set up a wallet for yourself and add the Bitcoin naturally.

You can track down Bitcoin ATMs close to you on CoinATMRadar.

For the daring, you can complete P2P (distributed) trades where you meet somebody in reality, give them hard cash or do a bank trade and they will move bitcoin into your wallet.

Destinations like LocalBitcoins are exceptionally trusted and convey definite surveys of individual purchasers and dealers – however in any circumstance where you’re meeting somebody and may be conveying a great deal of money play it safe – meet in a bustling area and bring a companion. In the case of anything appears to be suspect, leave.

Our favored choice while purchasing Bitcoin is by utilizing the conceded tax breaks presented by an IRA.

This is especially obvious while putting resources into 5 figures or more noteworthy. Assuming there’s consistently an assessment advantaged method for purchasing a resource we say take it!

Another tremendous in addition to while working with a Bitcoin IRA supplier, for example, CoinIRA is they will do all of the work for you, setting up the wallet, adding your decision of digital currencies and afterward putting away your Bitcoin in the most dependable manner conceivable – a genuinely vaulted storehouse, completely protected against misfortune.

No other technique for bitcoin capacity approaches on security and inward feeling of harmony.

CoinIRA likewise allows you to store valuable metals in your IRA through Goldco giving you the security and abundance protection of gold close by the benefit capability of Bitcoin.

The enormous players in Bitcoin Investments will quite often be the organizations who offer Bitcoin IRAs. Their extra administrations and the counsel they offer makes them an important accomplice for any financial backer hoping to make genuine acquisition of Bitcoin and other digital currencies.

CoinIRA is the first class decision at shopper insurance site ScamReport.com and work close by driving Gold IRA supplier Goldco.

Be careful about any Bitcoin IRA organizations proposing you hold your Bitcoin in a LLC inside your IRA – as this is a really hazy situation and similar as home-stockpiling IRAs can be considered as self-managing by the IRS.

Need more? Get your Free Bitcoin Investor Guide – an extraordinary actual financial backer pack conveyed direct to your entryway.